Bitcoin has been on a bumpy trip in current days. The world’s hottest cryptocurrency has seen its worth steadily decline, elevating issues a couple of extended bear market. Nonetheless, beneath the floor, some analysts are detecting faint bullish whispers that might sign a possible reversal.

Associated Studying

Shopping for Stress Emerges, However Can It Overcome The Downtrend?

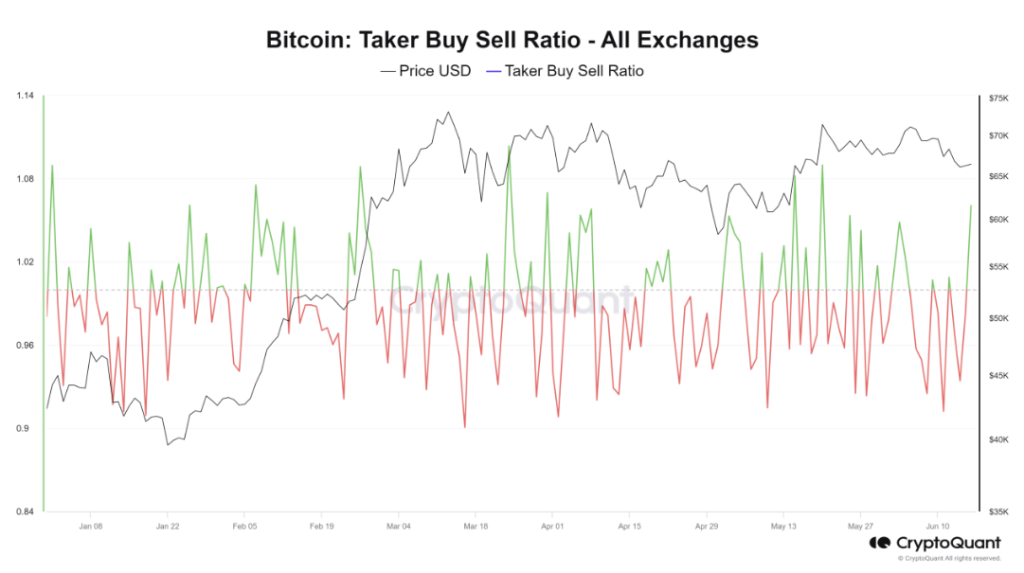

One glimmer of hope comes from the Bitcoin Taker Purchase Promote Ratio, a metric that tracks the steadiness between purchase and promote orders on exchanges. In accordance with NewBTC’s evaluation, this ratio has just lately dipped beneath one, indicating a bearish sentiment.

On a number of exchanges, the ratio is rising again above one, suggesting that the development is recovering. This means a change within the psychology of the market, as extra patrons than sellers are making orders.

This can be a optimistic growth, the info reveals. It signifies that some buyers are seeing the current worth drop as a chance to build up Bitcoin at a reduction. Nonetheless, it’s essential to do not forget that this is only one metric, and the general development stays bearish.

Change Inflows: The Different Narrative

One other fascinating wrinkle within the story comes from Bitcoin’s trade netflow. This metric measures the distinction between Bitcoins getting into and leaving exchanges. A optimistic netflow signifies extra Bitcoins flowing into exchanges, which is often seen as a bearish sign as a result of it may signify buyers making ready to promote.

Nonetheless, the present influx appears comparatively low in comparison with previous outflows, suggesting that the general development of accumulation may nonetheless be intact.

That is the opposite a part of the narrative, analysts mentioned. On the one hand, elevated trade inflows may result in promoting strain. However, the comparatively low quantity in comparison with previous outflows means that some buyers is likely to be transferring their holdings to non-public wallets for safekeeping, which could possibly be a bullish indicator in the long term.

A Cautious Outlook

Regardless of the emergence of those bullish whispers, the general sentiment surrounding Bitcoin stays cautious. The worth continues its downward trajectory, with the present help degree of $65,000 underneath immense strain. If this degree breaks, it may set off an additional sell-off and exacerbate the bearish development.

Associated Studying

Bitcoin is at a vital juncture, and the current indicators of shopping for strain and trade inflows are encouraging, however they must be backed by a sustained worth restoration. Till then, buyers ought to undertake a cautious strategy and be ready for continued volatility.

The approaching days shall be essential in figuring out the destiny of Bitcoin’s present worth motion. Whether or not the bullish whispers can rework into a convincing roar or get drowned out by the bearish undercurrent stays to be seen.

Featured picture from Getty Photos, chart from TradingView