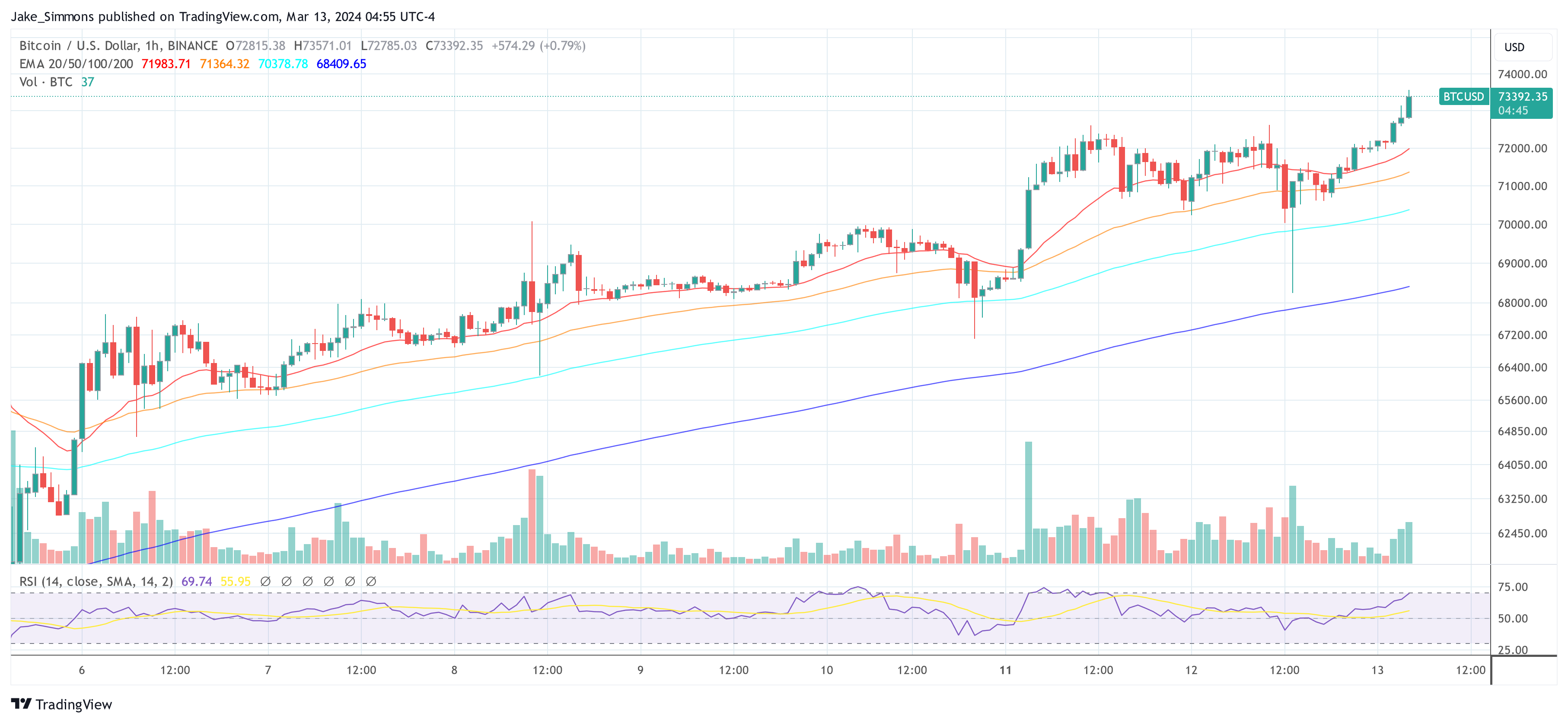

Yesterday, the Bitcoin value journey resembled a high-intensity rollercoaster experience, initially hovering previous the $73,000 mark earlier than encountering a tumultuous liquidation occasion. This occasion noticed over $361 million price of leveraged trades unwound, compelling the BTC value to retract sharply to beneath $68,300.

The drastic value fluctuation primarily affected lengthy place holders—traders who speculated on a continued value rise—with a staggering $258 million worn out. Subsequently, Bitcoin’s value staged a exceptional V-shaped restoration, throughout which brief sellers discovered themselves on the shedding finish, with simply over $103 million in positions liquidated.

This information by Coinglass marks the occasion as essentially the most important purge of lengthy positions since March 5. At the moment, Bitcoin skilled a decline to $60,800 following its climb to a then all-time excessive of roughly $69,000.

Bitcoin ETFs Register Document $1 Billion Inflows

Maybe spurred by the chance offered by the value dip, traders in spot Bitcoin Trade-Traded Funds (ETFs) engaged in a shopping for spree, unprecedented in its depth. For the primary time, spot Bitcoin ETFs witnessed a day by day influx surpassing $1 billion on Tuesday, March 12, primarily pushed by an influx of $849 million to BlackRock’s IBIT. In keeping with detailed data launched by Farside Traders, the entire web inflows throughout all Bitcoin ETFs have been at $1045 million (or $1.045 billion).

The second largest Bitcoin ETF so far, Constancy, noticed a somewhat quiet day with FBTC taking in solely $51.6 million, whereas Ark Make investments ($93 million), Bitwise ($24.6 million), Valkyrie ($39.6 million) and VanEck ($82.9 million) noticed comparatively sturdy capital inflows. Notably, Grayscale‘s GBTC noticed a waning outflow of simply $79 million.

Bitcoin analyst Alessandro Ottaviani shared his insights on X, underscoring the magnitude of those inflows, “1 Billy of Complete web Influx! ONE BILLION DOLLARS! […] Within the final twelve buying and selling days, The 9 influx has been $9.2b, with a mean of $768m per day. Simply think about if we hold this tempo and it’s confirmed that GBCT outflow is nearly exhausted.”

Crypto Quant analyst Maartunn offered extra context to the influx’s influence, revealing, “JUST IN: The Bitcoin Trade-Traded Fund (ETF) has skilled its highest inflows ever, with a further 14,706.2 BTC.” This assertion additional emphasizes the substantial improve in Bitcoin’s demand, doubtlessly setting it up for a serious provide squeeze.

🚨🚨 JUST IN: The Bitcoin Trade-Traded Fund (ETF) has skilled its highest inflows ever, with a further 14,706.2 BTC. https://t.co/xg7wADbRzy pic.twitter.com/IUAyt1jzGE

— Maartunn (@JA_Maartun) March 13, 2024

Including to the dialog, crypto analyst @venturefounder suggested potential future value actions primarily based on the present development, “Absolute Bitcoin insanity […] The 5-day shifting common web influx has totally recovered to peak. So… in all probability HIGHER. If this continues, $80-90k by the top of month shouldn’t be far fetched. No correction has lasted longer than 24 hours on the weekdays. Apparently, the primary main correction of the 2021 cycle got here when value went 2x earlier ATH. So may we see no main correction till $120k?”

At press time, BTC already surpassed the $73,500 mark and traded at $73,392.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site fully at your individual danger.