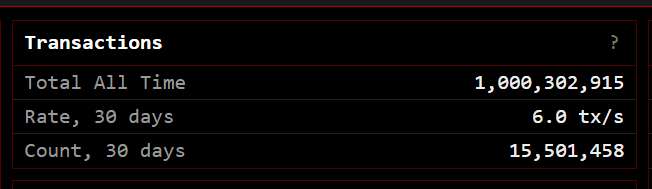

Bitcoin, the trailblazer of cryptocurrencies, reached a symbolic milestone this weekend, processing its 1-billionth transaction. This achievement has ignited a celebratory temper amongst proponents, who hail it as a testomony to the digital foreign money’s rising legitimacy and potential. Nonetheless, beneath the champagne toasts, whispers of warning linger as analysts grapple with the true significance of this benchmark.

Bitcoin’s Blockchain Bonanza: Safety And Velocity Take Middle Stage

On the coronary heart of the celebration lies the accomplishment itself. Bitcoin’s decentralized community, usually touted for its safety, has demonstrably facilitated 1 billion transactions – a testomony to its capacity to perform flawlessly at scale.

This feat, primarily based on information by Clark Moody, is especially noteworthy when in comparison with established cost giants like Visa, which took roughly 25 years to achieve the identical milestone. Proponents like Tarik Sammour emphasize this achievement, highlighting that “Bitcoin has accomplished so flawlessly, securely, and with none centralized middleman,” a stark distinction to the normal monetary system.

What’s wonderful shouldn’t be that the #Bitcoin community has now processed 1B transactions, however that it has accomplished so flawlessly, securely, and with none centralised middleman. https://t.co/XC09H5bO6u

— Tarik Sammour (@tarik_sammour) May 6, 2024

Bitcoin Vs. The Goliaths: Can Crypto Actually Compete?

The celebratory temper extends to Bitcoin’s potential as a viable funds platform. Analysts level to the speedy progress of Bitcoin in comparison with established gamers like Visa and Mastercard. Founding father of the Orange Tablet App, Matteo Pallegrini, emphasizes this level, underscoring Bitcoin’s resilience regardless of dealing with giants with “billions of {dollars} in advertising and marketing spend and hundreds of workers.”

This comparability fuels the narrative that Bitcoin is disrupting the funds panorama, providing a sooner and extra clear various.

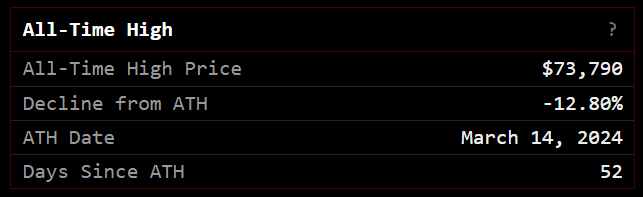

A screenshot of Bitcoin Community's transactions and BTC value efficiency. Supply: Clark Moody.

A Look Past The Billion: Challenges On The Horizon

Whereas the celebratory refrain is loud, a more in-depth look reveals some lingering issues. Bitcoin grapples with scalability points, struggling to deal with the excessive transaction quantity essential to actually compete with conventional cost processors.

This usually interprets to excessive transaction charges, probably hindering broader adoption. Moreover, the environmental affect of Bitcoin mining, which depends on huge quantities of power, stays a major level of competition.

Bitcoin is now buying and selling at $64.244. Chart: TradingView

The Verdict: A Toast With Reservations

The 1 billion transaction milestone undoubtedly marks a major second for Bitcoin. It underscores the rising recognition and potential of this digital foreign money. Nonetheless, a balanced perspective acknowledges the challenges Bitcoin faces – scalability, transaction charges, and environmental issues.

Associated Studying: XRP Holders Stack Cash Regardless of Value Dip: Bullish Sign Or HODL Of Desperation?

Whereas institutional funding and comparisons to web adoption are encouraging indicators, widespread particular person adoption stays a query mark. The way forward for Bitcoin hinges on its capacity to deal with these points and evolve into a very viable various within the world monetary panorama.

Featured picture from Pexels, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use info offered on this web site totally at your individual danger.