Each day Conquest 8.16.22 #062

All the pieces it’s essential know of right now’s fast-moving crypto markets

Subscribe to this each day publication TO NEVER MISS AN ISSUE.

The crypto market is a wild, wondrous and intimidating place; don’t trek alone! Subscribe to The Crypto Conquistador, and allow us to be your information.

Overview

- Arthur Hayes’ Ethereum prediction.

- Market pause. The place can we go from right here?

- Vitalik needs to punish some validators.

- Can Acala re-establish aUSD peg?

Good morning Fam,

The previous BitMEX CEO is at it once more by releasing one other very informative article the place he explains his buying and selling methods and predictions main into the most important occasion.

Most of us don’t have time to sit down down and skim the 30-minute weblog publish, however I did you the strong of recapping the advanced materials to its most elementary ideas. Only for you!

Hayes is at present studying Alchemy of Finance by George Soros, which impressed him to write down the publish. The central concept of Soros is the “concept of reflexivity” — a suggestions loop between market individuals and costs.

Fundamentals of Idea of Reflexivity

- Market individuals’ notion of a given market scenario influences how the scenario performs out.

- These expectations affect the information (“fundamentals”).

- Shapes expectations.

- A suggestions loop that turns into a self-fulfilling prophecy.

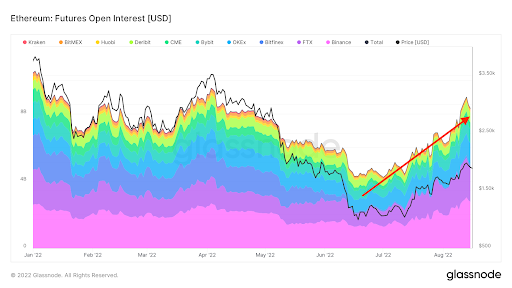

After Hayes spends nearly all of the weblog publish outlining the inputs and outputs per the idea of reflexivity, he then weighs the data towards the market’s present outlook for Ethereum. General, the futures market seems to carry a brief ETH place, which incorporates merchants hedging their spot Ether or individuals who plan to obtain the free chain-split tokens.

“ On condition that your complete curve out to June 2023 is buying and selling in backwardation — which means that the futures market is predicting ETH’s worth by the maturity date can be lower than the present spot worth — there may be extra promote strain than purchase strain on the margin.” *Chart under.

Based on Hayes, if the merge is profitable, the ETH shorters will seemingly shut their positions, and only a few will shut lengthy spot positions. Consequently, the following setup units the stage for a robust worth rally.

Hayes then mentions some methods to commerce the merge:

- Shopping for spot ETH.

- Shopping for Lido Finance (LDO).

- Longing ETH futures (Advanced and dangerous).

- Shopping for ETH name choices (Advanced and dangerous).

- Futures hedge (Advanced and dangerous).

Expectations

Hayes expects the structural discount in inflation (deflation) to occur post-merge and play out like bitcoin halvings (massive rallies).

However earlier than the merge, Hayes will proceed to purchase the dips in ETH, however plans to not shut any ETH spot positions.

Author’s Conclusion and translation

- If the Ethereum Merge fails, merchants will seemingly not wish to personal ETH, and a few will quick it.

All the next info is related IF The Merge is profitable:

- Arthur Hayes is exceptionally bullish on The Ethereum Merge and presents some ways to commerce it. Nevertheless, any derivatives trades maintain sophisticated dangers. Until you’re skilled, DO NOT TRADE THEM.

- Hayes predicts the same worth motion to Bitcoin halvings after the structural modifications to Ethereum tokenomics.

- Don’t over-trade The Merge. The worth can be risky main as much as the occasion.

- If we’re fortunate, we get just a few dips earlier than The Merge.

SPX/USD

The inventory market motion quelled after two bullish days. The S&P 500 reached a three-month excessive of $4,325 earlier than closing at $4,305. The index seems prepared for a pullback, however an absence of draw back catalyst might see shares proceed their month-long rally.

US president Biden signed the Inflation Discount Act into legislation, which units a 15% minimal company tax for corporations with revenues over $1 billion. Moreover, the invoice features a $369 billion funding into local weather and vitality insurance policies and $64 billion to increase the Reasonably priced Care Act. The invoice’s signing into legislation had little impact on futures, however tomorrow’s opening may inform in any other case.

Excessive-resolution chart

BTC/USD

The crypto market was comparatively quiet, with just a few altcoins, reminiscent of Dogecoin (DOGE) (up 14.9%), taking the chance to climb. BTC appears poised to interrupt the uptrend assist on the each day charts, however till a candle closes under the extent, the uptrend stays legitimate. BTC accomplished the each day candle down -1.00% to $22,854.

Excessive-resolution chart

For those who’re having fun with this report and assume it’s price 20 sats (.01 cent), please press the clap button under to assist assist my writing. (As much as 50 occasions!) THANKS!

Vitalik received’t have it! Ethereum co-founder, Vitalik Buterin, wants to burn the staked Ether of validators that complied with OFAC sanctions of Twister Money. The feedback got here after analysts started questioning the centralization of the community when validators complied with regulator requests. Based on @TheEylon, 66% of validators complied with the censorship requests.

$1 trillion vaporized. The New York Occasions has launched “How two wall road washouts with a can’t-lose crypto hedge fund vaporized a trillion {dollars},” which covers Three Arrows Capital’s collapse behind founders Zhu Su and Davies’ aggressive buying and selling methods.

Solana seeks to enhance decentralization. Bounce Capital and the Solana Basis have teamed as much as create a secondary validator shopper for the Solana blockchain. The transfer would enhance the blockchain’s efficiency and decentralization.

Information Tidbits:

- Crypto Lender Hodlnaut applies for creditor protections in Singapore.

- Coinbase releases plans for the Merge.

- Alex Mashinsky was accused of taking management of buying and selling methods at Celsius early within the 12 months.

- FTX hints at introducing choices buying and selling.

- Coinbase premium re-emerges.

- BitBoy sues YouTube persona Atozy over defamation.

On the protocol degree ⛓

DeFi giants be a part of Optimism L2: Yearn Finance and Iron Financial institution have joined the Optimism L2 community. The companies joined the community to enhance cross-chain interoperability, safety, and capital effectivity for customers.

Acala stablecoin is recovering. The Acala native stablecoin aUSD is nearing the $1.00 market after sixteen wallets exploited the community and printed $1.3b price of aUSD. Acala handed the referendum to burn the surplus tokens to re-peg the stablecoin’s greenback worth.

Protocol degree.

- Thread: Justin Bons accuses Polygon of being extremely insecure and centralized.

- Case study of Features Community token GNS.

- Nearing the launch of the Canto Layer 1 community.

NFT & metaverse replace 🐵

- Homeowners of CyptoPunks and Meebits non-fungible tokens (NFTs) at the moment are allowed to make use of them for business achieve after Yuga Labs launched the mental property rights for the collections.

- NFT Analytics agency Zash partners with Binance to develop NFT information and intelligence merchandise.

My 5 cents….

“Finest crypto market author on the planet.”

That’s what Raoul Pal stated about Arthur Hayes, and I agree. His articles should not solely informative, however very entertaining. Who else can efficiently examine the lifeless our bodies floating in a river to the crypto collapse as Hayes did in Floaters? Fascinating work.

Nonetheless, these two mega-minds are rooting for ETH earlier than The Merge. In fact, nothing in life is concrete, and each funding is a danger, however the Ethereum Merge presents a chance we seldom see in crypto. There’s a slight likelihood it may not go as deliberate, but when it does, be careful, ETH provide dynamics will dictate market situations for a lot of months to come back.

Thanks for studying, observe me on Twitter for each day updates!

NOT FINANCIAL ADVICE!

/cdn.vox-cdn.com/uploads/chorus_asset/file/24830575/canoo_van_photo.jpeg)