U.S. state and federal investigators are being inundated with reviews from individuals who’ve misplaced a whole lot of 1000’s or tens of millions of {dollars} in reference to a posh funding rip-off often known as “pig butchering,” whereby persons are lured by flirtatious strangers on-line into investing in cryptocurrency buying and selling platforms that ultimately seize any funds when victims attempt to money out.

The time period “pig butchering” refers to a time-tested, closely scripted, and human-intensive means of utilizing pretend profiles on relationship apps and social media to lure folks into investing in elaborate scams. In a extra visceral sense, pig butchering means fattening up a prey earlier than the slaughter.

“The fraud is called for the best way scammers feed their victims with guarantees of romance and riches earlier than slicing them off and taking all their cash,” the Federal Bureau of Investigation (FBI) warned in April 2022. “It’s run by a fraud ring of cryptocurrency scammers who mine relationship apps and different social media for victims and the rip-off is turning into alarmingly common.”

As documented in a sequence of investigative reviews printed over the previous yr throughout Asia, the folks creating these phony profiles are largely women and men from China and neighboring nations who’ve been kidnapped and trafficked to locations like Cambodia, the place they’re pressured to rip-off full strangers over the Web — day after day.

Probably the most prevalent pig butchering rip-off at this time entails subtle cryptocurrency funding platforms, the place traders invariably see incredible returns on their deposits — till they attempt to withdraw the funds. At that time, traders are advised they owe big tax payments. However even those that pay the phony levies by no means see their cash once more.

The come-ons for these scams are prevalent on relationship websites and apps, however in addition they ceaselessly begin with what seems to be a wayward SMS — equivalent to an on the spot message about an Uber experience that by no means confirmed. Or a reminder from an entire stranger a couple of deliberate meetup for espresso. In some ways, the content material of the message is irrelevant; the preliminary aim to easily to get the recipient curious sufficient to reply in a roundabout way.

Those that reply are requested to proceed the dialog through WhatsApp, the place a horny, pleasant profile of the other gender will work via a pre-set script that’s tailor-made to their prey’s obvious socioeconomic state of affairs. For instance, a divorced, skilled feminine who responds to those scams will likely be dealt with with one profile sort and script, whereas different scripts can be found to groom a widower, a younger skilled, or a single mother.

‘LIKE NOTHING I’VE SEEN BEFORE’

That’s in response to Erin West, deputy district lawyer for Santa Clara County in Northern California. West stated her workplace has been fielding a lot of pig butchering inquiries from her state, but additionally from regulation enforcement entities across the nation which might be ill-equipped to research such fraud.

“The folks pressured to perpetrate these scams have a information and a script, the place in case your sufferer is divorced say this, or a single mother say this,” West stated. “The dimensions of that is so large. It’s a serious downside with no simple solutions, but additionally with sufferer volumes I’ve by no means seen earlier than. With victims who’re actually dropping their minds and in some circumstances are suicidal.”

West is a key member of REACT, a job drive set as much as sort out particularly advanced types of cyber theft involving digital currencies. West stated the preliminary complaints from pig butchering victims got here early this yr.

“I first thought they had been one-off circumstances, after which I noticed we had been getting these each day,” West stated. “A number of them are being reported to native companies that don’t know what to do with them, so the circumstances languish.”

West stated pig butchering victims are sometimes fairly subtle and educated folks.

“One lady was a college professor who misplaced her husband to COVID, acquired lonely and was chatting on-line, and ultimately ended up making a gift of her retirement,” West recalled of a latest case. “There are simply horrifying tales that run the gamut when it comes to victims, from younger ladies early of their careers, to senior residents and even to folks working within the monetary companies trade.”

In some circumstances reported to REACT, the victims stated they spent days or even weeks corresponding with the phony WhatsApp persona earlier than the dialog shifted to investing.

“They’ll say ‘Hey, that is the meals I’m consuming tonight’ and the image they share will present a reasonably setting with a glass of wine, the place they’re showcasing an enviable way of life however probably not mentioning something about how they achieved that,” West stated. “After which later, perhaps just a few hours or days into the dialog, they’ll say, ‘You realize I made some cash lately investing in crypto,’ sort of sliding into the subject as if this wasn’t what they had been doing the entire time.”

Curious traders are directed towards elaborate and official-looking on-line crypto platforms that seem to have 1000’s of energetic traders. Many of those platforms embody in depth examine supplies and tutorials on cryptocurrency investing. New customers are strongly inspired to crew up with extra seasoned traders on the platform, and to make solely small investments that they’ll afford to lose.

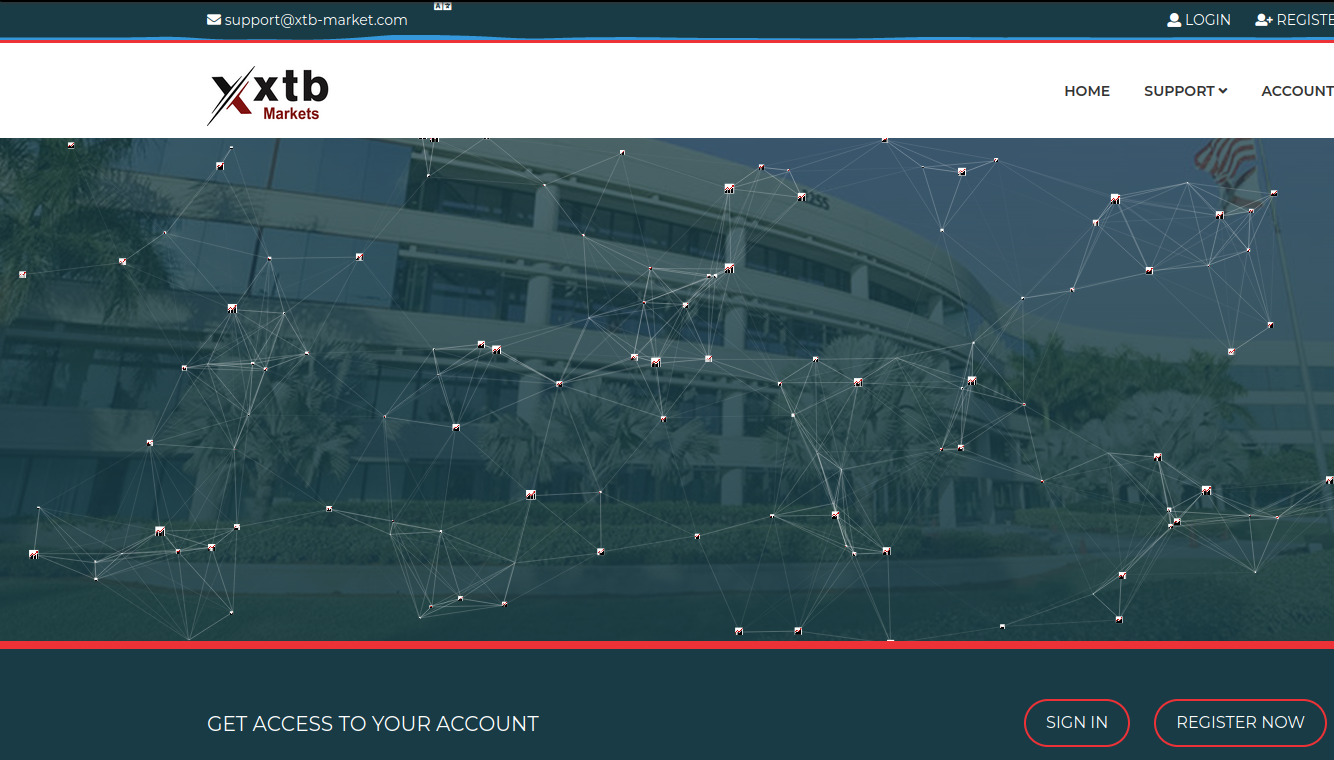

The now-defunct homepage of xtb-market[.]com, a rip-off cryptocurrency platform tied to a pig butchering scheme.

“They’re in a position to see some worth enhance, and perhaps even be allowed to take out that worth enhance in order that they really feel comfy in regards to the state of affairs,” West stated. Some traders then want little encouragement to deposit extra funds, which normally generate more and more increased “returns.”

West stated many crypto buying and selling platforms related to pig butchering scams seem to have been designed very like a online game, the place investor hype is constructed round upcoming “buying and selling alternatives” that trace at much more incredible earnings.

“There are bonus ranges and VIP ranges, and so they’ll construct hype and a way of frenzy into the buying and selling,” West stated. “There are undoubtedly some psychological mechanisms at work to encourage folks to speculate extra.”

“What’s so devastating about lots of the victims is that they lose that sense of who they’re,” she continued. “They thought they had been a savvy, subtle particular person, somebody who’s type of resistant to scams. I feel the massive scale of the trickery and psychological manipulation getting used right here can’t be understated. It’s like nothing I’ve seen earlier than.”

A $5,000,000 LOSS

Courtney Nolan, a divorced mom of three daughters, says she misplaced greater than $5 million to a pig butchering rip-off. Nolan lives in St. Louis and has a background in funding finance, however solely began investing in cryptocurrencies prior to now yr.

Nolan’s case could also be particularly dangerous as a result of she was already desirous about crypto investing when the scammer reached out. On the time, Bitcoin was buying and selling at or close to all-time highs of practically $68,000 per coin.

Nolan stated her nightmare started in late 2021 with a Twitter direct message from somebody who was following lots of the identical cryptocurrency influencers she adopted. Her fellow crypto fanatic then urged they proceed their dialogue on WhatsApp. After a lot backwards and forwards about his buying and selling methods, her new buddy agreed to mentor her on how one can make dependable income utilizing the crypto buying and selling platform xtb.com.

“I had dabbled in leveraged buying and selling earlier than, however his mentor program gave me over 100 pages of examine supplies and agreed to stroll me via their funding methods over the course of a yr,” Nolan advised KrebsOnSecurity.

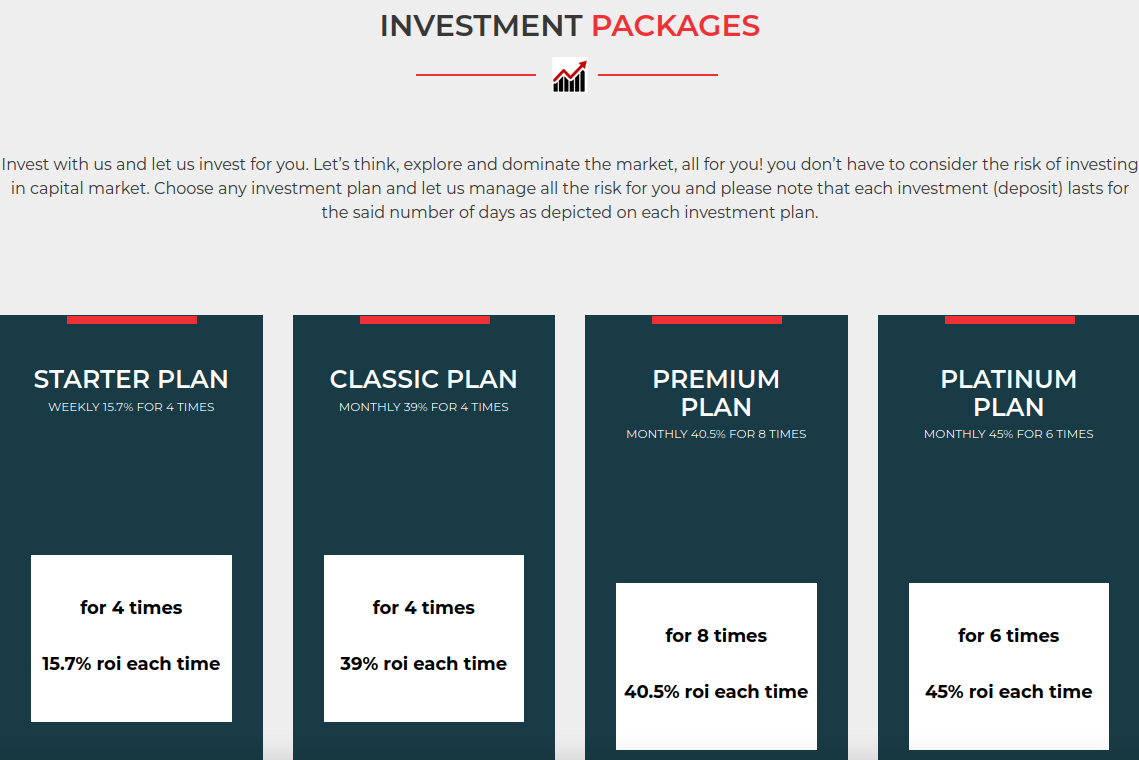

Nolan’s mentor had her create an account web site xtb-market[.]com, which was made to be confusingly much like XTB’s official platform. The location promoted a number of totally different funding packages, together with a “starter plan” that entails a $5,250 up-front funding and guarantees greater than 15 % return throughout 4 separate buying and selling bursts.

Platinum plans on xtb-market promised a whopping 45 % ROI, with a minimal funding of $265,000. The location additionally provided a beneficiant seven % fee for referrals, which inspired new traders to recruit others.

The now-defunct xtb-market[.]com.

Whereas chatting through WhatsApp, Nolan and her mentor would commerce aspect by aspect in xtb-market, initially with small investments starting from $500 to $5,000. When these generated hefty returns, Nolan made greater deposits. On a number of events she was in a position to withdraw quantities starting from $10,000 to $30,000.

However after investing greater than $4.5 million of her personal cash over practically 4 months, Nolan discovered her account was all of the sudden frozen. She was then issued a tax assertion saying she owed practically $500,000 in taxes earlier than she might reactivate her account or entry her funds.

Nolan stated it appears apparent in hindsight that she ought to by no means have paid the tax invoice. As a result of xtb-market and her mentor reduce all communications along with her after that, and your entire web site disappeared just some weeks later.

Justin Maile, an investigation companion supervisor at Chainalysis, advised Vice Information that the tax portion of the pig butchering rip-off depends on the “sunk prices fallacy,” when persons are reluctant to desert a failing technique or plan of action as a result of they’ve already invested closely in it.

“As soon as the sufferer begins getting skeptical or tries to withdraw their funds, they’re usually advised that they should pay tax on the good points earlier than funds could be unlocked,” Maile advised Vice Information. “The scammers will attempt to get any final funds out of the victims by exploiting the sunk price fallacy and dangling big income in entrance of them.”

Vice lately printed an in-depth report on pig butchering’s hyperlink to organized crime gangs in Asia that lure younger job seekers with the promise of customer support jobs in name facilities. As an alternative, those that present up on the appointed place and time are taken on lengthy automotive rides and/or pressured hikes throughout the borders into Cambodia, the place they’re pressed into indentured servitude.

Vice discovered lots of the folks pressured to work in pig-butchering scams are being held in Chinese language-owned casinos working in Cambodia. Lots of these casinos had been newly constructed when the Covid pandemic hit. As the brand new casinos and accommodations sat empty, organized crime teams noticed a chance to make use of these amenities to generate big earnings streams, and lots of international vacationers stranded in neighboring nations had been ultimately trafficked to those rip-off facilities.

Vice reviews:

“Whereas figures on the variety of folks in rip-off facilities in Cambodia is unknown, finest estimates pieced collectively from varied sources level to the tens of 1000’s throughout rip-off facilities in Sihanoukville, Phnom Penh, and websites in border areas Poipet and Bavet. In April, Thailand’s assistant nationwide police commissioner stated 800 Thai residents had been rescued from rip-off facilities in Cambodia in latest months, with an extra 1,000 residents nonetheless trapped throughout the nation. One Vietnamese employee estimated 300 of his compatriots had been held on only one ground in a tall workplace block internet hosting rip-off operations.”

“…inside Victory Paradise Resort alone there have been 7,000 folks, the bulk from mainland China, but additionally Indonesians, Singaporeans and Filipinos. In response to the Khmer Occasions, one 10-building advanced of high-rises in Sihanoukville, often known as The China Mission, holds between 8,000 to 10,000 folks taking part in varied scams—a workforce that may generate income across the $1 billion mark annually at $300 per employee per day.”

THE KILLING FLOOR

REACTs’ West stated whereas there are a lot of pig butchering victims reporting their victimization to the FBI, only a few are receiving something greater than directions about submitting a criticism with the FBI’s Web Crime Criticism Heart (IC3), which retains observe of cybercrime losses and victims.

“There’s an enormous hole in victims which might be seeing any sort of service in any respect, the place they’re reporting to the FBI however not with the ability to discuss to anybody,” she stated. “They’re filling out the IC3 kind and by no means listening to again. It type of feels just like the federal authorities is ignoring this, so persons are going to native companies, that are sending these victims our manner.”

For a lot of youthful victims of pig butchering, even losses of some thousand {dollars} could be financially devastating. KrebsOnSecurity lately heard from two totally different readers who stated they had been of their 20s and misplaced greater than $40,000 every when the funding platforms they had been buying and selling on vanished with their cash.

The FBI can usually bundle quite a few IC3 complaints involving the identical assailants and victims right into a single case for federal prosecutors to pursue the responsible, and/or attempt to recapture what was stolen. Basically, nonetheless, victims of crypto crimes hardly ever see that cash once more, or in the event that they do it might probably take a few years.

“The following piece is what can we really do with these circumstances,” West stated. “We used to border success as getting dangerous folks behind bars, however these circumstances go away us as regulation enforcement with not a number of alternative there.”

West stated the excellent news is U.S. authorities are seeing some success in freezing cryptocurrency wallets suspected of being tied to large-scale cybercriminal operations. Certainly, Nolan advised KrebsOnSecurity that her losses had been substantial sufficient to warrant an official investigation by the FBI, which she says has since taken steps to freeze no less than a few of the property tied to xtb-market[.]com.

Likewise, West stated she was lately in a position to freeze cryptocurrency funds stolen from some pig butchering victims, and now REACT is specializing in serving to state and native authorities learn to do the identical.

“It’s vital to have the ability to mobilize shortly and know how one can freeze and seize crypto and get it again to its rightful proprietor,” West stated. “We undoubtedly have made seizures in circumstances involving pig butchering, however we haven’t gotten that again to the rightful homeowners but.”

In April, the FBI warned Web customers to be on guard towards pig butchering scams, which it stated attracts victims with “guarantees of romance and riches” earlier than duping them out of their cash. The IC3 stated it obtained greater than 4,300 complaints associated to crypto-romance scams, leading to losses of greater than $429 million.

Listed here are some frequent components of a pig butchering rip-off:

–Courting apps: Pig-butchering makes an attempt are frequent on relationship apps, however they’ll start with virtually any sort of communication, together with SMS textual content messages.

–WhatsApp: In nearly all documented circumstances of pig butchering, the goal is moved pretty shortly into chatting with the scammer through WhatsApp.

–No video: The scammers will provide you with all types of excuses to not do a video name. However they are going to all the time refuse.

–Funding chit-chat: Your contact (ultimately) claims to have inside information in regards to the cryptocurrency market and may help you earn a living.

The FBI’s tips about avoiding crypto scams:

-By no means ship cash, commerce, or make investments primarily based on the recommendation of somebody you’ve gotten solely met on-line.

-Don’t discuss your present monetary standing to unknown and untrusted folks.

-Don’t present your banking data, Social Safety Quantity, copies of your identification or passport, or some other delicate data to anybody on-line or to a website you have no idea is reputable.

-If a web-based funding or buying and selling website is selling unbelievable income, it’s most definitely that—unbelievable.

-Be cautious of people who declare to have unique funding alternatives and urge you to behave quick.