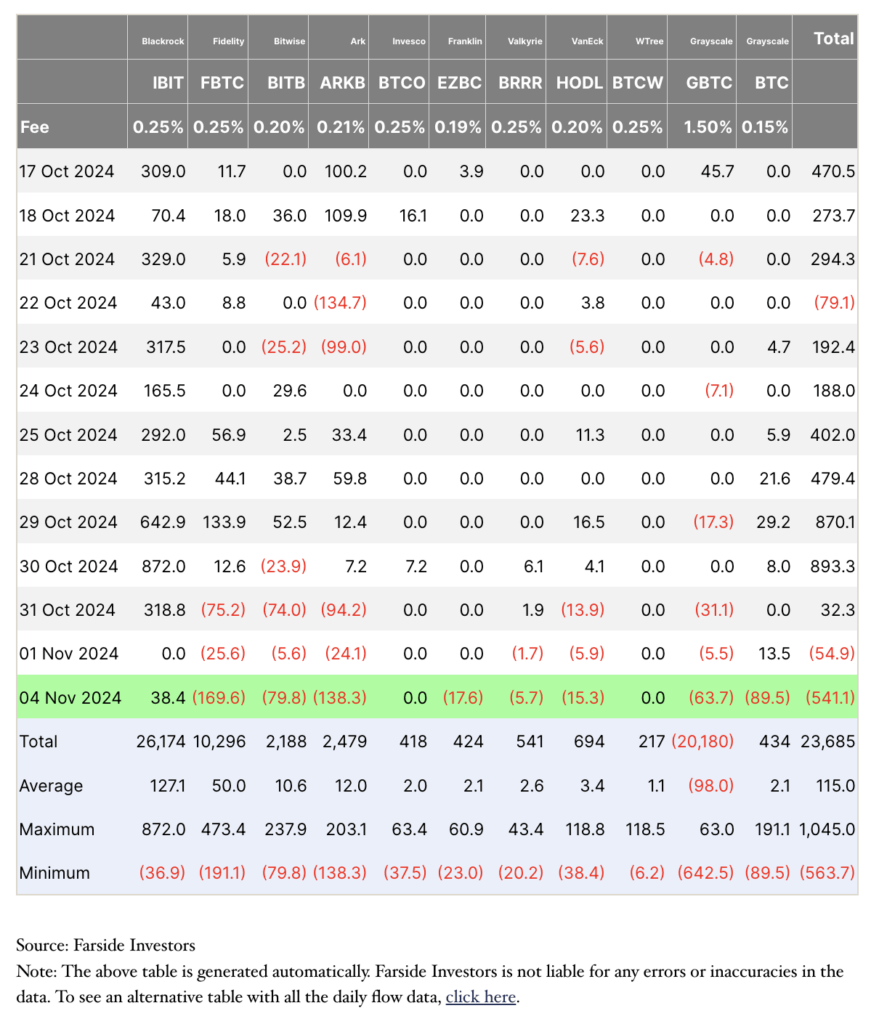

Main asset administration companies reported important outflows in Bitcoin ETFs following over $3 billion in inflows since Oct. 23. On Nov. 1, BlackRock’s IBIT confirmed no change, whereas Grayscale’s GBTC decreased by $5.5 million. By Nov. 4, BlackRock’s IBIT registered an influx of $38.4 million, whereas Grayscale’s GBTC noticed an outflow of $63.7 million.

Corporations like Constancy’s FBTC and Ark’s ARKB additionally skilled notable actions. Ark’s ARKB decreased by $24.1 million on Nov. 1 and confronted an outflow of $138.3 million by Nov. 4. Constancy’s FBTC had outflows of $25.6 million and $169.6 million on Nov. 1 and 4, respectively.

Bitcoin presently trades at $68,813.50, 7% under its all-time excessive of $73,686.93. Its market capitalization is $1.36 trillion, and its 24-hour buying and selling quantity is $42.2 billion. In keeping with CryptoSlate knowledge, Bitcoin’s market dominance is 60.7%.

The put up Bitcoin ETFs see $540 million outflow amid elevated US Election volatility appeared first on CryptoSlate.