Ethereum (ETH) not too long ago dropped under the vital and psychological help degree at $3,000, elevating issues for ETH bulls. This growth comes amid the continued decline in income generated on the Ethereum community.

Associated Studying

Ethereum Crashes Under $3,000

Ethereum is down under $3,000, with this downtrend believed to be as a result of a number of components. One is the outflows, which the Spot Ethereum ETFs have been experiencing since they started buying and selling on July 23. Information from Farside Buyers exhibits that these funds once more skilled a web outflow of $54.3 million on August 2.

These funds haven’t had the specified impression on ETH’s value that they had been anticipated to have, with Ethereum down over 10% since they started buying and selling. Information from Soso Worth exhibits that these funds have suffered cumulative web outflows of $510.7 million since they launched. Grayscale’s Ethereum Belief (ETHE) has been individually answerable for these outflows, with $2.12 billion flowing out of the fund since its launch.

This has put vital promoting stress on ETH, resulting in its latest downtrend. ETH’s value has additionally dropped under $3,000 due to the downtrend within the broader crypto market led by Bitcoin. Ethereum was sure to undergo a big decline following Bitcoin’s drop as information from the market intelligence platform IntoTheBlock exhibits that each property at present have a robust value correlation.

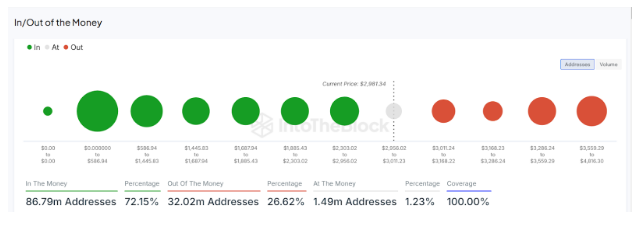

Ethereum’s drop under $3,000 is undoubtedly worrisome for traders, contemplating how a lot decrease it might drop. Nevertheless, ETH has rapidly reclaimed the $3,000 degree these previous three months each time it drops under this significant help zone. As such, this time might not be any completely different, particularly with information from IntoTheBlock indicating a robust demand for Ethereum at this value degree.

If Ethereum fails to carry this vary, the second-largest crypto token dangers dropping to as little as $2,700, a extra essential help zone for ETH contemplating that 11.11 million addresses purchased the token at a mean value of $2,647.

Ethereum’s Income Drops To New Lows

Information from Token Terminal exhibits that Ethereum’s income has dropped to new lows, down by 40.4% within the final 30 days and 44.8% yearly. Charges earned on the community haven’t been spectacular both. During the last 30 days, Ethereum customers have paid $92.97 million in charges, a 32.8% decline and 38.3% at an annual price.

This drop in Ethereum’s income and charges will be attributed to the decline within the community’s energetic every day customers. Additional information from Token Terminal exhibits a 9.8% drop in Ethereum’s month-to-month energetic customers. The identical goes for the weekly and every day energetic customers, with 20.1% and 15.3% drops, respectively.

Associated Studying

On the time of writing, Ethereum is buying and selling at round $2,979, down over 5% within the final 24 hours, in keeping with information from CoinMarketCap.

Featured picture from Pexels, chart from TradingVIew