The general cryptocurrency market skilled a major value decline, leading to billions of {dollars} value of crypto liquidations. This market crash started shortly after Jerome Powell’s anti-crypto stance following the Fed fee reduce and the latest switch of $100 million value of Bitcoin (BTC) by the defunct cryptocurrency trade Mt. Gox.

Mt Gox $100M BTC Transactions Sends Shockwaves

On December 19, 2024, the blockchain intelligence agency Arkham posted on X (previously Twitter) that Mt. Gox transferred a major $102.5 million value of BTC final evening following the Fed fee reduce assembly. The put up additionally famous that this substantial quantity of BTC was distributed throughout three separate transactions to a few completely different addresses, every receiving $30.18 million.

Nevertheless, Arkham additional famous that the rest remains to be in Mt. Gox’s custody.

These transactions by the defunct cryptocurrency trade seem to have a major impression on the crypto market. Mt. Gox is required to distribute billions of {dollars} value of BTC to its collectors, which is closely influencing BTC costs and the general crypto market.

$1.18 Billion Value Crypto Liquidation

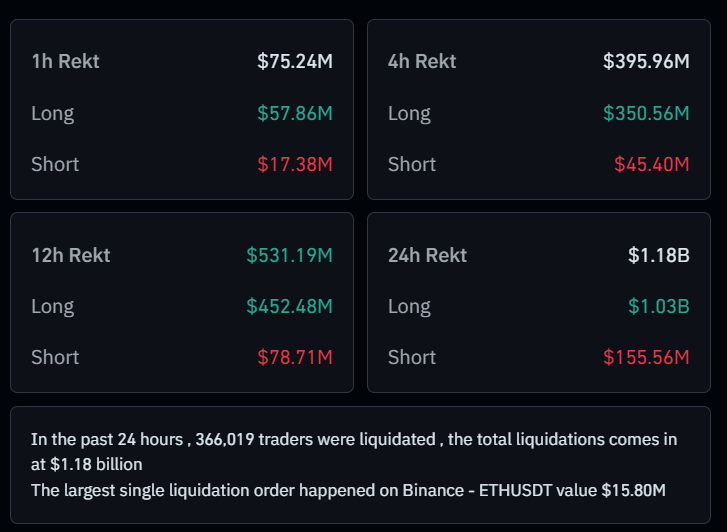

The present market sentiment seems extraordinarily bearish, with merchants and traders experiencing heightened worry as a consequence of billions of {dollars} in liquidations. In keeping with the on-chain analytics agency Coinglass, the latest market crash resulted within the liquidation of a major $1.18 billion value of lengthy and quick positions.

The vast majority of the liquidations got here from lengthy positions, as merchants holding $900 million value of lengthy positions had been liquidated. In distinction, the crypto market witnessed solely $160 million in brief liquidations over the previous 24 hours.

In consequence, the general cryptocurrency market has seen a 3.51% decline, with main belongings like Bitcoin (BTC), Ethereum (ETH), XRP, and Solana (SOL) witnessing even steeper drops of over 4.75%, 9.2%, 6.5%, and 9%, respectively, up to now 24 hours. This bearish sentiment is compounded by ongoing fears associated to the Mt. Gox distributions.