Main Developments for the Week

- Bitcoin surges 11% in finest September in a decade: Is $85K subsequent?

- Celo surges 29%: what are the important thing components behind the worth bounce?

- TIA surges 26% as Celestia secures $100M for community progress

- ETH/BTC exhibits bearish development; may a turnaround nonetheless occur by EOY?

- Bitcoin heads for a This fall all-time excessive regardless of election yr jitters

- Kamala Harris pushes for the U.S. to guide in blockchain and digital property in her financial imaginative and prescient

- China’s former finance minister calls crypto a key participant within the digital financial system

- U.S. Bitcoin ETFs see document inflows, hitting their highest since June

- FTX collectors pissed off as payouts dwindle underneath new plan

- U.S. Bitcoin ETFs rake in $1.1B, highest since mid-July

Bitcoin Surges 11% in Greatest September in a Decade: Is $85K Subsequent?

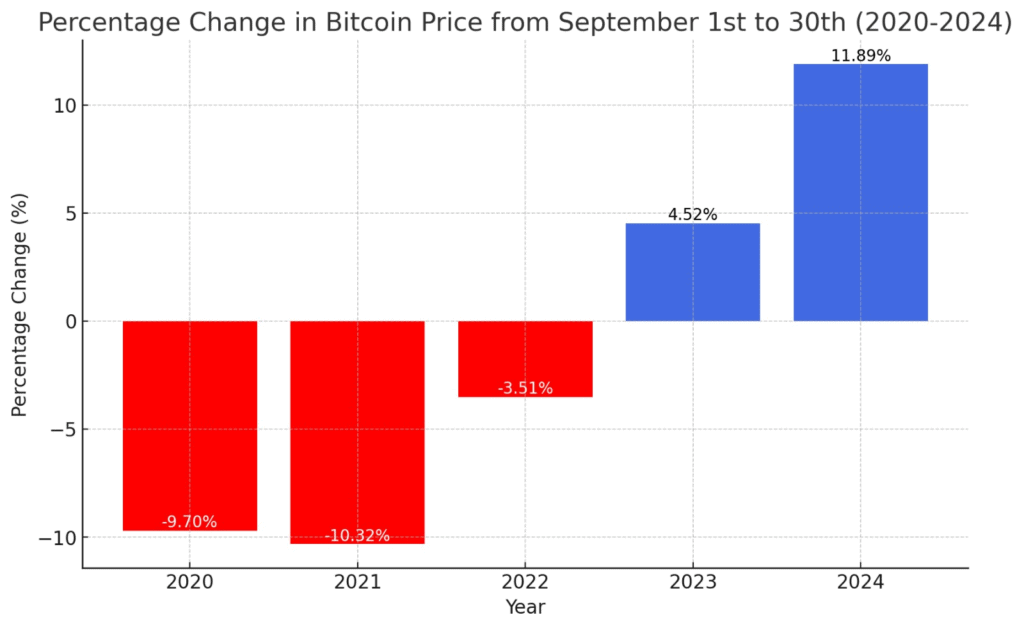

Bitcoin is closing September on a excessive, with an 11% achieve that makes it the best-performing September since 2013.

Traditionally, September has been a bearish month for Bitcoin, typically ending in losses, however 2024 has defied this development. The constructive efficiency is pushed by a number of components, together with world financial easing, institutional investments, and growing demand.

This momentum has raised expectations for a powerful This fall, with October—dubbed “Uptober”—traditionally the most effective months for Bitcoin, exhibiting a mean achieve of twenty-two%.

Previous efficiency just isn’t a sign of future outcomes

The above chart compares BTC’s common value for every September from 2020 to 2024, with purple and blue bar colours representing market sentiment, highlighting the numerous progress in BTC’s common 2024 value, the place the sentiment shifted to bullish, in comparison with earlier years the place the market remained bearish. What this means stays to be seen.

One other key issue boosting Bitcoin’s outlook is the weakening U.S. greenback, with the Greenback Index (DXY) nearing its lowest level in over a yr. Because the greenback and Bitcoin sometimes transfer in reverse instructions, the greenback’s decline is additional supporting a bullish case for Bitcoin.

Analysts and merchants are actually eyeing a possible value goal of between $75K to $85 for the close to future, assuming these traits proceed.

eToro’s @BitcoinWorldWide Good Portfolio provides traders publicity to a diversified vary of property throughout the Bitcoin ecosystem, aligning with the elevated institutional belief and progress trajectory of Bitcoin’s market integration.

Celo surges 29%: key components behind the worth bounce

Celo has seen a notable value surge of roughly 29.24% up to now week, pushed by a number of key components. Constructive feedback from Ethereum founder Vitalik Buterin have boosted investor confidence. Moreover, the rising adoption of stablecoins like USDC and USDT on the Celo community has elevated its utility. The transition of Celo into an Ethereum Layer 2 blockchain has enhanced scalability and integration, drawing extra curiosity. Lastly, elevated community exercise, comparable to an increase in every day lively addresses and stablecoin transactions, has additional supported the worth bounce.

TIA Surges 26% as Celestia Secures $100M for Community Progress

Celestia, a modular blockchain challenge, has seen a surge in its token (TIA) value following a profitable $100 million fundraising spherical led by Bain Capital Crypto. The funds will help the event of the TIA community, specializing in scaling to 1-gigabyte blocks, considerably growing knowledge throughput. This transfer may place Celestia as a serious participant in blockchain scalability, with ambitions to exceed the transaction capabilities of programs like Visa. TIA’s market cap now stands at $1.4 billion, rating it because the sixty fourth largest crypto challenge.

ETH/BTC exhibits bearish development; may a turnaround nonetheless occur earlier than yr’s finish?

The ETH/BTC pair has been underperforming considerably, with Ether (ETH) hitting a three-and-a-half-year low towards Bitcoin (BTC) in mid-September 2024. Whereas Bitcoin has been comparatively steady, Ethereum has struggled to take care of upward momentum, and analysts are divided on whether or not ETH will rebound. Some recommend {that a} potential reversal may occur if key resistance ranges are breached, however ETH stays nicely under its all-time highs.

The long-term ETH/BTC chart exhibits a symmetrical triangle sample, signaling indecision between patrons (bulls) and sellers (bears). Each shifting averages are sloping downward, indicating bearish momentum, and the Relative Energy Index (RSI)—a device that measures whether or not an asset is overbought or oversold—is close to the oversold zone.

The worth may rally if it breaks above the triangle’s resistance. Nonetheless, if the pair continues decrease, it may face additional declines. Though market sentiment for ETH stays blended, with predictions exhibiting an 85% probability that ETH is not going to hit new highs in 2024, some analysts see this as a potential shopping for alternative if resistance ranges are overcome.

Election Yr No Barrier: Bitcoin Poised for This fall All-Time Excessive

Bitcoin is anticipated to take care of its robust efficiency by way of the fourth quarter of 2024, whatever the final result of the U.S. presidential election. Traditionally, Bitcoin has carried out nicely in election years, with previous Q4s typically seeing good points of over 50%.

This development, pushed by financial instability and growing U.S. debt, is prone to proceed. Analysts count on the continuing U.S. debt and deficit points, which stay unaddressed by each political events, to spice up Bitcoin’s attraction as a hedge towards financial instability.

Information exhibits that Bitcoin traditionally thrives in This fall because of these macroeconomic components, no matter election outcomes. In earlier election cycles, Bitcoin has seen good points of greater than 50% throughout This fall, with the 2020 halving leading to a large 168% value improve.

Including to this bullish sentiment is the Federal Reserve’s current rate of interest cuts, which make conventional property much less engaging and increase Bitcoin’s narrative as “digital gold.” Buyers are watching intently, with many betting on Bitcoin’s function as “digital gold” in unsure occasions. Ought to these traits proceed, Bitcoin may turn into much more engaging to institutional traders, particularly if the broader financial system faces additional volatility.