Bitcoin has confronted important worth fluctuations marked by a notable crash on August 5 that noticed its worth dip to $49,000. This was adopted by a rebound to roughly $65,000, solely to expertise one other decline to round $52,000 final Friday.

Regardless of these challenges, the most important cryptocurrency by market capitalization is present process essential assist retests, paying homage to the patterns noticed in September 2023 earlier than it soared to an all-time excessive of $73,700 in March.

Bitcoin Might Hit New All-Time Highs

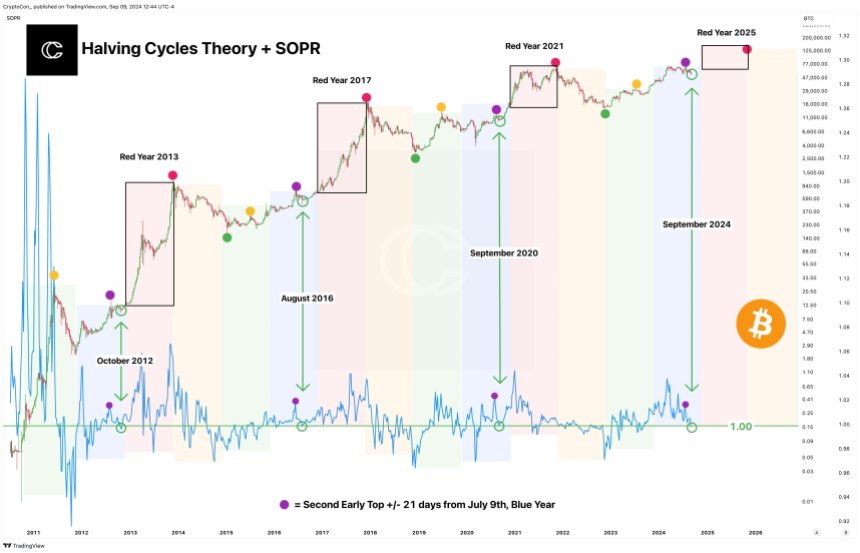

Crypto analyst Crypto Con highlighted this pattern in a social media put up, emphasizing Bitcoin’s spent output revenue ratio (SOPR). In accordance with Con, earlier peaks have correlated with the 1.0 worth line on the SOPR chart, the place the cryptocurrency sometimes finds a backside earlier than coming into a bull market part.

This cyclical habits has been constant round particular months—October, August, and September—drawing parallels to the recession predictions which have emerged just lately, very like in September 2023 and on the cycle backside in November 2022 following crypto change FTX’s implosion.

The present indicators counsel that Bitcoin could also be on the verge of a major worth uptick, probably surpassing its earlier all-time highs. This bullish sentiment is bolstered by historic information that present Bitcoin’s propensity to interrupt by previous peaks, as seen within the chart above.

Is September A ‘Faux-Breakdown Month’?

In a extra granular evaluation of short-term worth motion, fellow analyst Rekt Capital identified that Bitcoin’s weekly shut above $53,250 is essential for sustaining the assist degree inside the bargain-buying vary of $52,000 to $55,000.

This vary kinds beneath a downward-trending channel noticed by the analyst at $56,500 on Bitcoin’s weekly chart. Rekt emphasised that reclaiming $55,881 as assist can be important for Bitcoin to construct momentum and try a restoration inside the channel.

Moreover, Rekt raised an attention-grabbing speculation about September probably being a “fake-breakdown month.” Historic information point out that September sometimes sees a mean month-to-month return of -5%, whereas October averages 22.90%.

This sample means that any assist that the Bitcoin worth seems to have misplaced through the previous month may very well be swiftly reclaimed, particularly because the cryptocurrency at the moment trades round $56,600. Ought to October observe its historic pattern, a 22.90% improve would place Bitcoin under its all-time excessive at roughly $68,780.

On the time of writing, the most important cryptocurrency available on the market information a 4% improve within the 24-hour time-frame, leading to its worth regaining the $56,600 mark. Nonetheless, during the last 30 days, BTC has recorded losses of over 7%.

Featured picture from DALL-E, chart from TradingView.com