Ethereum’s latest efficiency has many questioning if the cryptocurrency is on the rise once more, and with Donald Trump doubtlessly bringing in a crypto-friendly administration, the circumstances may very well be proper for a brand new DeFi surge. Ethereum (ETH) simply broke previous the $2,800 mark—its highest degree since August, pulling it out of a hunch the place it lingered between $2,300 and $2,600. Some business consultants are saying that Trump re-electing as President of the US might change the sport for ETH and the DeFi sector. Let’s dig in to know what they actually imply by this.

Trump’s Deregulation Stance May Spark DeFi Development

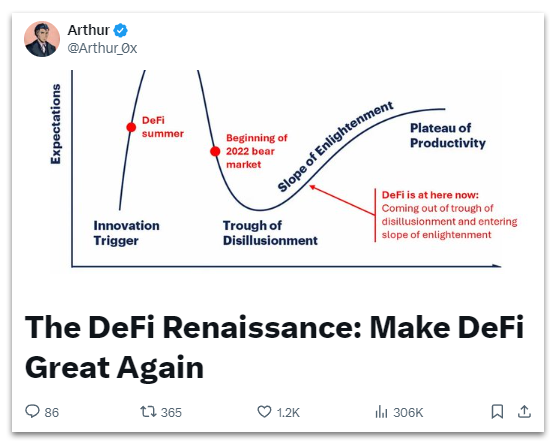

Trump’s presidency would possibly imply simpler laws for crypto, together with Ethereum and DeFi initiatives. Many within the crypto world, together with large names like Arthur Cheong from DeFiance Capital, consider Trump might deliver a “DeFi Renaissance.” This time period factors to a time when DeFi might develop with out as many regulatory hurdles. Cheong thinks that if Trump lowers these limitations, we might see an increase in each new initiatives and the worth of tokens linked to DeFi, probably boosting ETH demand as extra individuals take part.

Curiously, a ratio monitoring ETH and Bitcoin (BTC) reveals investor curiosity in ETH has been decrease these days. However with Trump’s method, we’d see a change in that pattern, particularly if ETH can safe a stronger place out there.

DeFi Efficiency: Indicators of Resilience and Development

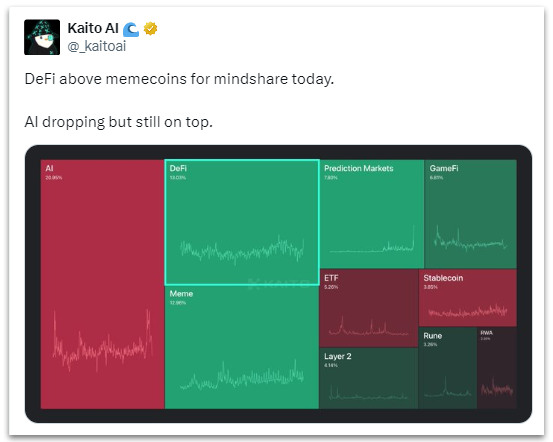

One other sign pointing towards DeFi’s potential development comes from key metrics like person exercise and capital inflows, each rising just lately. Aave, a core venture throughout the DeFi world, is reportedly performing higher than it did at its peak in late 2021, displaying the sector’s resilience and maturity. DeFi’s elevated visibility on social media platforms, particularly X (previously Twitter), additionally means that retail buyers are paying nearer consideration. In line with Kaito information, DeFi is trending greater than fashionable sectors like AI or meme cash, an indication that extra on a regular basis buyers are getting .

A have a look at DeFi indexes additionally reveals a constructive market response, with costs for high DeFi tokens leaping by a mean of twenty-two% throughout the final 24 hours, in accordance with CoinGecko. The anticipation round a attainable crypto-friendly method beneath Trump could be driving this worth surge, particularly together with his household’s hyperlinks to World Liberty Monetary, a monetary companies participant.

What’s Subsequent for DeFi and Ethereum?

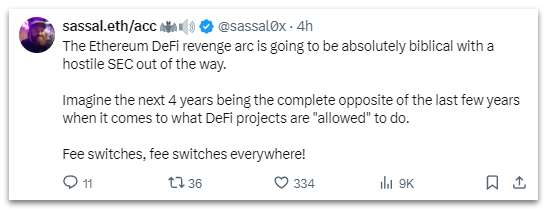

With Trump’s presidency, many predict fewer compliance prices and clearer guidelines for DeFi platforms. Some consultants, like Ethereum influencer @sassal0x, recommend that Trump’s insurance policies would possibly even reclassify sure tokens as commodities slightly than securities. Such a transfer might open up extra income avenues, with DeFi initiatives doubtlessly implementing “price switches” to generate regular earnings.

Whereas Trump’s insurance policies stay speculative for now, the market is already displaying indicators of enthusiasm. If these hopes pan out, DeFi and Ethereum could be on the verge of a serious upswing. Will Trump’s presidency actually unlock DeFi’s subsequent part? That is still to be seen, however the early indicators are promising.