Este artículo también está disponible en español.

Bitcoin (BTC) company adoption continues to realize momentum as video-sharing and cloud providers platform Rumble lately unveiled a BTC treasury technique. This transfer aligns with a rising pattern of companies worldwide embracing Bitcoin as a strategic asset.

Rumble Publicizes Bitcoin Treasury Technique, Inventory Rises

The YouTube competitor is the most recent firm to affix the Bitcoin bandwagon, as its Board of Administrators authorised a company treasury diversification technique that allocates a portion of its extra money reserves to BTC.

Associated Studying

As a part of this technique, Rumble plans to buy as much as $20 million price of BTC. The corporate described Bitcoin as a “precious software for strategic planning.” Rumble CEO and Chairman Chris Pavlovski defined:

We consider that the world continues to be within the early levels of the adoption of Bitcoin, which has lately accelerated with the election of a crypto-friendly US presidential administration and elevated institutional adoption. In contrast to any government-issued forex, Bitcoin is just not topic to dilution by means of infinite money-printing, enabling it to be a precious inflation hedge and a very good addition to our treasury.

The corporate acknowledged that its administration would consider components equivalent to market situations, Bitcoin’s buying and selling value, and Rumble’s money movement wants to find out the timing and quantity of BTC purchases. Nonetheless, it emphasised that the technique may very well be modified, paused, or discontinued.

Apparently, the announcement adopted a ballot carried out by Pavlovski on X, the place he requested customers whether or not Rumble ought to add Bitcoin to its stability sheet. Over 93% of the 43,790 respondents voted in favor of the proposal.

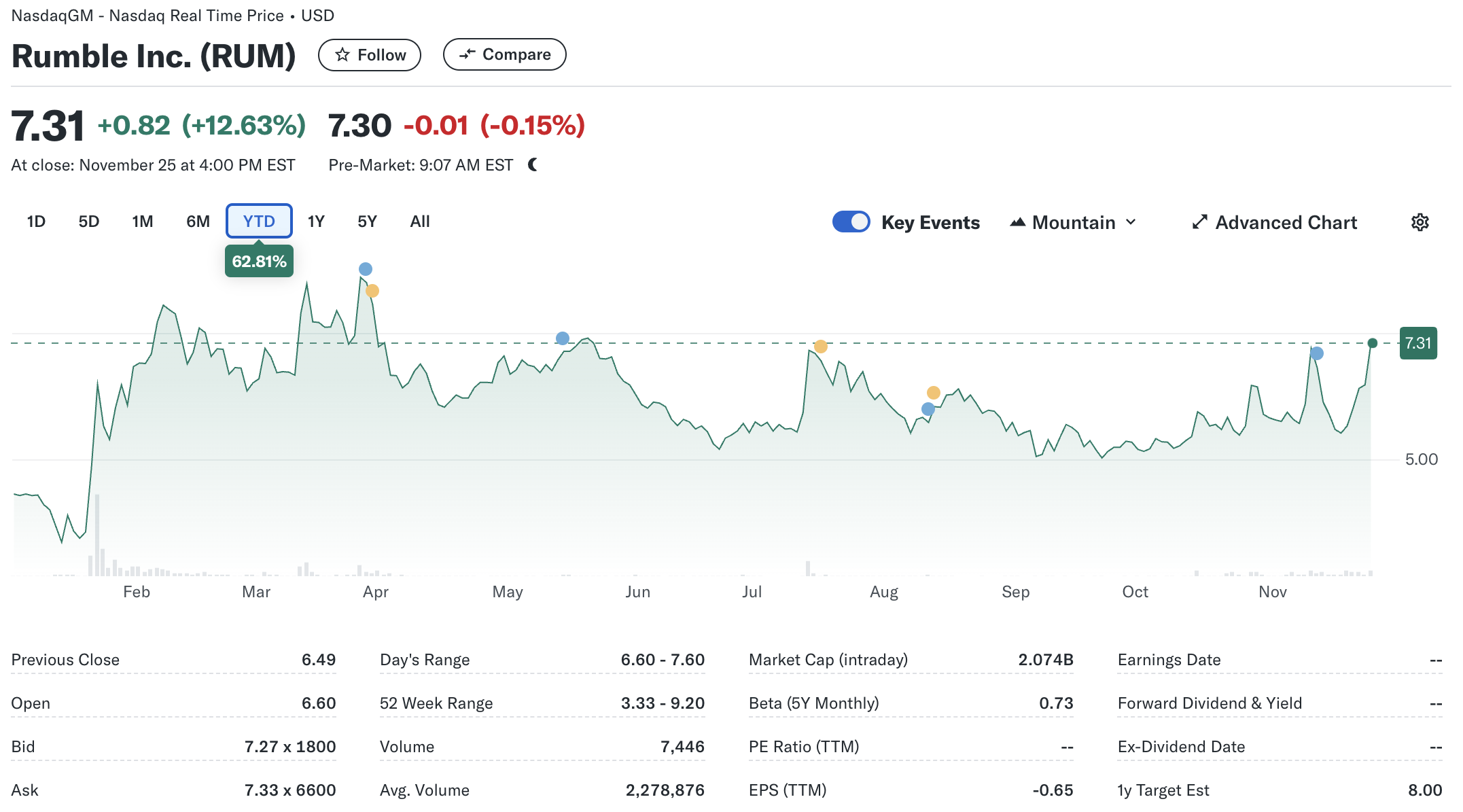

Rumble’s inventory value surged after the announcement, reflecting investor confidence. The tech firm’s shares closed at $7.31, marking a 12.63% enhance in a single day.

BTC as a Company Asset: A Profitable Technique?

Rumble’s determination so as to add BTC to its stability sheet mirrors the strategy of MicroStrategy (MSTR), a pioneer in Bitcoin treasury administration. Yesterday, the Michael Saylor-led agency revealed that it had acquired an extra 55,000 BTC, bringing its holdings to $5.4 billion.

Associated Studying

MicroStrategy’s Bitcoin play has labored tremendously for the corporate’s inventory efficiency. Prior to now 12 months alone, MSTR value has elevated by greater than 670%, outperforming each BTC and the S&P 500 relating to returns on funding.

In the meantime, Japanese agency Metaplanet lately crossed the 1,000 BTC milestone because it continues to bolster its Bitcoin holdings with frequent purchases. Moreover, hypothesis about main tech giants like Dell and Microsoft getting into the Bitcoin market may gas demand and drive the asset’s value to new highs.

A current evaluation by crypto specialists exhibits that BTC might hit the highly-anticipated six-figure value goal early subsequent 12 months. BTC trades at $92,071 at press time, down 5.5% up to now 24 hours.

Featured picture from Unsplash, charts from Yahoo! Finance and Tradingview.com