Regardless of Tron’s (TRX) decline of over 10% previously week, prime merchants’ lengthy positions and curiosity recommend that the worth is poised for an upside transfer. Together with all the most important cryptocurrencies, TRX has skilled a value drop of over 1.8% within the final 24 hours.

Bullish Outlook For TRX

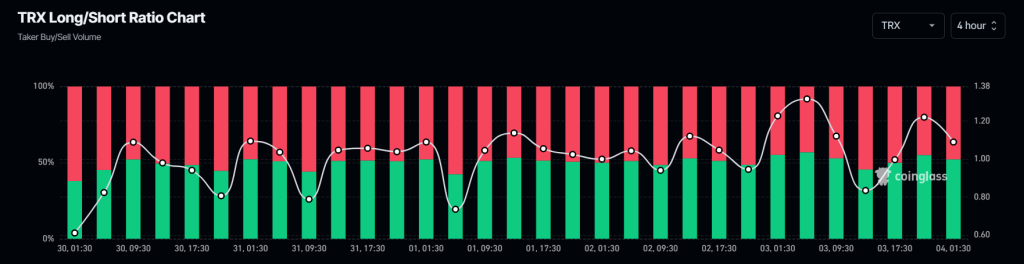

The on-chain analytic agency CoinGlass’s TRX Lengthy/Brief ratio chart alerts a bullish outlook for the token. Based on the information, 55.8% of TRX prime merchants are holding lengthy positions indicating a possible upside rally.

TRON Technical Evaluation and Key Ranges

Based on the professional technical evaluation, TRX remains to be in an uptrend as it’s buying and selling above the 200 Exponential Transferring Common (EMA) on a day by day timeframe. Nonetheless, after a powerful bullish breakout of a resistance stage, TRX seems to be retesting that breakout stage.

In the meantime, the $0.15 stage is a powerful assist stage for TRX and the worth reversal could happen from that stage. However, if it fails to carry the $0.15 stage and closes a day by day candle beneath this assist, we might even see an enormous sell-off within the coming days.

Main Liquidation ranges

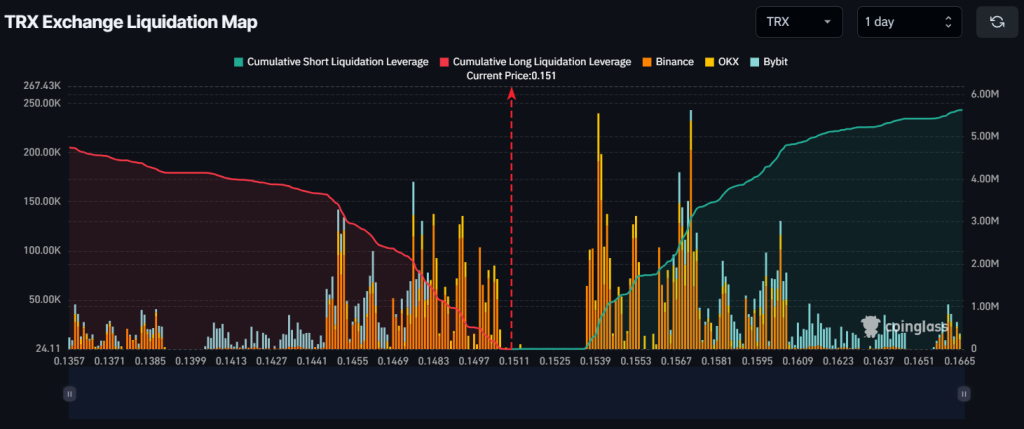

As of now, the most important liquidation ranges are close to $0.147 on the decrease facet and $0.157 on the higher facet, as merchants are overleveraged at these ranges, in accordance with information from CoinGlass.

If the market sentiment stays bearish and the TRX value falls to the $0.147 stage, practically $2.06 million price of lengthy positions shall be liquidated. Conversely, if the sentiment shifts and the worth rises to the $0.157 stage, roughly $3.18 million brief positions shall be liquidated.

This information signifies that, on the next timeframe, brief sellers are nonetheless dominating the belongings and have the potential to liquidate lengthy positions.

TRON Value Efficiency

At press time, TRX is buying and selling close to the $0.152 stage and has skilled a value drop of over 2% within the final 24 hours. In the meantime, its buying and selling quantity has additionally dropped by 8% throughout the identical interval, indicating decrease participation from merchants amid bearish market sentiment.

Regardless of a notable value drop in the previous couple of days, 57.60% of TRX holders stay worthwhile, whereas 32% of holders are dealing with losses, and 10% of TRX holders are at breakeven, in accordance with information from the on-chain analytics agency IntoTheBlock.