What simply occurred? It’s no secret that Intel is struggling. The tech big’s inventory worth has plummeted in recent times, making it a viable takeover goal. A proposal from Qualcomm is now on the desk, and if it materializes, it may considerably alter the semiconductor business’s trajectory. However first, the businesses should choose their manner via a minefield of economic, regulatory, and strategic concerns.

In a improvement that might reshape the semiconductor business, Qualcomm has made a takeover provide to rival Intel, sources accustomed to the matter have advised The Wall Road Journal. A profitable acquisition of Intel, given its $90 billion market worth, would rank as the biggest expertise M&A deal ever, topping Microsoft’s $69 billion acquisition of Activision Blizzard.

The proposed merger would mix Qualcomm’s experience in cellular chip expertise with Intel’s robust presence in private laptop and server processors. Buying Intel would signify a serious strategic shift for Qualcomm, diversifying its portfolio and strengthening its place within the evolving tech panorama.

The WSJ’s report follows a Reuters story that Qualcomm executives have been inspecting Intel’s numerous design items to find out whether or not any would match their product portfolio.

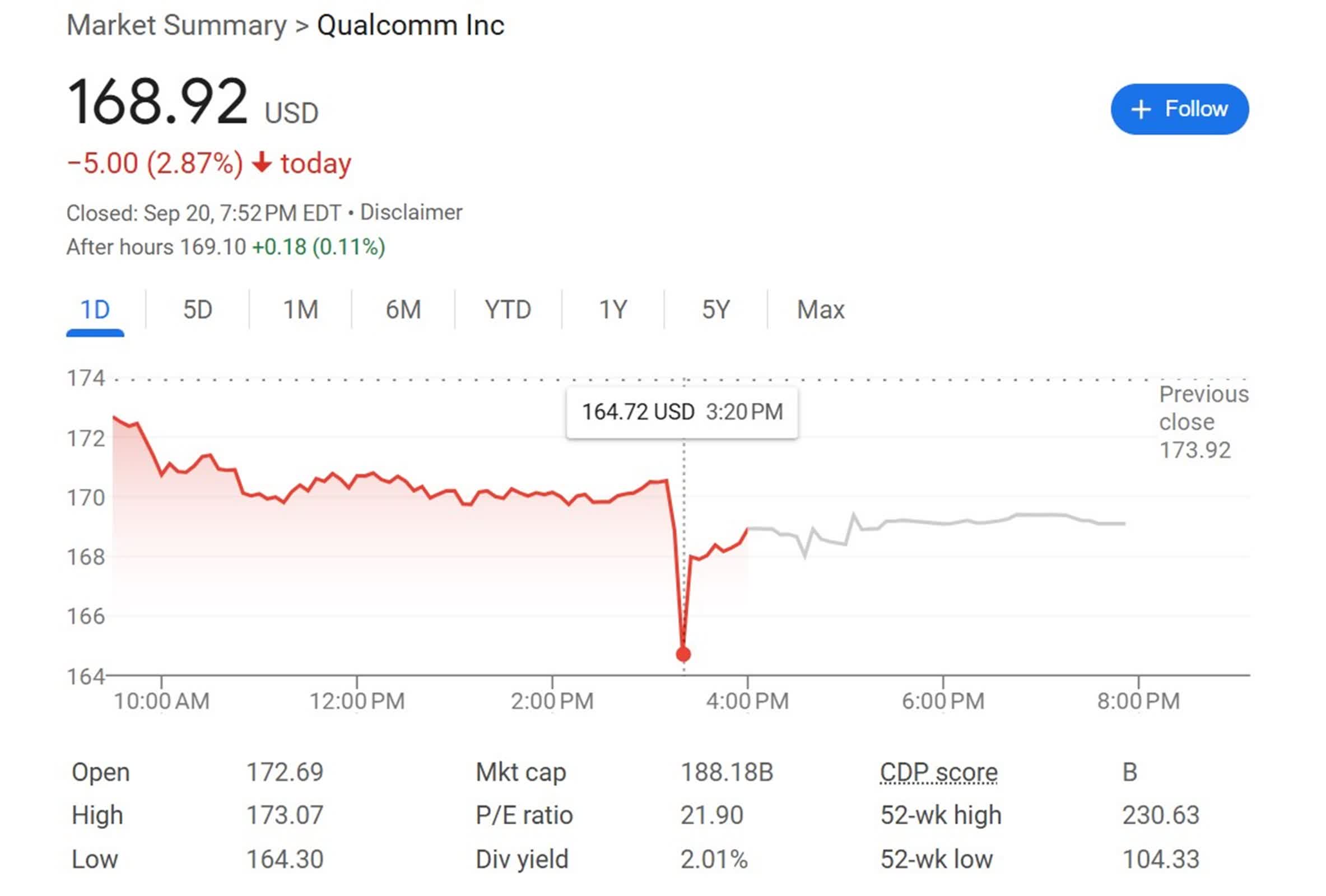

Qualcomm’s value is almost twice that of Intel, boasting a market cap of $184 billion, making a takeover or acquisition of its numerous divisions financially possible for the cellular chip big.

Intel, as soon as the undisputed chief in chip manufacturing, has confronted important challenges in recent times. Its market worth has plummeted from a peak of $290 billion in 2020, making it a viable acquisition goal.

The corporate’s latest quarterly earnings report painted a grim image, with income falling far in need of expectations and a bleak forecast for the approaching months. Below CEO Pat Gelsinger, Intel has been working to revitalize its enterprise. As a part of its turnaround efforts, Intel has initiated a sweeping cost-reduction plan to scale back its workforce by over 15 p.c by year-end, restructure operations, and slash operational bills by greater than $10 billion within the upcoming 12 months. This plan features a 20-percent discount in capital expenditures, important cuts to R&D, and discontinuing underperforming merchandise.

Earlier this month, Intel CEO Pat Gelsinger knowledgeable staff that the corporate is reworking its foundry arm into an unbiased subsidiary, confirming rumors that had been circulating since August.

“Collectively, these modifications are crucial steps ahead as we construct a leaner, easier and extra environment friendly Intel,” Gelsinger mentioned of the transfer to separate the foundry. “And so they construct on the quick progress we now have made since saying our plan on August 1 to create a extra aggressive value construction.”

Qualcomm’s acquisition of Intel is hardly a given and Intel has made no remark in regards to the proposal. It had reportedly been contemplating promoting sure property as a part of its efforts to streamline the corporate, however an Intel spokesperson additionally clarified that it’s “deeply dedicated” to its PC enterprise.

Moreover, such a deal would face intense scrutiny from antitrust regulators. The mixed entity would wield important energy throughout a number of chip markets, elevating considerations about competitors and market dominance.

Then again, the transfer could possibly be considered as a possibility to shore up the US chip manufacturing capabilities. A merger between these two giants may bolster America’s aggressive edge within the international chip market, notably towards rising competitors from Asia.