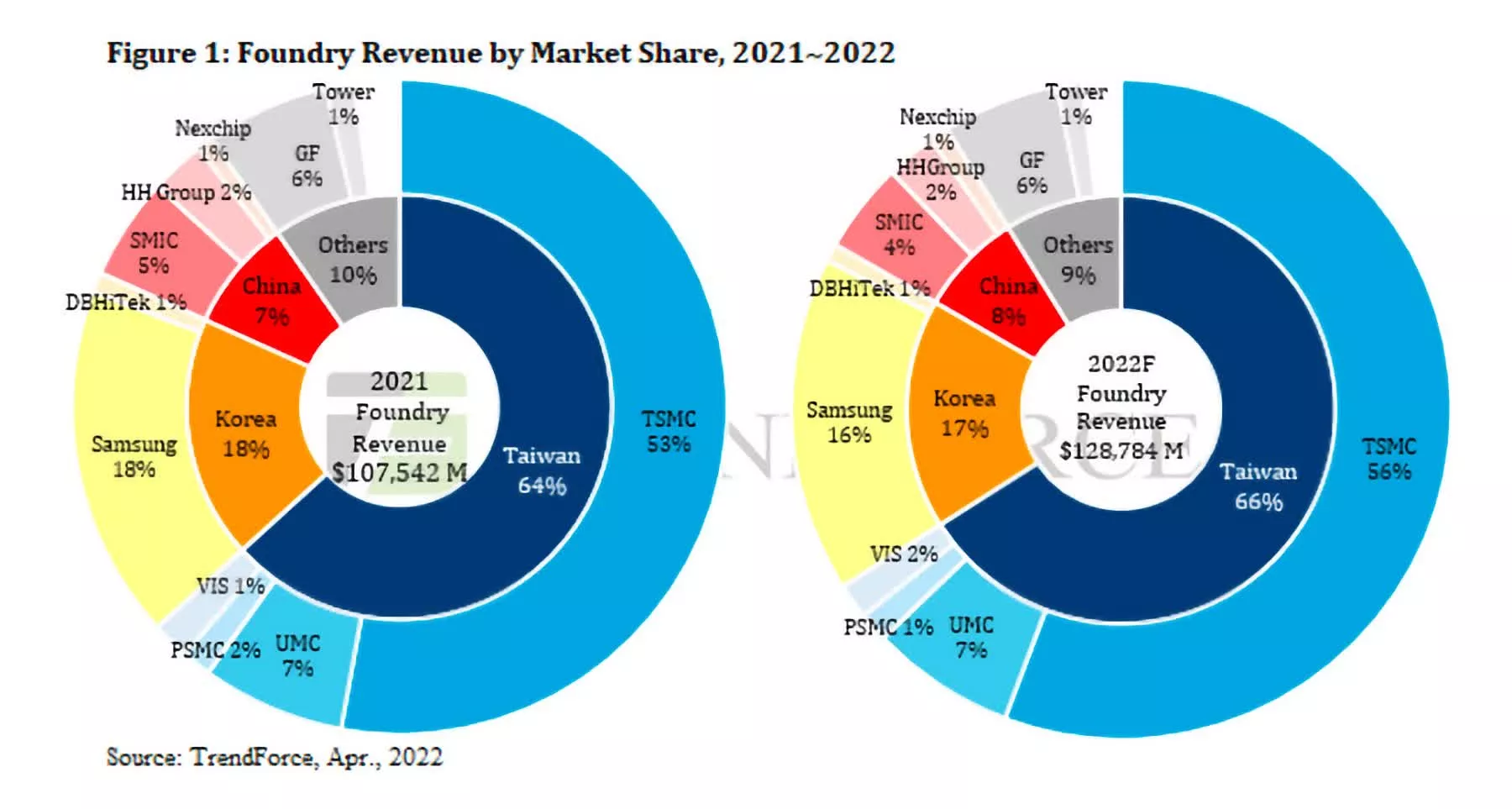

There is just one firm working at the vanguard of semiconductor manufacturing and that’s TSMC. Many will learn that and assume “In fact, that is apparent,” however we imply that in a really particular manner (many extra will learn that after which return to swiping movies on TikTok, so thanks for sticking round…).

For the previous few years, there have really been two corporations working at the vanguard — TSMC and Samsung. With all the eye that TSMC will get for each business and geopolitical causes, we discovered that lots of people type of forgot about Samsung. A number of years in the past that might be a mistake, Samsung was at all times aggressive with TSMC, if slightly bit slower and more durable to work with. However it’s seems like that will change.

Editor’s Word:

Visitor creator Jonathan Goldberg is the founding father of D2D Advisory, a multi-functional consulting agency. Jonathan has developed progress methods and alliances for corporations within the cell, networking, gaming, and software program industries.

As standard, Dylan Patel has a superb piece on the troubles at Samsung. The fast abstract of that piece is that Samsung is going through delays each for its 7nm course of and for its DRAM reminiscence merchandise. Learn again on a number of the press protection of Samsung over the previous yr, and it seems quite a bit like one thing is de facto unsuitable there. Delays. False begins. Combined messaging. For us, the eeriest a part of that is that this can be a sample we have now seen many occasions earlier than. That is what each firm seems like simply earlier than they fall off the Moore’s Regulation curve.

To be clear, we’re not saying that Samsung goes to desert improvement of vanguard manufacturing capabilities. They’ve immense assets and know-how. They must preserve shifting ahead. However that doesn’t imply they must construction their enterprise the identical manner.

Extra particularly, we have now heard just a few folks argue that Samsung ought to exit the foundry enterprise, cease manufacturing chips for others and as an alternative focus solely on their extremely worthwhile reminiscence enterprise. We all know that there are folks inside Samsung making this argument, however we have now no solution to gauge how influential they are going to finally be.

Because of this it so vital to recollect Samsung in discussions about foundries. They’ve supplied a substitute for TSMC for years, however there’s a non-zero probability that they could not present that different. Once more, we’re not saying that is going to occur, however in all our discussions about provide chain resiliency it is very important keep in mind that issues might really worsen.

What would that seem like?

Right here the reply relies upon quite a bit on which buyer we’re speaking about. Most of the largest chip corporations — notably Nvidia and AMD — have way back moved away from Samsung for essentially the most half and devoted themselves to TSMC.

They made giant order commitments, a course of which is now haunting their outcomes. On the different finish of the spectrum, nearly each small startup chip firm we all know has by no means thought-about working with anybody aside from TSMC for the vanguard.

Samsung’s foundry enterprise will not be simple to work with for small corporations, customer support will not be their key promoting level. These corporations are already residing in a world the place TSMC is the one choice, and they’re paying full value for that, with one other 20% bump coming quickly. That leaves a big group within the center, Samsung foundry reportedly has over 100 clients, of which Qualcomm is the most important. Although most of these corporations probably work with TSMC as effectively, shedding Samsung as a foundry would trigger a number of ache. This might probably imply product delays and significant price will increase — a.ok.a. disruption.

None of that is set in stone. Rather a lot might change. Samsung might make the organizational modifications it must unstick their manufacturing course of enhancements. They might get subsidies from the Korean and US governments to “encourage” their remaining round.

Additional out, Intel might conceivably flip round its manufacturing after which work out customer support. However after two years of everybody being continually shocked to learn the way brittle the semis provide chain is, now is an efficient time for the business to start out performing some situation evaluation and contingency planning.