ETHFI, the governance token of the decentralized liquid staking protocol Ether.fi, debuted for $4.13 following its distribution by its airdrop on March 18.

Nonetheless, because the $210 million airdrop, the worth of ETHFI has skilled a major decline, plummeting over 35% to its present buying and selling value of $3.05, in line with CoinGecko knowledge.

ETHFI Airdrop Attracts 20,000 Members

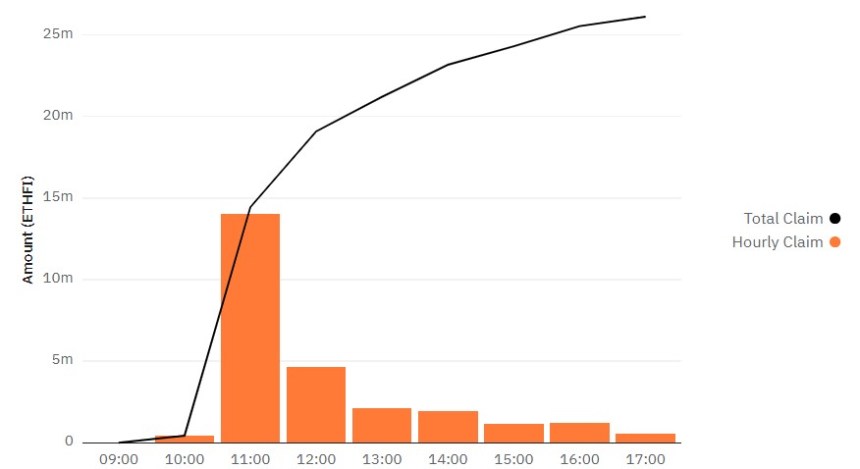

Market skilled Tom Wan has offered a abstract of the ETHFI airdrop. Out of the overall provide of 16.8 million ETHFI tokens, roughly 28% have been claimed by members.

The airdrop attracted round 20,000 claimers, showcasing appreciable curiosity within the token distribution. Notably, the highest wallets, accounting for 1.67% of the overall distribution, have the potential to obtain between 10,000 and 25,000 ETHFI tokens, reflecting substantial holdings.

Most claimers, comprising roughly 67% of members, are anticipated to obtain a decrease allocation of ETHFI tokens, starting from 175 to 500.

This distribution technique goals to make sure a broader and extra equitable dispersion of the tokens amongst members. Nonetheless, an attention-grabbing remark is that 76% of claimers have transferred their ETHFI tokens to different wallets, indicating a possible want for liquidity or buying and selling actions.

Moreover, it’s noteworthy that 38% of the token receivers are new wallets, suggesting an enlargement of the ETHFI consumer base as of Could 1, 2023. This inflow of latest members showcases a rising curiosity within the governance and utility supplied by Ether.Fi’s protocol.

Ether.fi Witnesses Surge In Whole Worth Locked

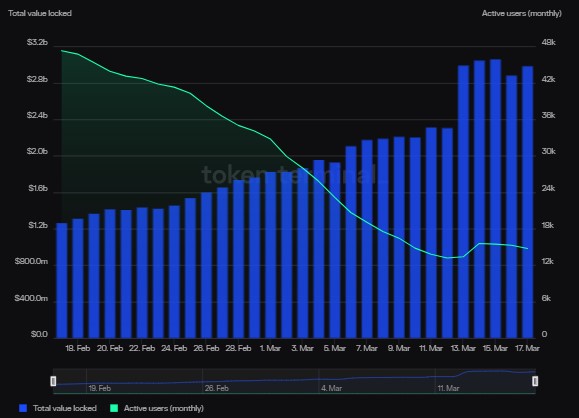

Ether.fi has skilled notable development in internet deposits and Whole Worth Locked (TVL), as evidenced by knowledge offered by Token Terminal. Nonetheless, the platform has confronted fluctuations in its energetic consumer base.

In accordance with Token Terminal, internet deposits on Ether.fi have considerably elevated, reaching $2.99 billion over the previous 30 days alone. This marks a major development charge of 136.9%.

Concurrently, the TVL on Ether.fi has mirrored the surge in internet deposits, which additionally quantity to $2.99 billion over the identical 30-day interval. This metric represents the overall worth of belongings, predominantly cryptocurrency, locked inside the protocol.

Nonetheless, whereas Ether.fi has witnessed sturdy development in internet deposits and TVL, the platform has skilled fluctuations in its energetic consumer base. Day by day energetic customers have proven a substantial decline of 54.3% over the previous 30 days, presently standing at 506.

Equally, weekly energetic customers have skilled a extra average decline of three.5%, presently standing at 5,780. This implies that whereas there was a slight discount in consumer engagement each week, a good portion of the consumer base stays actively concerned with the protocol.

Probably the most substantial decline in consumer exercise is noticed in month-to-month energetic customers, with a notable drop of 68.9% over the previous 30 days. The determine presently stands at 14,740 customers.

General, the distribution of the ETHFI token by the airdrop has garnered important consideration and participation. On the similar time, the token’s worth has skilled a decline since its preliminary itemizing, the long-term potential and impression of ETHFI inside the Ether.Fi ecosystems are but to be absolutely realized.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site totally at your personal threat.