The second largest chip producer on the planet, Samsung, has introduced its forecast for the corporate’s first quarter outcomes of 2024. Whereas it is solely anticipating an affordable 8% enhance in gross sales, in comparison with this time final 12 months, working income are anticipated to enhance by greater than 900%—from a mere half a billion {dollars} as much as an infinite $4.9 billion.

Sadly, the forecast would not go into any particulars as to why Samsung’s fortunes have dramatically modified, however its monetary report for 2023 offers some clues. A large portion of its gross sales revenue is all the way down to the success of Samsung’s reminiscence division, accounting for roughly one third of all gross sales.

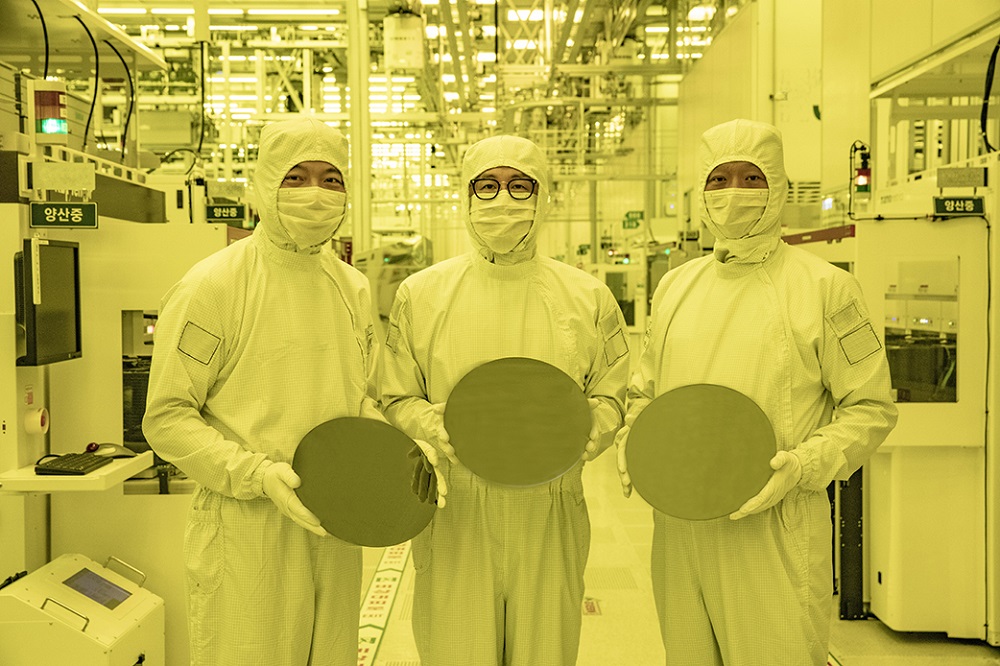

Peel aside the innards of a typical gaming PC and you may stand likelihood of seeing Samsung reminiscence chips plastered throughout it—GDDR6 used for the VRAM on the graphics card, DDR4 or DDR5 for the system reminiscence, and probably NAND flash chips in SSDs. Within the case of DRAM, Samsung leads the business, with a 40% market share, with rivals SK Hynix and Micron taking second and third place respectively.

It is not fairly as excellent news for the foundries churning out processors, regardless of having a backlog of orders. It was reported final 12 months that Samsung was struggling to make its new 3nm GAA (Gate All Round) course of node work nicely and till it does, any cash invested in analysis and improvement will not get coated in gross sales.

In the meantime, chief rival TSMC is forecasting that the primary quarter of 2024 shall be extra of the identical—a wholesome $18.9 billion of web income and an enormous working margin of 42%. The Taiwanese chip agency manufactures just about every little thing for AMD and Apple, the vast majority of Nvidia’s merchandise, and round 30% of all of the silicon wafers that Intel wants.

Towards such dominance, you may suppose that Samsung stands no likelihood, however do not forget that it makes a number of the greatest show panels for gaming displays you should purchase, and it is one of many few producers of HBM3e—an ultra-high bandwidth reminiscence that AI and compute mega-processors, like AMD’s MI300X and Nvidia’s H100 and B200 all use.

Later this 12 months, we are able to seemingly count on to see new graphics processors from AMD, Intel, and Nvidia, and a few of these are in all probability going to be utilizing the following technology of VRAM chip, GDDR7. With so few firms making this sort of graphics RAM, Samsung appears set to obtain numerous orders from Asus, Gigabyte, MSI, and the remaining.

There’s additionally the truth that TSMC’s order books are in excessive demand, particularly for its newest course of nodes, and there is a good likelihood that AMD and Nvidia could flip to Samsung to manufacture older, low-end GPUs to the provision of them ticking alongside properly.

Whether or not that involves go is anybody’s guess proper now, nevertheless it’s clear that Samsung is anticipating nice issues to occur this 12 months, be it reminiscence, processors, or any one in all its merchandise in its expansive portfolio.

A profitable Samsung is an effective factor for the chip business, as it can assist to maintain the market aggressive, which ought to lead to first rate costs and availability for the tip client.

Let’s hope that is simply not wishful pondering on my half.

/cdn.vox-cdn.com/uploads/chorus_asset/file/24830575/canoo_van_photo.jpeg)