On this bearish market sentiment, crypto whales have begun exhibiting curiosity in Ethereum (ETH), the second-biggest cryptocurrency by market cap. On September 18, 2024, the on-chain analytics agency Lookonchain made a submit on X (Beforehand Twitter) stating {that a} whale who offered 5,690 ETH, price $13.1 million, yesterday has purchased again 5,660 ETH price $13.1 million, at a median worth of $2,316.

ETH Buyback Earlier than Fed Choice

By doing so, this whale has misplaced 30.8 ETH price $71,400 in a single day. Nevertheless, this huge Ethereum buyback occurred simply earlier than the Fed price reduce announcement. It appears this whale would possibly anticipate the influence of the Fed’s choice, which may clarify why the acquisition was made through the opening bell of the US inventory market.

Bearish On-chain Metrics

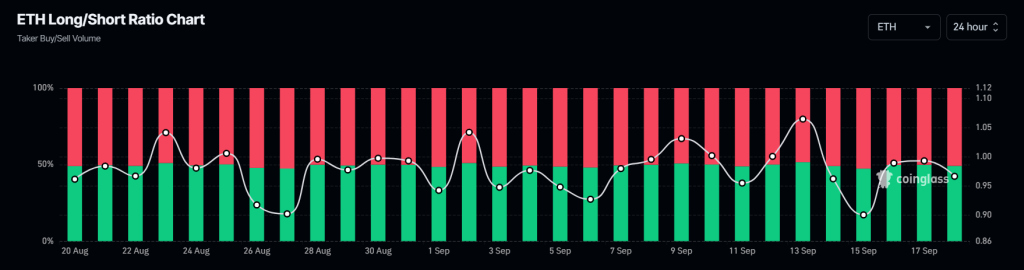

Regardless of this huge ETH buy, the on-chain metrics are nonetheless flashing a bearish sign. Based on the on-chain analytics agency Coinglass, ETH’s Lengthy/Brief at present stands at 0.966, indicating bearish market sentiment amongst merchants. Moreover, its future open curiosity has declined by 2.5% within the final 24 hours, suggesting diminished curiosity from merchants, possible as a result of bearish market outlook.

Whereas combining all the information it seems that the present sentiment is sort of bearish and merchants are hesitating to construct both lengthy or brief positions. Presently, 50.85% of prime ETH merchants maintain brief positions, whereas 49.15% maintain lengthy positions. This means that bears are at present dominating the asset.

Ethereum Technical Evaluation and Upcoming Ranges

Based on the professional technical evaluation, ETH seems bearish and is at present at a vital assist degree of $2,230 degree. Moreover, it’s dealing with resistance from the descending trendline. Based mostly on the historic worth momentum, ETH worth may rise to the $2,800 degree if it closes its every day candle above the $2,470 degree.

In the meantime, ETH’s Relative Energy Index (RSI) is in oversold territory, suggesting a possible worth reversal within the coming days.

At press time, ETH is buying and selling close to the $2,300 degree and has skilled a worth decline of over 2.5% within the final 24 hours. Throughout the identical interval, its buying and selling quantity has elevated by 10%, indicating larger participation from merchants amid the market downturn.