Este artículo también está disponible en español.

A latest report from crypto information and analysis agency Messari has make clear the efficiency of the Solana (SOL) ecosystem through the third quarter of 2024. The report highlights a mix of progress and challenges confronted by the blockchain amid broader volatility within the cryptocurrency market throughout that interval.

Solana Stablecoin Market Cap Rises To $3.8 Billion

One of many standout metrics from the report is the expansion of Solana’s Whole Worth Locked (TVL) in decentralized finance (DeFi), which rose by 26% quarter-over-quarter (QoQ) to achieve $5.7 billion.

This progress positioned Solana because the third-largest community when it comes to DeFi TVL, surpassing Tron in late September. Notably, the TVL denominated in SOL additionally elevated, rising by 20% QoQ to 37 million SOL.

Associated Studying

Kamino emerged as a number one participant throughout the Solana ecosystem, experiencing a 57% progress in TVL, ending the quarter with $1.5 billion and capturing a 26% market share. This surge is attributed to the combination of latest tokens, together with PayPal’s USD (PYUSD) and jupSOL, which have enhanced the platform’s enchantment.

Regardless of the general constructive developments, decentralized change (DEX) quantity skilled a slight decline, reflecting a downturn in memecoin buying and selling. Common every day spot DEX quantity fell by 10% QoQ to $1.7 billion.

Per the report, the diminishing curiosity in memecoins was evident, as solely two tokens—WIF and POPCAT—managed to make it into the highest ten by buying and selling quantity for the quarter.

In distinction, Solana’s stablecoin ecosystem confirmed resilience, with the market cap for stablecoins rising by 23% QoQ to $3.8 billion, solidifying its rank because the fifth-largest community on this class.

On the non-fungible token (NFT) entrance, nevertheless, the efficiency was much less favorable. Common every day NFT quantity fell by 27% QoQ to $2.5 million, with Magic Eden sustaining a dominant market share regardless of experiencing a 44% decline in quantity.

Community Exercise Thrives

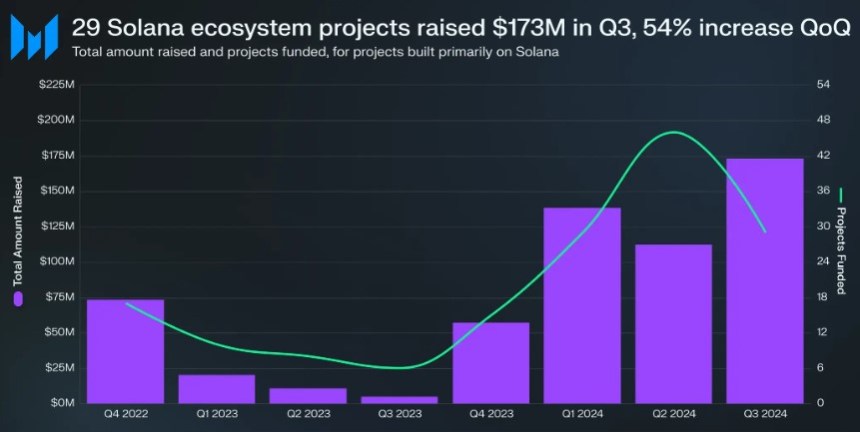

Regardless of the challenges, the variety of funding rounds for tasks throughout the Solana ecosystem noticed a discount of 37% QoQ, with solely 29 tasks saying funding. But, the full quantity raised soared to $173 million, a 54% improve QoQ and the very best quarterly funding since Q2 2022.

Community exercise remained strong, as evidenced by a 109% improve in common every day charge payers, which reached 1.9 million. Moreover, the common every day new charge payers grew by 430% QoQ to 1.3 million, signaling a rising person base.

Associated Studying

The typical transaction charge on Solana elevated by 6% QoQ to 0.00015 SOL (roughly $0.023), whereas the median transaction charge dropped by 19% to 0.000008 SOL (round $0.0013).

As of October 15, Solana’s market capitalization additionally grew by 5% QoQ, reaching $71 billion and sustaining its place because the fifth-largest cryptocurrency, trailing solely Bitcoin, Ethereum, Tether, and Binance Coin.

Nevertheless, the Actual Financial Worth (REV) of Solana, which tracks transaction charges and miner extractable worth (MEV) for validators, decreased by 25% QoQ to 1.3 million SOL (roughly $196 million), with 56% of this complete coming from transaction charges.

On the time of writing, SOL was buying and selling at $166, down 5% for the seven day interval.

Featured picture from DALL-E, chart from TradingView.com