Bitcoin’s value has risen roughly 2% up to now 24 hours, trending above $70,000, a psychological stage. As bulls put together for extra positive factors, Willy Woo, an on-chain analyst, believes the coin may soar even greater after breaking above the all-important resistance stage at $72,000.

Will Bitcoin Soar To $75,000 Due To A Brief Squeeze?

Even after the spike on Could 20 lifted the coin above $66,000 after days of decrease lows, taking Bitcoin to $56,500, bulls didn’t comply with by means of. As issues stand now, Bitcoin is inside a broader vary, capped at $72,000, the primary native help, and $73,800, the all-time excessive.

Associated Studying

Nonetheless, a breach can be vital contemplating the importance of $72,000, a stage that has solely been retested however not damaged in a number of weeks. One rationalization for potential value enlargement is {that a} breakout, ideally with rising quantity, would possibly sign the beginning of one other leg up, drawing demand.

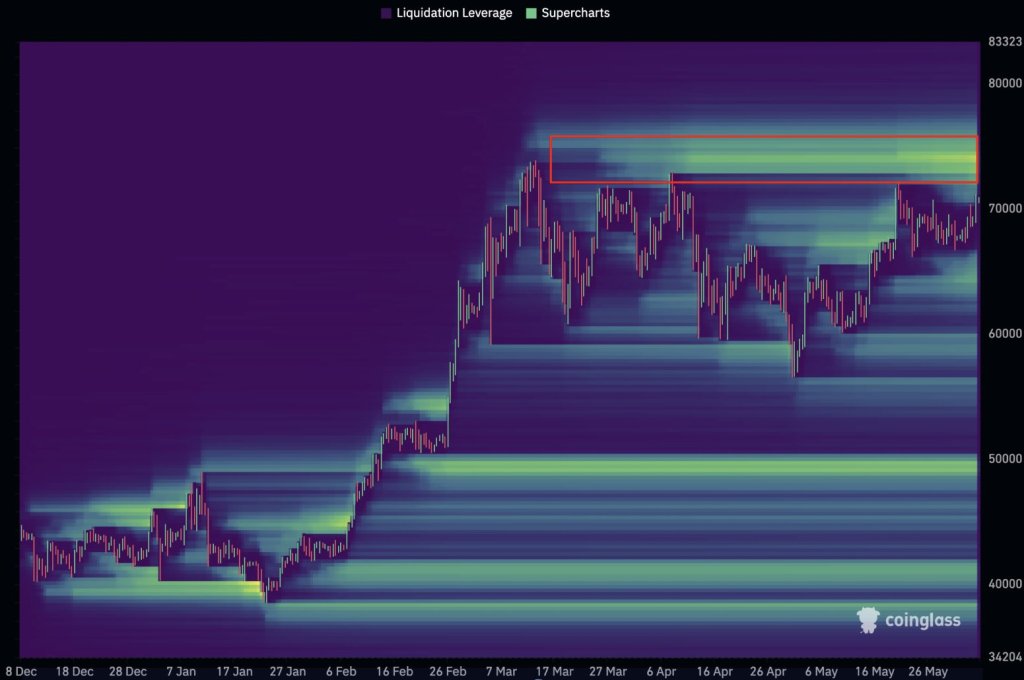

For Woo, closing $72,000 may see costs quick broaden, even breaking $75,000 due to a brief squeeze. As soon as bulls pierce and shut above this stage of curiosity, there can be a wave of liquidations, the place many brief positions are compelled to shut, driving costs greater.

Based mostly on Woo’s evaluation, roughly $1.5 billion value of brief positions might be liquidated “all the way in which as much as $75,000.” If this occurs, then it’s extremely possible that Bitcoin will register new all-time highs roughly seven weeks after Halving.

Influx To Spot BTC ETFs Rising, Demand Will Solely Proceed Rising

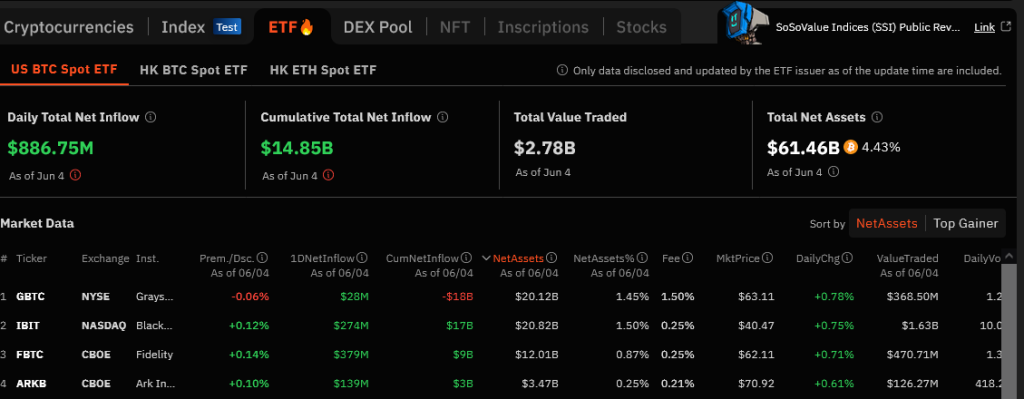

Underpinning this bullish sentiment is the spectacular surge in institutional inflows into spot Bitcoin exchange-traded funds (ETFs) on June 4. In keeping with sosovalue information, spot Bitcoin ETF issuers purchased $886.6 million value of BTC yesterday.

Constancy purchased $378.7 million of BTC, whereas BlackRock, behind the most important spot BTC ETF, purchased $274.4 million of the coin. Bitwise additionally made a considerable demand, including $61 million of BTC.

Apparently, Grayscale additionally noticed inflows, including $28.2 million of BTC on behalf of its purchasers. This inflow was the second-highest every day influx quantity because the launch of spot Bitcoin ETFs in January 2024.

Associated Studying

With this wave of institutional demand, Bitcoin is above $71,500. Most significantly, costs stay above $70,000, confirming the bull spike from the center BB on June 3.

The demand for these complicated derivatives will solely enhance. Yesterday, the Thailand Securities and Change Fee (SEC) authorised the nation’s first spot Bitcoin ETF. The product will solely be accessible to rich and institutional buyers. The inexperienced lighting comes after an analogous product went dwell in Australia.

Characteristic picture from DALLE, chart from TradingView