Chainlink (LINK) has loved a pointy surge of greater than 21% over the previous 24 hours. Right here’s what information suggests could possibly be behind this rally.

Chainlink Has Stunned Crypto Market With Breakout In The Previous Day

Whereas most cryptocurrency sectors have seen flat or small inexperienced returns during the last 24 hours, Chainlink has proven a decoupling because it has noticed some sharp bullish momentum on this window.

Associated Studying

Here’s a chart that shows how LINK’s latest efficiency has seemed like:

With this sudden burst, Chainlink has touched the $16.7 mark for the primary time because the crash throughout the first half of April. Whereas the asset has now retraced a significant a part of this plunge, it nonetheless hasn’t made a full restoration.

Ought to LINK’s bullish momentum proceed, although, it might not be too lengthy earlier than the cryptocurrency can reclaim the $17.8 degree it was buying and selling at simply earlier than the crash.

As for the place Chainlink stands within the wider market, the desk beneath exhibits that, primarily based on market cap, it’s at present the fifteenth largest coin.

LINK isn’t too far off from Polkadot (DOT) now, so it’s doable that if the value rise continues, the coin will dethrone DOT and take over the 14th spot on the listing.

Now, what could possibly be the rationale for Chainlink’s sudden decoupling from the remainder of the market? Information from the on-chain analytics agency Santiment could maybe present some hints.

The Complete Quantity Of LINK Whales Is At A 6-Month Excessive Now

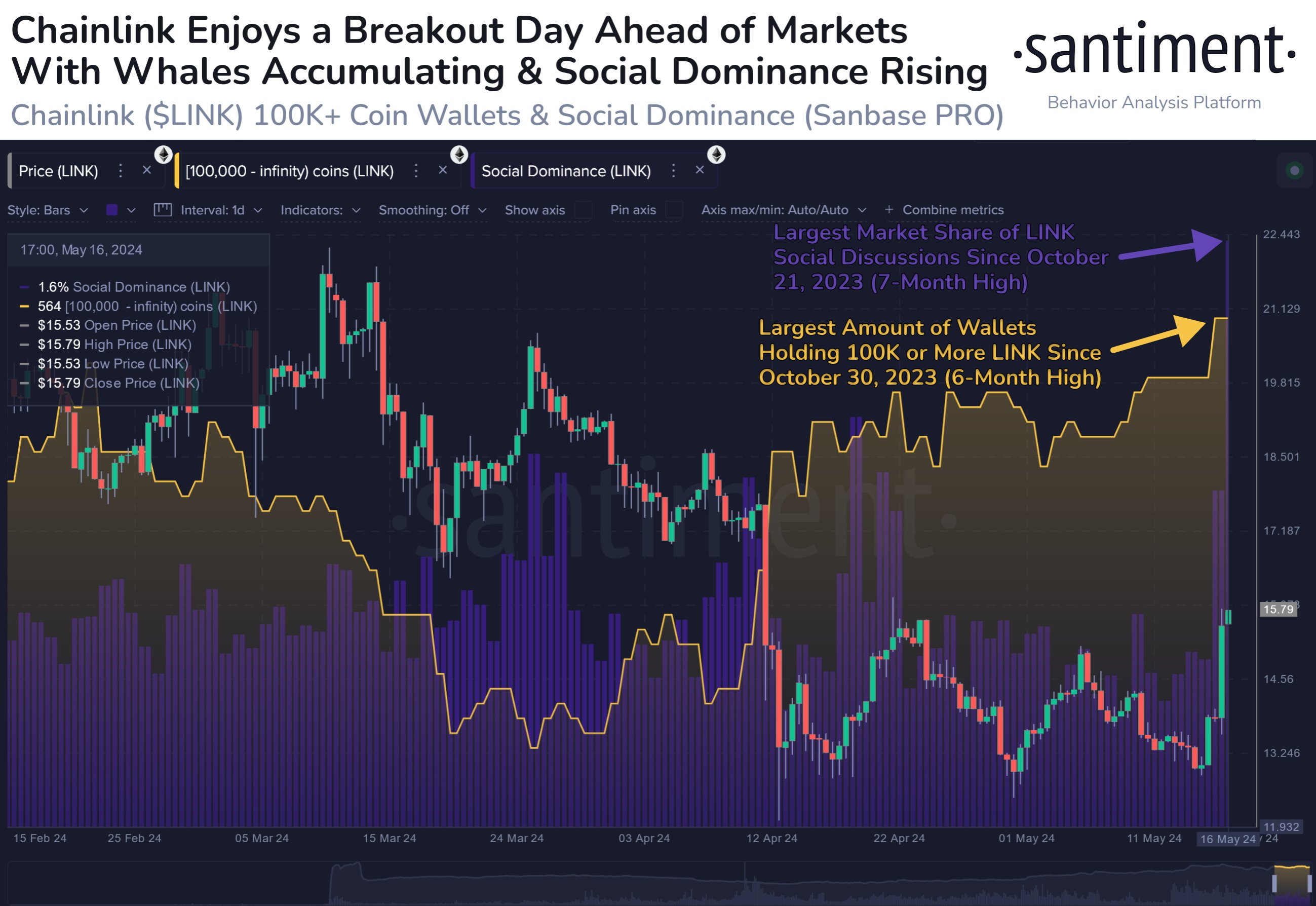

As identified by Santiment in a submit on X, Chainlink buyers holding 100,000 tokens or extra of the asset of their steadiness have not too long ago seen their deal with depend enhance.

This cutoff is equal to round $1.67 million on the present LINK trade fee. Buyers with holdings this huge are popularly known as whales.

Whales could be influential entities out there as a result of they will transfer a considerable amount of quantity in a brief span of time. As such, their conduct could also be value monitoring.

From the graph, it’s seen that Chainlink’s whole variety of whale addresses has hit 564 after the most recent rise, which is the best the metric has been since October of final yr. This enhance within the variety of whales on the community could also be partially behind the surge that LINK has simply seen.

In the identical chart, the analytics agency has additionally hooked up the information for one more indicator: social dominance. This metric tells us concerning the share of cryptocurrency-related social media discussions that LINK occupies proper now.

Associated Studying

This indicator has shot up alongside this rally, implying the curiosity across the coin has spiked. Traditionally, such an increase in consideration has been a bearish signal for the asset, so it stays to be seen if these excessive values might be maintained. “If social dominance calms and FOMO doesn’t take over, bullish circumstances are forward,” notes Santiment.

Featured picture from iStock.com, CoinMarketCap.com, Santiment.internet, chart from TradingView.com