In a latest report by market intelligence agency Chainalysis, it has been revealed that international crypto good points in 2023 amounted to a staggering $37.6 billion. This revenue surge displays improved asset costs and market sentiment in comparison with 2022.

Though this determine falls in need of the $159.7 billion good points witnessed through the 2021 bull market, it signifies a big restoration from the estimated losses of $127.1 billion skilled in 2022.

Sharp Surge In Crypto Good points

The report means that regardless of related development charges in crypto asset costs in 2021 and 2023, the entire good points for the latter 12 months had been decrease. In line with Chainalysis, this discrepancy may doubtlessly be attributed to traders’ decreased inclination to transform their crypto property into money.

The evaluation additional means that traders in 2023 appear to have anticipated additional value will increase, as crypto asset costs didn’t exceed earlier all-time highs (ATHs) through the 12 months, in contrast to in 2021.

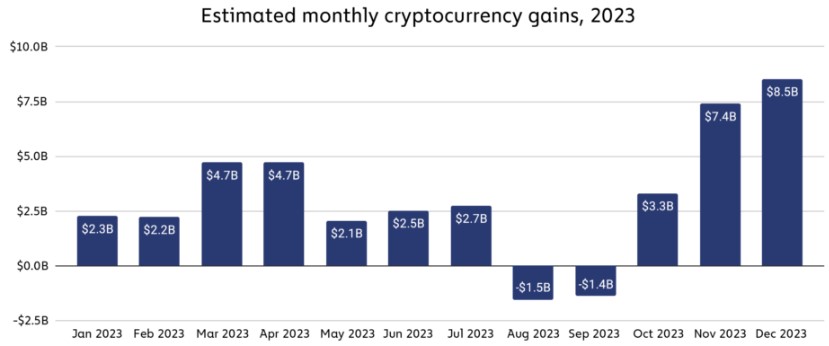

Cryptocurrency good points remained comparatively constant all through 2023, besides for 2 consecutive months of losses in August and September, as seen within the picture above. Nevertheless, good points surged sharply thereafter, with November and December eclipsing all earlier months.

United States Leads

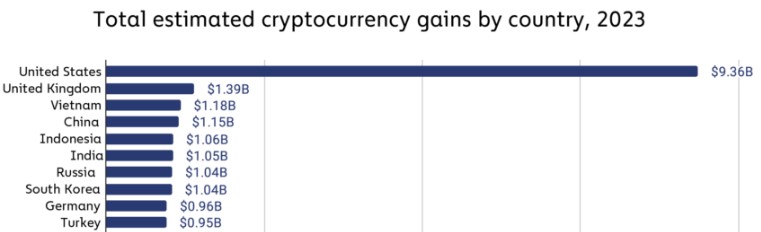

Main the pack in cryptocurrency good points was america, with an estimated $9.36 billion in income in 2023. The UK secured the second place with an estimated $1.39 billion in crypto good points.

Notably, a number of higher and lower-middle-income international locations, notably in Asia, akin to Vietnam, China, Indonesia, and India, achieved important good points, every surpassing $1 billion and rating throughout the prime six international locations worldwide.

Chainalysis had beforehand noticed robust cryptocurrency adoption in these revenue classes, notably in “lower-middle-income” international locations, which demonstrated resilience even through the latest bear market. The good points estimates point out that traders in these international locations have reaped substantial advantages from embracing the asset class.

Finally, the Chainalysis report means that the constructive developments noticed in 2023 have carried over into 2024, with distinguished cryptocurrencies akin to Bitcoin (BTC) hitting all-time highs of $73,700 following the approval of Bitcoin exchange-traded funds (ETFs) and elevated institutional adoption.

If these developments persist, the agency believes that it’s conceivable that good points in 2024 will align extra carefully with these witnessed in 2021.

As of this writing, the entire crypto market cap valuation stands at $2.5 trillion, a pointy drop of over 4% within the final 24 hours alone, and down from Thursday’s two-year excessive of $2.7 trillion. Bitcoin, alternatively, is buying and selling at $68,400 after dropping as little as $65,500 however has rapidly regained its present buying and selling value, limiting losses to 4% over the previous 24 hours.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use info offered on this web site totally at your personal danger.