Fast Take

Bitcoin’s 20% decline from its all-time excessive has raised considerations concerning the potential affect on the continued bull run.

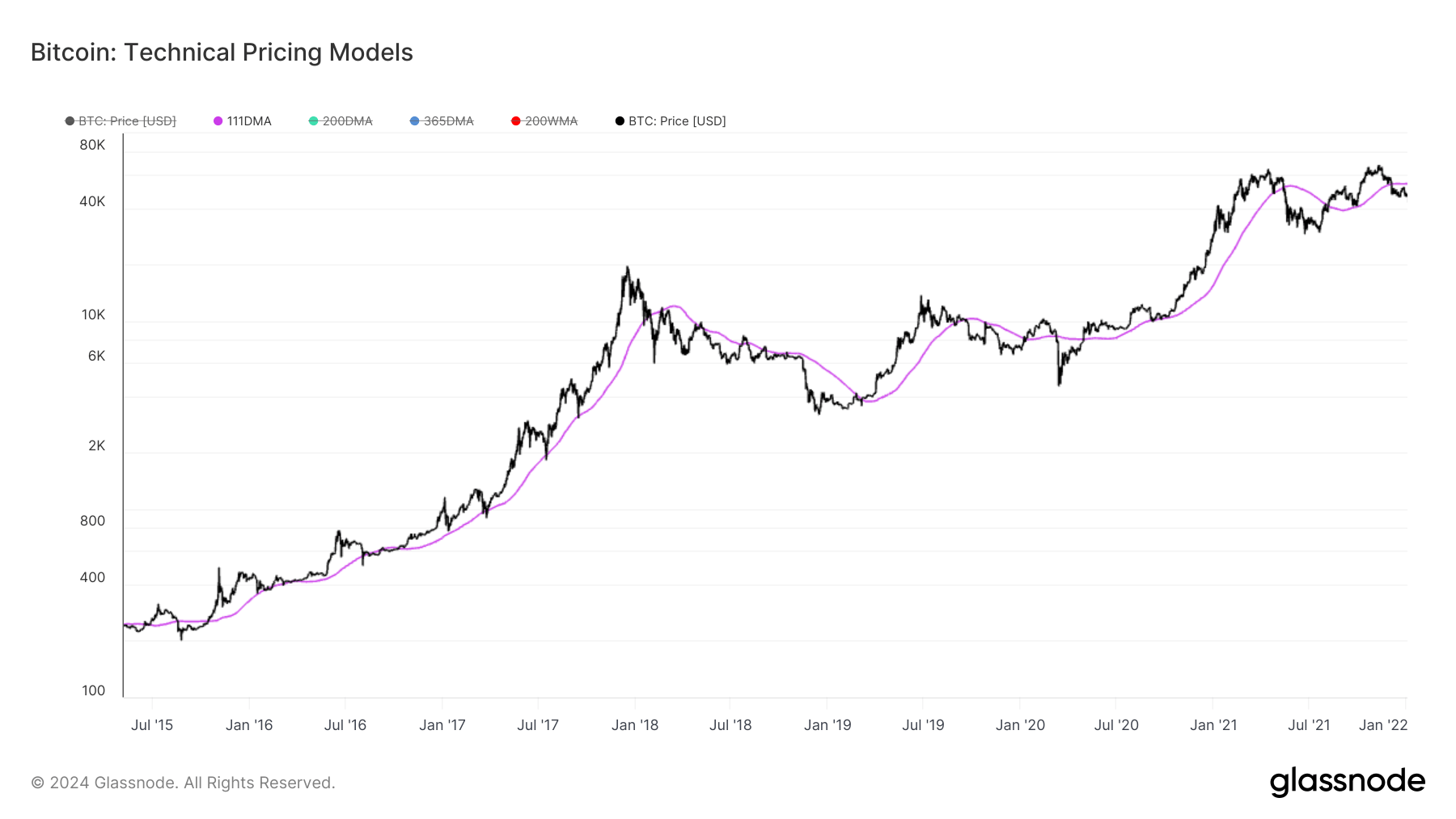

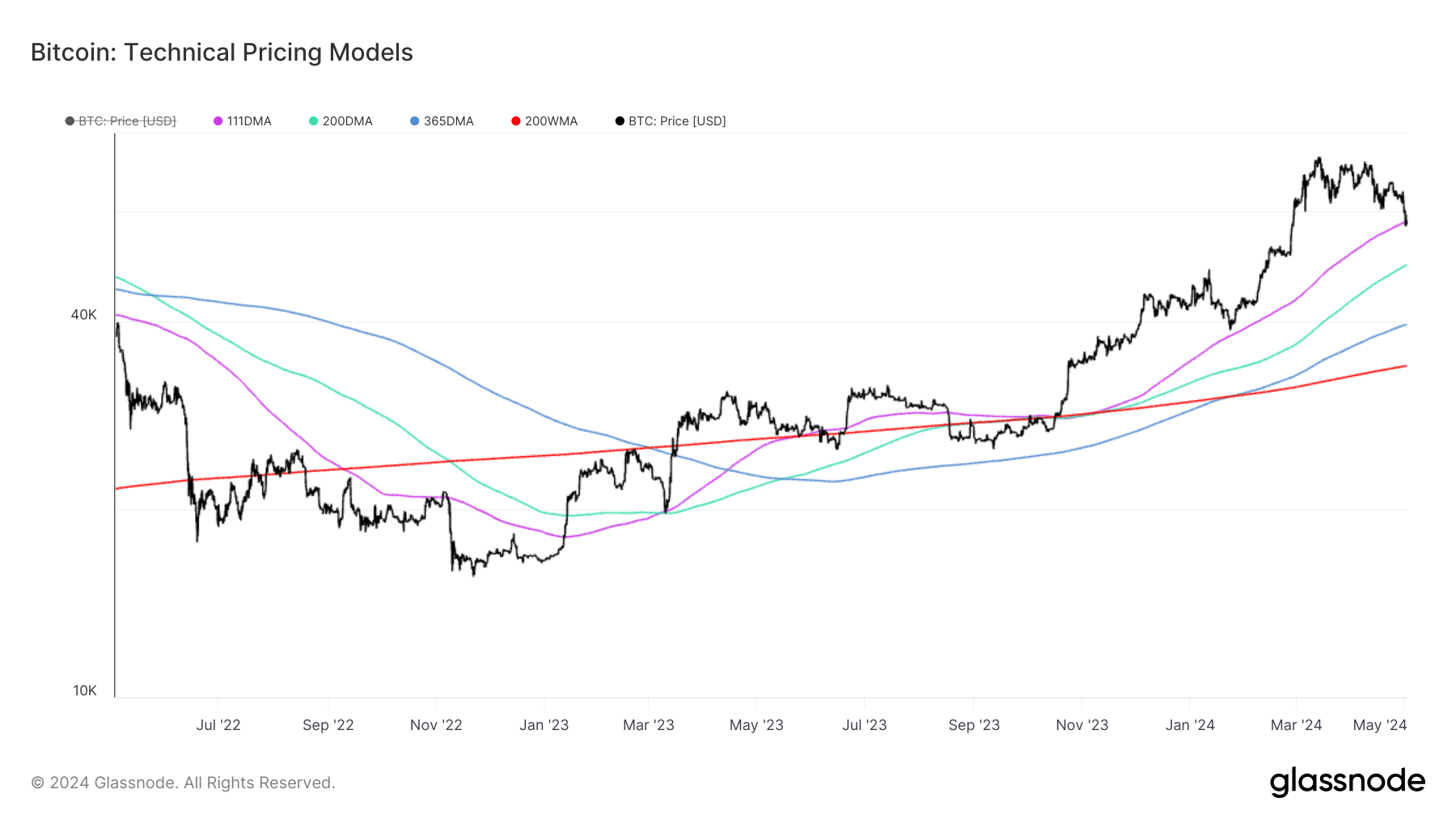

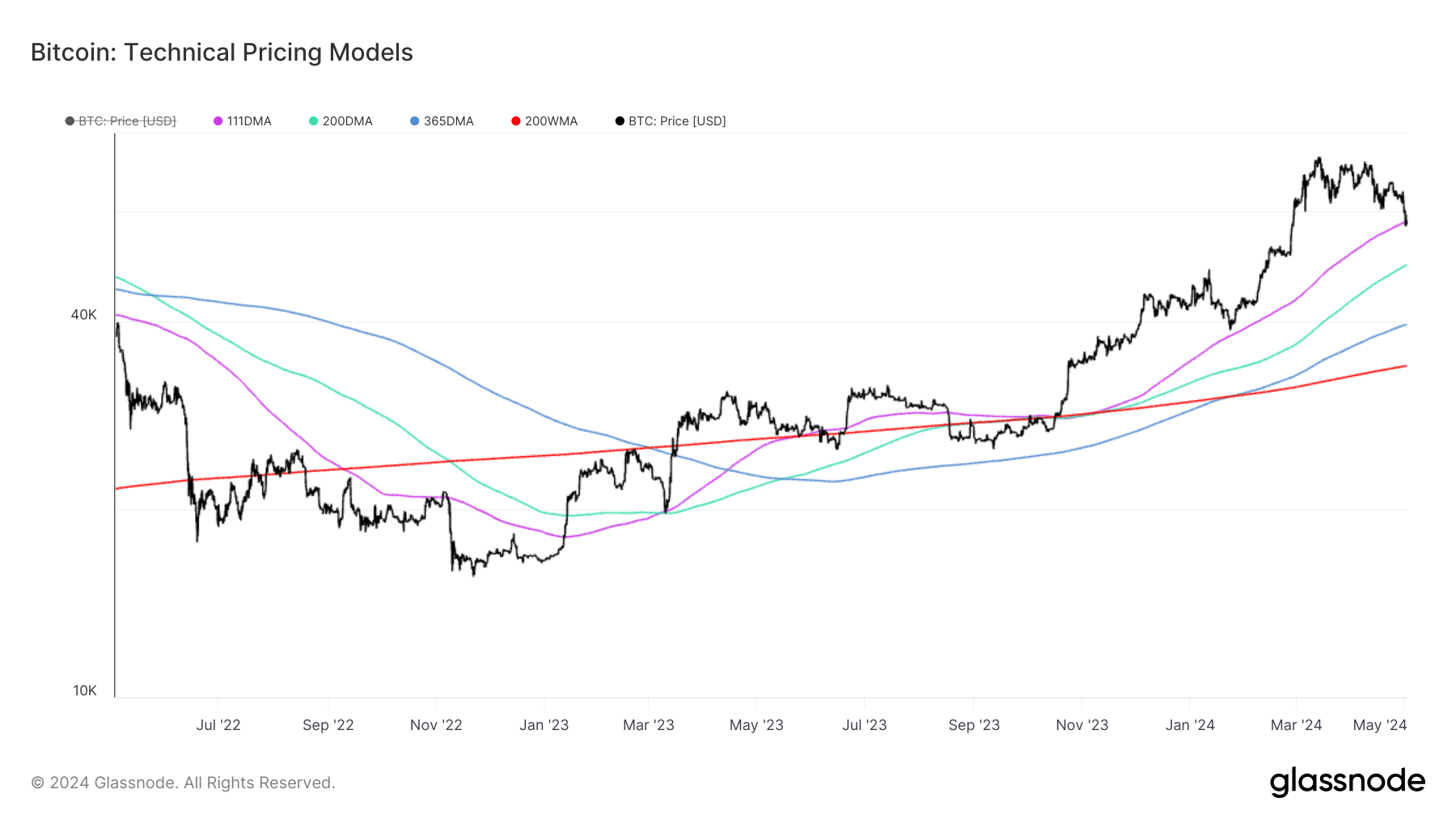

To raised perceive the present market circumstances, we will analyze Bitcoin’s worth towards key transferring averages, extensively used technical indicators within the digital asset area. Probably the most essential transferring averages is the 111-day transferring common (111dma), at the moment at $57,779. Bitcoin briefly dipped beneath this stage, a situation that has occurred in earlier bull runs, notably in 2017. This transferring common has traditionally been a important help stage throughout bullish durations.

Different key transferring averages to look at embrace the 200-day transferring common (200dma) at $49,278, the 365-day easy transferring common (365dma) at $39,593, and the 200-week transferring common (200wma) at $33,963. Bitcoin should keep its place above these ranges to maintain the potential bull run alive.

In line with Glassnode information, these transferring averages serve totally different functions. The Pi Cycle Indicator (111D-SMA) captures short-to-mid-term market momentum, whereas the Mayer A number of (200D-SMA) is usually related to the transition level between bull and bear markets. The Yearly Shifting Common (365D-SMA) gives a long-standing baseline for prime time frame market momentum, and the 200 Week Shifting Common (200W-SMA) captures the baseline momentum of a traditional four-year Bitcoin cycle.

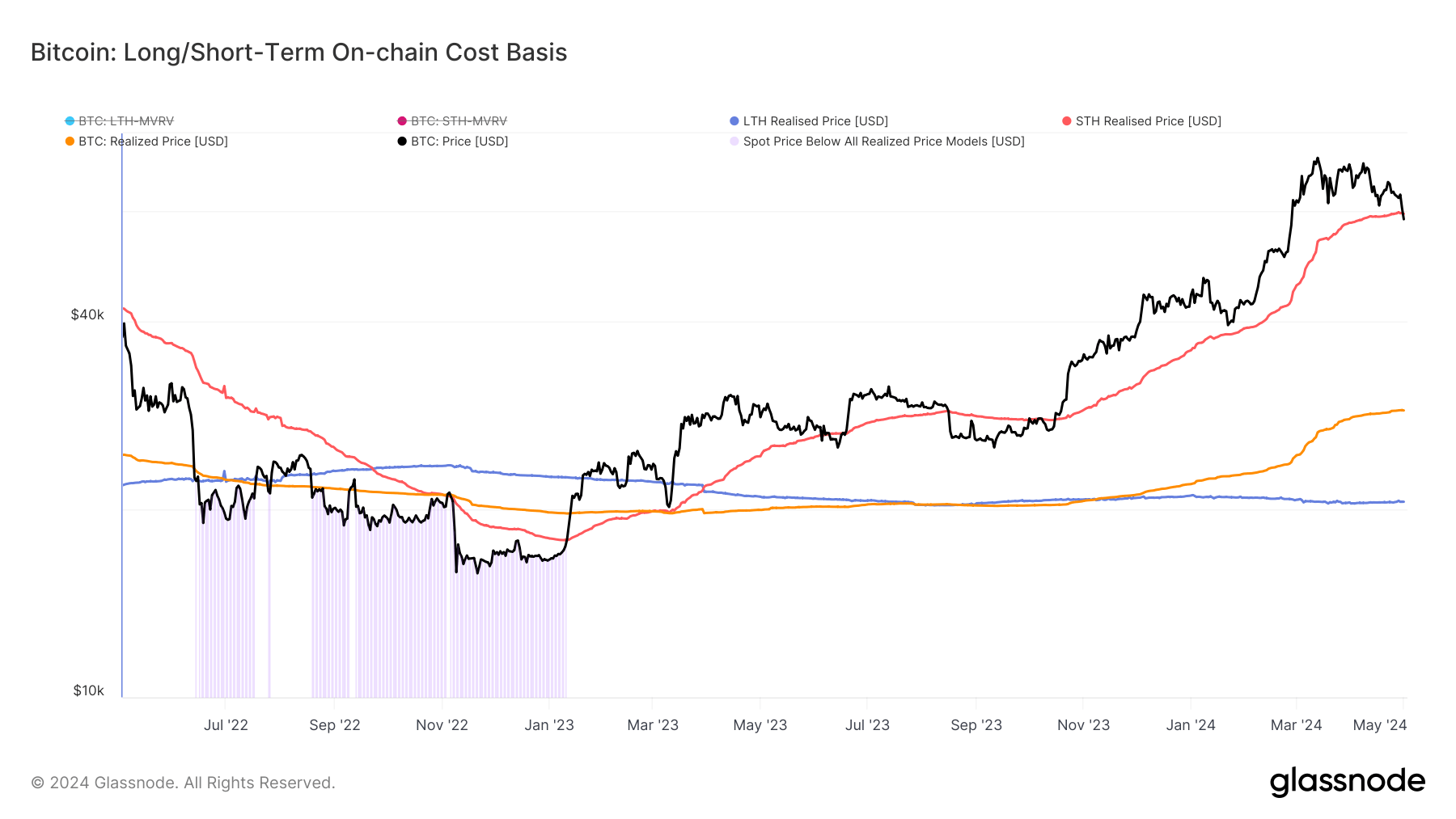

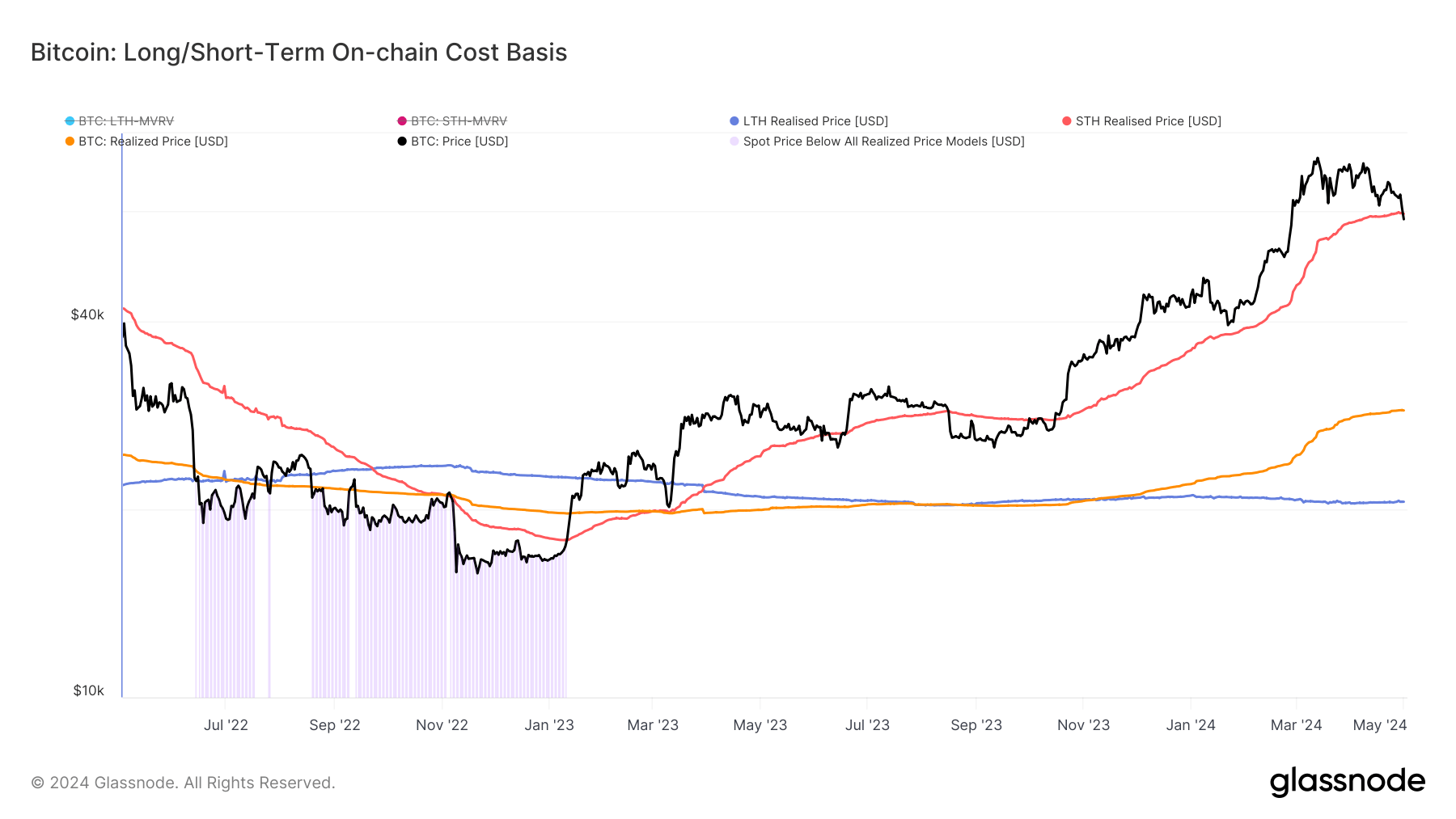

Moreover, Bitcoin has fallen beneath the short-term holder realized worth, at the moment at $59,468. Reclaiming this stage is taken into account an important indicator of the digital asset’s potential restoration.