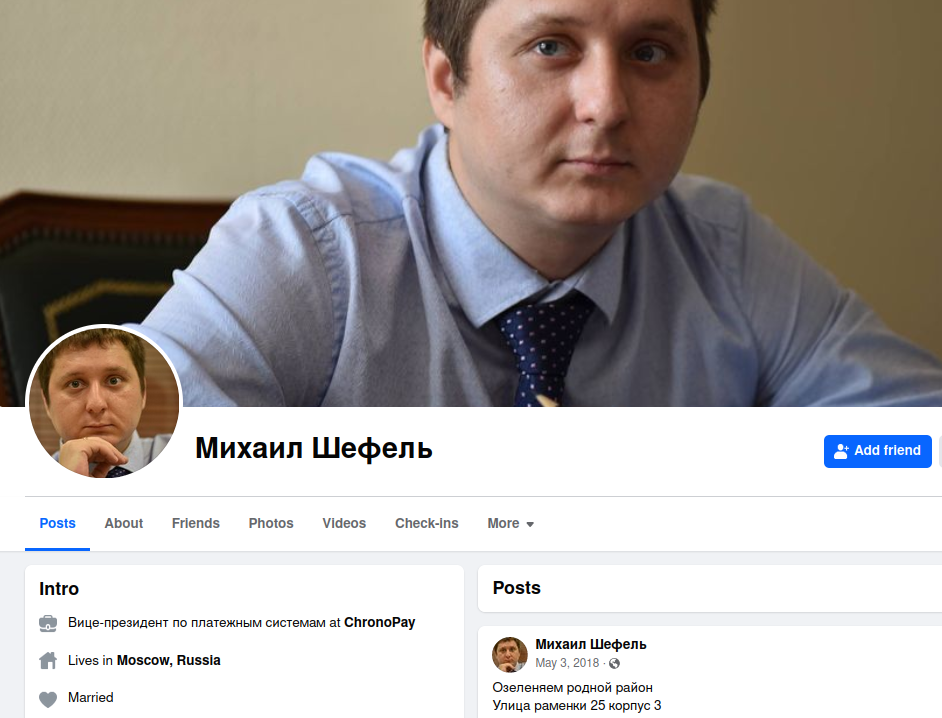

Above: Dropbox’s progressive development initiative — A referral program to offer/get storage

Why a referral program?

Referral applications — the “give $5, get $5” affords you see in lots of apps — have turn out to be widespread in recent times. They’ve huge benefits over paid advertising channels, in that you simply give your CAC to your customers, who then spend it inside your product, versus handing it over to Google or Fb. As a result of they’re a type of viral advertising — using your community of customers to usher in extra customers — they faucet in to your product’s community results, as I describe in The Chilly Begin Drawback. That is notably helpful for merchandise that focus on excessive acquisition value niches, whether or not that’s crypto customers or on-demand drivers, whose CAC are sometimes >$200, for the reason that customers typically know one another.

A profitable referral program might be 20-30% of your acquisition combine, as certainly one of a number of acquisition loops. It’s not a silver bullet, but it surely’s value including to enhance different advertising efforts.

The historical past of the referral program

How did a structured type of buyer referrals come into being? It’s mentioned that the primary documented referral program was created by Julius Caesar, who in 55 BC would paid his troopers 300 sestertii (one thing like a 3rd of their annual pay) to refer a good friend to affix the military. And 1000’s of years later, we nonetheless use, plus or minus, the identical thought. It appears as if each client app has applied some type of a referral program, although I argue it actually kicked off in ~2008, which is when Dropbox’s progressive referral program was rolled out.

Sure, essentially the most well-known early implementation of referral applications got here from Dropbox, which impressed a era of startups — notably YCombinator-backed startups — to experiment with related concepts. Why did this make sense for them? CEO/cofounder Drew Houston’s made a really useful presentation describing his journey in the direction of referral applications, and the overall trajectory was the next:

- First, do all of the belongings you’re “supposed” to do

- Massive bang launch at a tech convention. Attempt some AdWords, rent a PR agency / VP of Advertising

- Paid advertising applications created a CAC of $233-388 for a $99 product

- Then attempting affiliate applications, show adverts, and plenty of different issues — which all failed

- … however then failing! And realizing none of it really works that properly

- Then realizing the important thing was to speed up word-of-mouth and viral development by providing a “give and get cupboard space” program

- Growth. 100,000 customers to 4 million in simply 15 months, with 35% of every day signups

Your complete deck is great — created roughly a decade in the past, however nonetheless very related — and I extremely encourage you to test it out right here.

Referral applications work very properly for sure sorts of merchandise, notably ones which are already spreading by way of phrase of mouth. In Dropbox’s case, there’s a pure use case between pals and colleagues — shared folders — which naturally complement the referral channel. Referrals drive that ahead, offering an financial incentive to inform pals. As one other instance, at Uber the place I ran the referral applications for drivers and riders at numerous factors (and spent >$300M/yr on them), this system for driver referrals was naturally profitable. Drivers had been typically from sure sub-communities, whether or not newly arrived immigrants or limo drivers, and folks had been naturally already speaking in regards to the incomes alternative. Referrals, generally as excessive as $500/signup, accelerated that in a giant approach.

And but referral applications have their limits. In fact they don’t actually work that properly for merchandise which have low LTV — that’s why we don’t see free social picture sharing apps reward their customers for referrals. There’s no LTV to arbitrage towards, and the referral quantities create a type of buyer acquisition value. Additionally they have a tendency to say no in significance over time. Years after the rollout of Dropbox’s referral program, I had the chance to affix Dropbox as an advisor, the place I bought a first-hand take a look at the info. By then, the pure virality of their core product — simply the method of individuals sharing their folders and information with others — had come to utterly dominate person acquisition. This had turn out to be the first technique of unfold, and the referral program grew to become a lot much less essential. I’ll focus on why, in a while, however this appears to be the pure sample of issues — referral applications are very useful originally of a market. Ultimately it turns into much less essential, and that’s OK.

However we get forward of ourselves. Let’s begin first by how a referral program is often outlined.

The construction of a referral program

We see the identical tough patterns in referral applications which are applied throughout the business. Airbnb, Uber, Instacart have them, and so do Coinbase and Wealthfront. There are variations after all, as some give attention to giving and getting {dollars}. Some ask you to share a code, or a hyperlink, or join your addressbook to ask pals.

One method to manage all these variations is to divide them into the next — and you might want to reply a sequence of questions for a way you construction this system:

- Ask

- When do you ask the person to refer?

- Why do you refer? Is it tied to a vacation, or a specific promotion?

- What’s the message?

- Goal

- Which customers do you goal? All of them?

- How do you set referral quantities?

- Incentive

- What’s the motivation, is it extrinsic ($) or intrinsic (factors, storage, and so forth)?

- Do you give the inviter or recipient the identical reward?

- Payback

- What’s the success standards for this system?

- How do you concentrate on cannibalization?

Let’s use an instance to explain this.

For instance, take Airbnb’s host referral program:

You could possibly break this down into the next classes:

- Ask: Invite somebody who can host their whole place or non-public room

- Goal: All Airbnb customers

- Incentive: Earn $200

- Payback: CAC is healthier/corresponding to different advertising channels (simply speculating!)

That is the fundamental construction, and now that we have now this in place, it’s time to speak about a lot of design concerns wanted when making a referral program.

The Ask

Product people typically begin by agonizing over the ask. They surprise if it’s too trivial to create a “Get $5, Give $5” referral program, or if that’s too fundamental. However I feel that’s the fallacious place to focus — in spite of everything, you may at all times phrase smith and check many variations later after you have this system up and working.

The actual query is, WHERE do you make the ask? And my reply is straightforward: Ask many instances, in lots of locations, with totally different messages, and in-context with no matter motion you’re asking the person to take. What you discover, after instrumenting all of your referral UI, is that there’s only a sure conversion fee on this display. And that almost all customers, should you put the referral performance on a banner someplace random within the product, merely don’t work together with the referral options. Reasonably than attempting to lift conversions, as an alternative, present the display extra typically — get extra impressions!

Thus, make the referral ask a part of the primary flows. After the person is shopping for one thing inside your app, ask them if they need $X money again now, by inviting somebody. Or in the event that they work together with a good friend throughout the app — assuming the product permits invites of some type — observe up by asking in the event that they need to invite others. And add it to the onboarding move, and on the finish of key transactions when the person is in any other case finished, and also you would possibly as properly seize engagement. And for god’s sake, don’t make it appear to be “an advert” with huge splash textual content and graphics — make it plan, like one thing that’s a part of the conventional UI the place the person can work together.

One in all my favourite concepts from Uber is the idea of “holidizing” a referral marketing campaign. For drivers, as the vacations approached, you would possibly inform them to earn more money in the direction of items and festivities, by collaborating in a referral program. Or for the run as much as a serious live performance on the town, you would possibly run a particular tiered marketing campaign the place referring 1 good friend will get you X, however 5 will get you 5*X and an enormous bonus on prime. There’s one thing nice about freshening up the messaging every month to align to main holidays, with new quantities, new imagery, and in any other case.

The Goal

The headline finest apply is that your referral program ought to goal new customers to refer their pals — this implies prompting customers throughout their preliminary onboarding flows, and including emails as a part of the onboarding, amongst different floor areas. That is in direct contradiction to people who typically argue to let customers expertise the product first, have expertise, earlier than they’re hit as much as invite. Why give attention to new customers? First, mathematically, it’s best to make a huge impact if you end up hitting a cohort of 1000 new customers when it’s as near 1000 as attainable, not in day 30 when the cohort could have churned and gotten all the way down to 150. And within the math of the viral issue, you’ve got a greater likelihood to hit >1 when you’ve got 1000 customers invite 1000 customers than to ask 150 to ask 1000. Second, new customers typically have extra pals who haven’t but used the product, as a result of they’re new themselves. As soon as they’ve gone by means of the referral program a number of instances, then they’ll have naturally tapped out their networks.

And naturally, the only factor to do is a “give $5, get $5” and provides that supply to everybody, in an untargeted trend. However a product chief quickly realizes that that is inefficient — maybe it’s finest to offer some customers $15 and others $5, relying on their worth. That is precisely what many market corporations have finished, when it’s simple to phase their community into high-value cities like New York and SF versus, say, Memphis — you may set customized referral quantities in every place. However why cease at cities? Maybe you do an evaluation and determine sure main traits of high-value customers as their account steadiness, or the sorts of different apps they use, or in any other case — when you consider this as personalizing an ephemeral provide to customers, then you may run no matter promotions you need.

The Incentive

You’ll notice within the authentic Dropbox provide, the motivation itself was cupboard space not {dollars} — that is the dilemma of intrinsic versus extrinsic rewards for customers that take part in your program. Many referral applications for cellular video games have a tendency in the direction of intrinsic rewards as properly, incomes you factors should you invite pals. The benefit of intrinsic rewards is that it’s notably value efficient when the motivation is one thing you may management, like factors. The issue with intrinsic rewards, after all, is that exterior customers — individuals who have by no means heard of your product — are the least aware of factors or in any other case. Dropbox’s storage provide is possibly someplace within the center, because it’s not less than a concrete type of worth. Because of this, most referral applications have tended in the direction of {dollars} over time, although I feel the essential thought is to prioritize new, exterior customers, and take into consideration the way to make the motivation as concrete as attainable.

There’s the fundamental query of the way to set the motivation quantity. Sometimes that is based mostly on a fundamental calculation of CAC/LTV, which has main weaknesses because it doesn’t consider cannibalization (which we’ll focus on later). As a substitute, the main target is usually to choose a easy quantity — if you realize that the common person who indicators up spends $20, then you may create a referral program that rewards a $5 give/get with some margin of security. However the huge lever on the motivation, after all, is to extend the quantity — and the biggest quantity typically comes from tiered affords which have some type of breakage. An instance of that is to say, “$100 if you enroll and purchase 5 issues” quite than “$5 if you enroll.” Provided that the distinction between a signup and a repeat conversion fee is likely to be 100x, you would possibly be capable of safely increase the quantity 20x. At Uber, this went as far as to mix two distinct numbers: A headline quantity that mixed each the preliminary signup conversion in addition to the primary month’s earnings (once more, so long as you drove X journeys within the first few weeks). This resulted in a $3000+ quantity, an enormous improve from the preliminary $200 numbers we began with. These bigger headline numbers at all times examined a lot better on A/B checks, whether or not in e-mail advertising or banner kind, and whereas it would really feel just like the reward turns into unattainable, it’s attainable to create a second or third or fourth tier to go together with the large headline quantity. You could possibly say, earn $X if you fulfill all the necessities, however then a smaller quantity, $Y, if you solely fulfill a number of. That approach you get the advertising impression of the large quantity however nonetheless have a fallback for customers who don’t hit all of the milestones.

The final facet of the motivation construction I’ll focus on is a symmetric versus uneven provide — that’s, ought to or not it’s a “give $20, get $5” or “give $5, get $20.” Which one sounds higher to you? That is anecdotal, however in testing I’ve seen, the inviter-centric quantity typically works higher — that’s, catering to their self curiosity. Nevertheless, I’ve additionally seen B2B contexts the place in knowledgeable setting, folks have a tendency in the direction of inviting extra if they’re perceived as altruistic, giving out a big $ low cost to others. In the long run, most likely simply value A/B testing to see what works finest.

The Payback

You’ll want some sort of ROI metric to drive the technique of the referral program. Are you spending the best quantities, or must you improve the numbers? How a lot product effort must be put into implementing new floor areas? And many others. Is it working? These basic questions are sometimes answered with a basic CAC/LTV evaluation, and there’s a motive to doing that.

In spite of everything, if the lifetime worth of those customers exceeds the price of buying them, shouldn’t you simply go full steam forward? Effectively, possibly. What if you may get less expensive acquisition by way of one other channel, like TikTok adverts. Then any {dollars} that go to this is likely to be higher spent on adverts. Or what if bettering a referral program takes engineering staff away from essential options? So sure, after all take a look at the CAC/LTV of your referral initiative, however take into consideration the way you would possibly evaluate the tradeoffs towards every thing else.

The trickier ROI query is cannibalization: How lots of the customers that you simply herald by way of referrals would have are available by means of phrase of mouth anyway? When you spike the referral quantities, going from $5 to $20, are you simply making a “pull ahead” impact the place customers that might have arrived without spending a dime a number of months from now are coming in all of a sudden, however at a value, and to the detriment of a later month?

Cannibalization is a tough impact to tease out, however typically the aim is to measure one thing like “Value Per Incremental Buyer” by A/B testing affords to a management group that will get the usual quantity, and a check group that will get the elevated quantity. Since you’re attempting to seize natural customers, you typically have to do that as a “twin cities” experiment, the place we run one set of affords in Phoenix and one other in Dallas — that is the Uber strategy, and in B2B you would possibly do it by way of one set of corporations versus one other. And you then measure what the uptick really appears like. If there may be lots of cannibalization, then the CPIC quantity will probably be massive — that is the true CAC, cannibalization apart.

The opposite, easier kind, is solely to do an “On/Off check.” When you flip off all of your referrals for a number of days, do you discover a giant drop in new customers? If sure, then your referral program is working. If not, then you might be probably paying lots of buyer acquisition value for one thing that might be taking place anyway.

The weaknesses of a referral program

As I discussed on the intro of this essay, Dropbox’s ultimately grew to become much less depending on their referral program. There’s a pure trajectory right here, as a result of because the market matures and extra customers have already adopted the product, the less pals there are to ask. You solely want a number of “I have already got that” responses to cease collaborating in referrals altogether. For merchandise which have a real community impact, as Dropbox does, the acquisition will ultimately be taken over by intrinsic use circumstances like folder sharing quite than one thing as extrinsic as a referral reward.

And in a approach, I discover myself principally skeptical when groups strategy me to construct a referral program. The very first thing I ask is, are you certain you wouldn’t quite construct a viral development engine? Constructing viral options and a referral program are related issues — attempting to get customers to ask pals — however really viral options round sharing and speaking are evergreen and create lasting worth. They assist customers have interaction and retain, and as a secondary impact, generate new customers as properly. And it’s an enormous profit to get these new customers onto your platform without spending a dime. For Dropbox, which means investing in product options like inviting teammates into initiatives, or file sharing, or in any other case, quite than creating ever extra complicated referral buildings. At Uber, this would possibly imply constructing virality into options like “Share ETA” or invoice splitting or group meals ordering.

In that approach, I discover myself a reluctant fan of referral applications — they’ll work, and might turn out to be a ten%+ acquisition channel for merchandise — however they’ll at all times take a again seat for me, in comparison with constructing nice viral performance.

PS. Get new updates/evaluation on tech and startups

I write a high-quality, weekly e-newsletter masking what’s taking place in Silicon Valley, targeted on startups, advertising, and cellular.

Views expressed in “content material” (together with posts, podcasts, movies) linked on this web site or posted in social media and different platforms (collectively, “content material distribution retailers”) are my very own and should not the views of AH Capital Administration, L.L.C. (“a16z”) or its respective associates. AH Capital Administration is an funding adviser registered with the Securities and Change Fee. Registration as an funding adviser doesn’t indicate any particular ability or coaching. The posts should not directed to any traders or potential traders, and don’t represent a proposal to promote — or a solicitation of a proposal to purchase — any securities, and is probably not used or relied upon in evaluating the deserves of any funding.

The content material shouldn’t be construed as or relied upon in any method as funding, authorized, tax, or different recommendation. It is best to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these supplies are topic to alter with out discover and will differ or be opposite to opinions expressed by others. Any charts supplied listed below are for informational functions solely, and shouldn’t be relied upon when making any funding resolution. Sure data contained in right here has been obtained from third-party sources. Whereas taken from sources believed to be dependable, I’ve not independently verified such data and makes no representations in regards to the enduring accuracy of the knowledge or its appropriateness for a given state of affairs. The content material speaks solely as of the date indicated.

On no account ought to any posts or different data supplied on this web site — or on related content material distribution retailers — be construed as a proposal soliciting the acquisition or sale of any safety or curiosity in any pooled funding automobile sponsored, mentioned, or talked about by a16z personnel. Nor ought to or not it’s construed as a proposal to offer funding advisory providers; a proposal to spend money on an a16z-managed pooled funding automobile will probably be made individually and solely by the use of the confidential providing paperwork of the particular pooled funding autos — which must be learn of their entirety, and solely to those that, amongst different necessities, meet sure {qualifications} underneath federal securities legal guidelines. Such traders, outlined as accredited traders and certified purchasers, are typically deemed able to evaluating the deserves and dangers of potential investments and monetary issues. There might be no assurances that a16z’s funding goals will probably be achieved or funding methods will probably be profitable. Any funding in a automobile managed by a16z includes a excessive diploma of threat together with the danger that your entire quantity invested is misplaced. Any investments or portfolio corporations talked about, referred to, or described should not consultant of all investments in autos managed by a16z and there might be no assurance that the investments will probably be worthwhile or that different investments made sooner or later could have related traits or outcomes. An inventory of investments made by funds managed by a16z is accessible at https://a16z.com/investments/.

Excluded from this record are investments for which the issuer has not supplied permission for a16z to reveal publicly in addition to unannounced investments in publicly traded digital belongings. Previous outcomes of Andreessen Horowitz’s investments, pooled funding autos, or funding methods should not essentially indicative of future outcomes. Please see https://a16z.com/disclosures for extra essential data.