Within the final a number of months, liquidations have change into high of the information cycle within the crypto world. This text will clarify what liquidations are within the context of crypto, together with how they occur and what you are able to do to keep away from them.

What’s a Crypto Liquidation?

A liquidation is the pressured closing out of all or a part of the preliminary margin place by a dealer or asset lender. Liquidation happens when a dealer is unable to fulfill the allocation of a leveraged place and doesn’t have sufficient funds to maintain the commerce working.

A leveraged place refers to utilizing your current belongings as collateral for a mortgage or borrowing cash after which utilizing the principal already pledged and the borrowed cash to purchase monetary merchandise collectively to make a much bigger revenue.

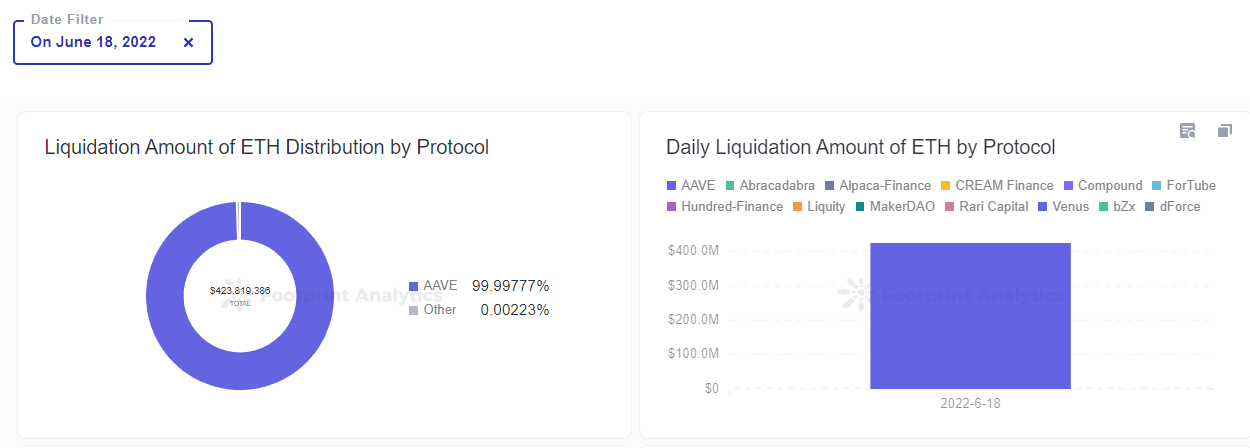

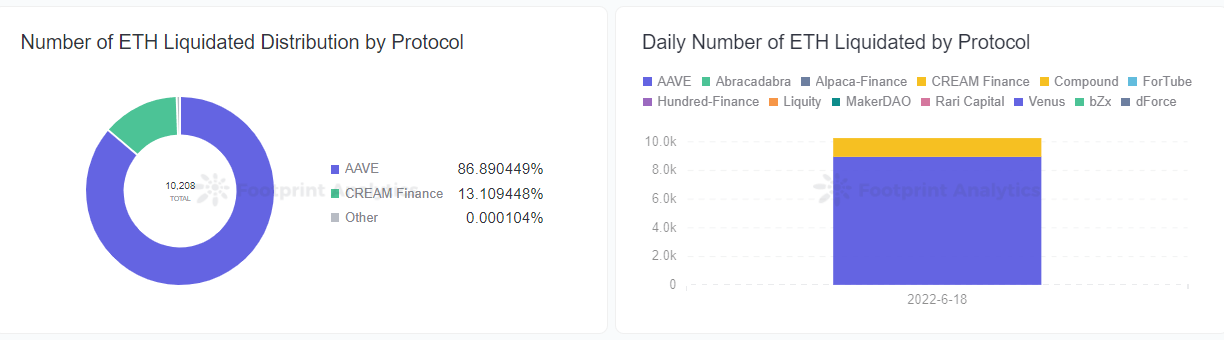

Most lending protocols, equivalent to Aave, MakerDAO, and Abracadabra, have a liquidation operate. In keeping with Footprint Analytics information, on June 18, when the value of ETH fell, there have been 13 liquidation occasions within the DeFi market. On the identical day, lending protocols liquidated 10,208 ETH, with a liquidation quantity of $424 million.

With liquidations come liquidators. Massive establishments or traders could purchase the liquidated belongings at a reduced worth and promote them available in the market to earn the distinction.

Why Do Crypto Liquidations Occur?

In DeFi, stake lending is when customers pledge their belongings to the lending protocol in change for the goal asset after which make investments once more for a second time to earn extra revenue. It’s basically a by-product. With a view to keep the long-term stability of the system, the lending protocol will design a liquidation mechanism to cut back the danger for the protocol.

Let’s check out MakerDAO.

MakerDAO helps a wide range of currencies equivalent to ETH, USDC and TUSD as collateral so as to diversify the danger of the protocol belongings and alter the availability and demand of DAI. MakerDAO has established a stake fee, which is over-collateralization, of 150%. This determines the set off for a liquidation.

Right here’s an instance:

When the value of ETH is $1,500, a borrower stakes 100 ETH to the MakerDAO protocol (valued at 150,000) and might lend as much as $99,999 DAI on the 150% stake fee set by the platform. At this level, the liquidation worth is $1,500.

If the value of ETH falls beneath $1,500, ETH will hit the stake fee and will likely be weak to liquidation by the platform. Whether it is liquidated, it’s equal to a borrower shopping for 100 ETH for $99,999.

Nonetheless, if the borrower doesn’t need to be liquidated shortly, there are a number of methods to cut back the danger of liquidation.

- Lend lower than $99,999 DAI

- Return lent DAI and costs earlier than the liquidation set off

- Proceed to stake extra ETH earlier than liquidation is triggered, lowering the stake fee

Along with setting a 150% pledge fee, MakerDAO additionally units a 13% penalty rule for liquidation. In different phrases, debtors who’ve been liquidated will solely obtain 87% of their top-up belongings. 3% of the nice will go to the liquidator and 10% to the platform. The aim of this mechanism is to encourage debtors to control their collateral belongings to keep away from liquidation and penalties.

How do Liquidations Impression the Market?

When the crypto market is affluent, high-profile and heavy positions by establishments and large-scale customers are the ”reassuring tablets” for all traders. Within the present downtrend, the previous bull market promoters have change into black swans lining up, every holding by-product belongings that may be liquidated. What’s even scarier is that in a clear system on-chain, the numbers of those crypto belongings might be seen at a look.

For establishments

As soon as it suffers an entire liquidation, it may set off a sequence response of associated protocols, establishments and others, along with bringing extra promoting strain. It’s because the loss hole between the lending place and the collateralized belongings will likely be pressured to be borne by these protocols and establishments, which can put them in a dying spiral.

For instance, when stETH went off-anchor, CeFi establishment Celsius was drastically affected, exacerbating liquidity issues and inflicting a large run on customers. The establishment was pressured to promote stETH in response to the demand from customers to redeem their belongings, and was finally unable to face up to the strain to droop account withdrawals and transfers. In flip, Three Arrows Capital holds a big lending place in Celsius, and Celsius’ issue in defending itself will certainly have an effect on Three Arrows Capital’s asset stress drawback till they collapse.

For DeFi protocols

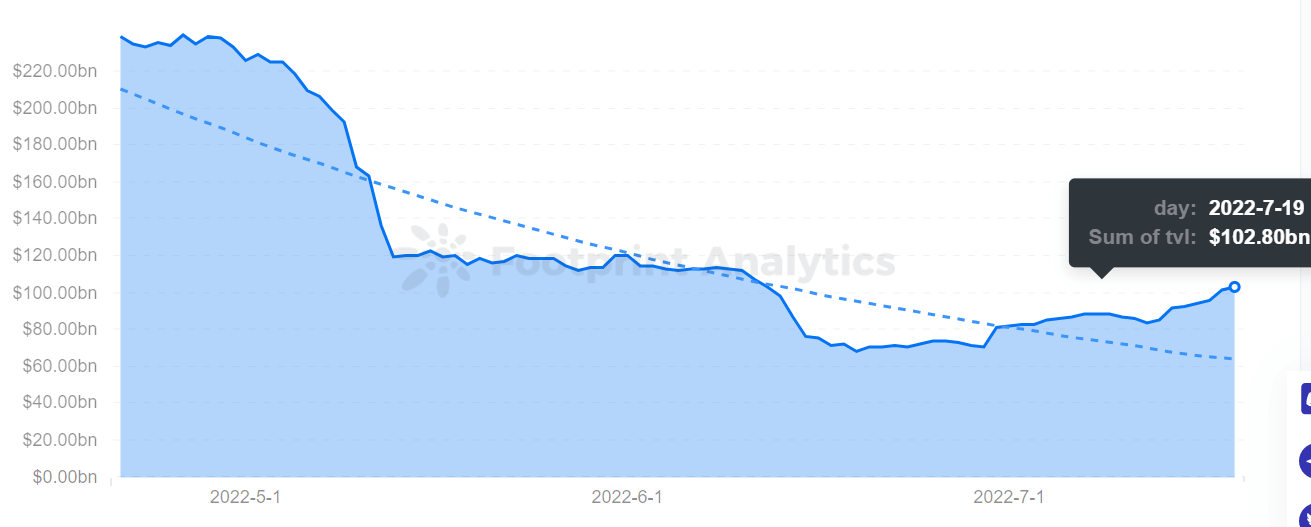

When the value of the foreign money falls and the worth of the belongings staked by customers within the platform falls beneath the liquidation line (the mechanism for organising liquidation will fluctuate from platform to platform), the staked belongings will likely be liquidated. In fact, customers will promote dangerous belongings shortly to keep away from liquidation in a downturn. This additionally impacts DeFi’s TVL, which has seen TVL fall 57% over the previous 90 days.

If the protocol can not face up to the strain of a run, it can additionally face the identical dangers because the establishment.

For customers

When a person’s belongings are liquidated, along with dropping their holdings, they’re additionally topic to charges or penalties charged by the platform.

Abstract

As with conventional monetary markets, cryptocurrency markets are equally cyclical. Bull markets don’t final without end, and neither do bear markets. At every stage, you will need to be cautious and watch your belongings intently to keep away from liquidation, which may result in losses and a dying spiral.

Within the crypto world, abiding by the foundations of sensible contracts, shouldn’t a resilient financial system be like this?

This piece is contributed by Footprint Analytics neighborhood in July. 2022 by Vincy

Knowledge Supply: Footprint Analytics – ETH Liquidation Dashboard

The Footprint Neighborhood is a spot the place information and crypto fanatics worldwide assist one another perceive and acquire insights about Web3, the metaverse, DeFi, GameFi, or some other space of the fledgling world of blockchain. Right here you’ll discover energetic, various voices supporting one another and driving the neighborhood ahead.