Onchain Highlights

DEFINITION: Realized volatility is the usual deviation of returns from the imply return of a market. Excessive values in realized volatility point out a section of excessive danger in that market. It’s measured on log returns over a hard and fast time horizon or over a rolling window to acquire a time-dependent observable. Whereas implied volatility refers back to the market’s evaluation of future volatility, realized volatility measures what occurred up to now. Right here, we calculate the realized volatility based mostly on day by day returns and multiply it with an element of sqrt(365) to yield the annualized day by day realized volatility over a rolling window of 1 week.

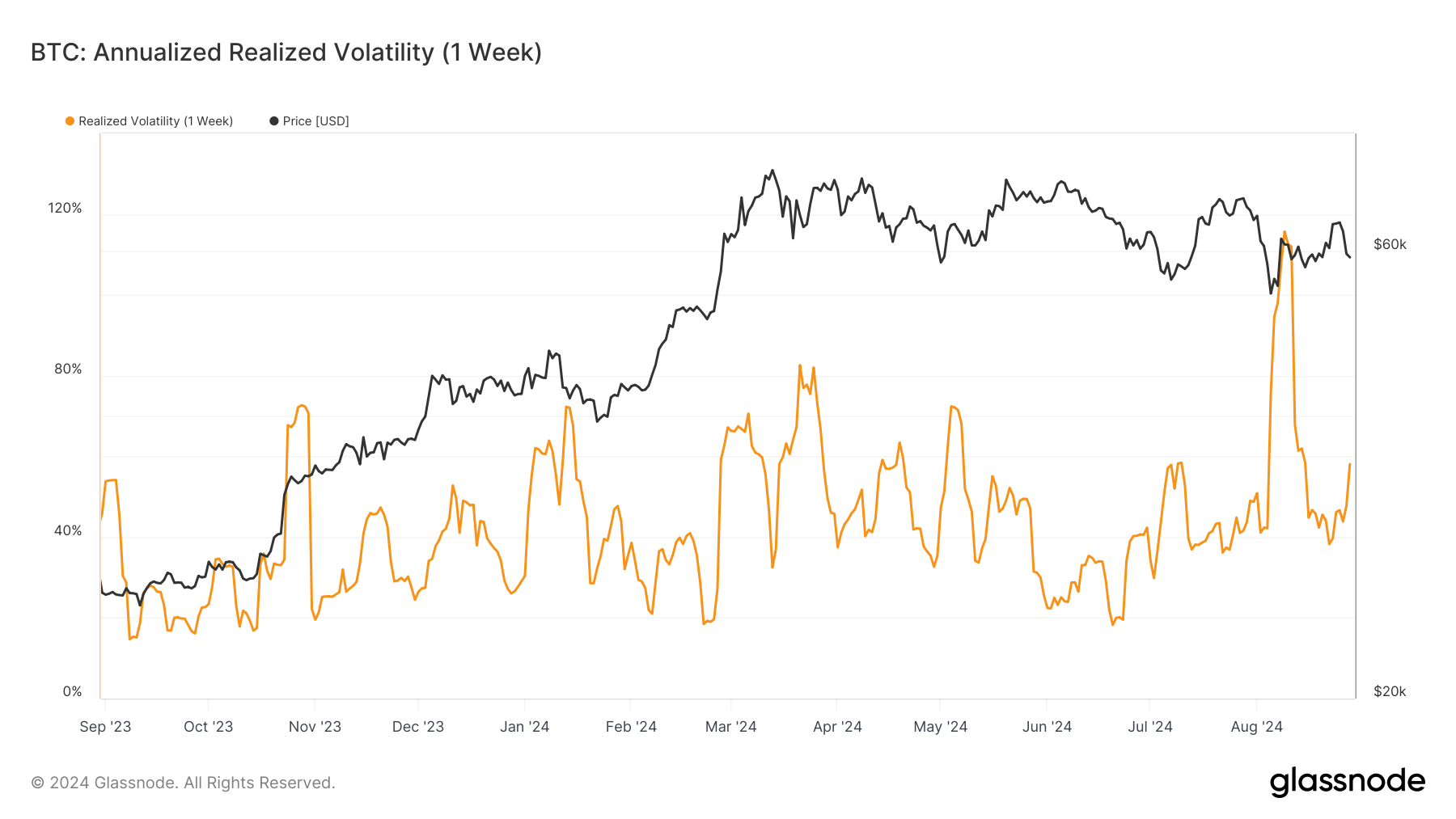

Bitcoin has skilled various ranges of realized volatility lately. The chart exhibits that Bitcoin’s annualized realized volatility over a 1-week window has seen important fluctuations since 2023.

In September 2023, the volatility was comparatively low however started to rise sharply, peaking a month later in November 2023. This era of elevated volatility coincided with a considerable improve in Bitcoin’s worth, which moved from roughly $20,000 to $60,000 inside the identical timeframe. Nevertheless, this volatility subsided in early 2024 as Bitcoin’s worth stabilized.

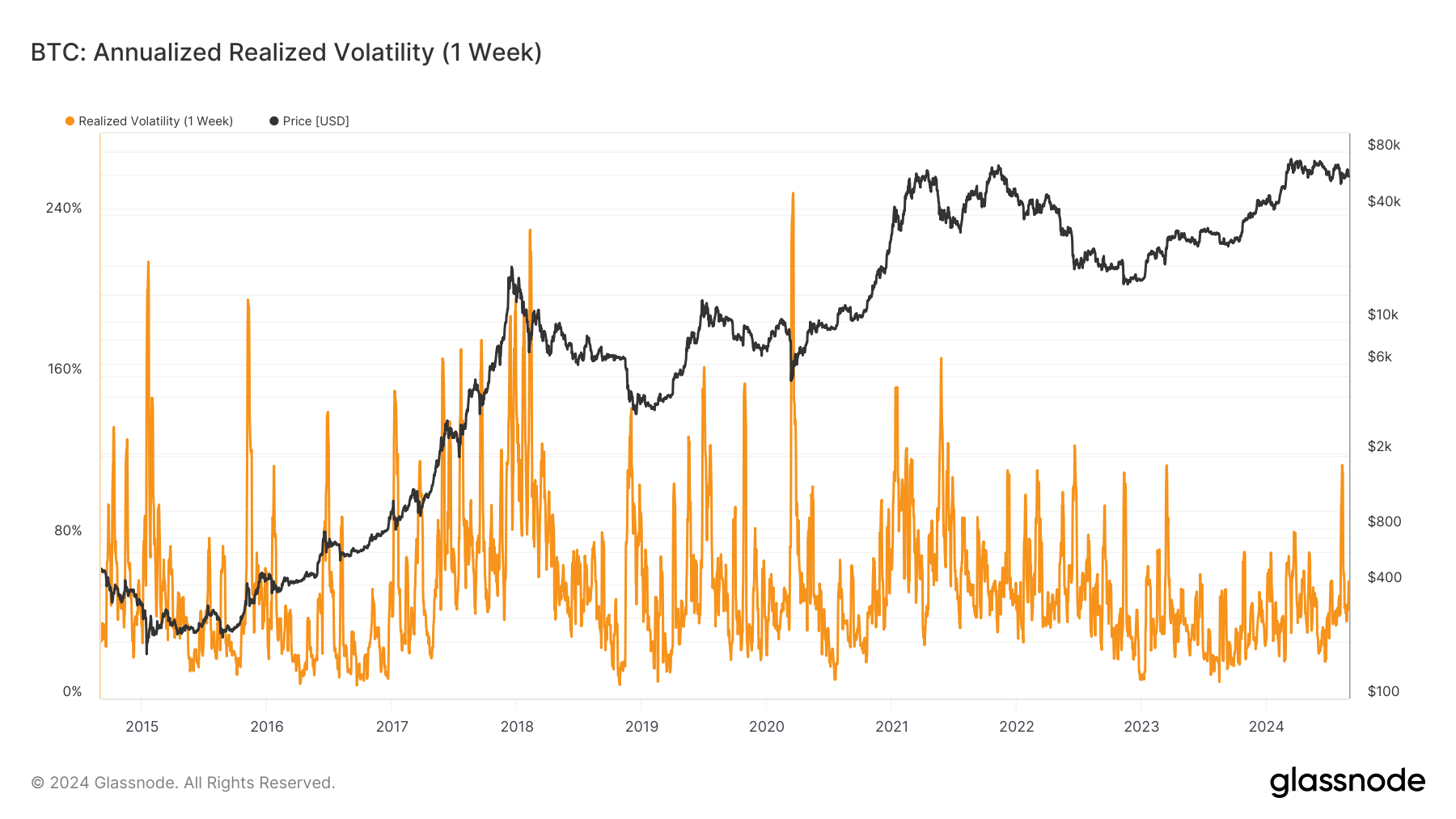

Evaluating this to historic information since 2015, it’s evident that Bitcoin’s realized volatility has been a constant characteristic of the asset, usually spiking in periods of speedy worth motion. These fluctuations mirror the market’s response to numerous macroeconomic elements and inner traits inside the crypto house. As Bitcoin continues to mature as an asset class, these patterns in volatility could supply insights into market sentiment and the potential for future worth actions.

The put up Bitcoin’s realized volatility in August reaches highest stage in over a 12 months appeared first on CryptoSlate.