A buying and selling robotic that’s earned a status for outperforming the markets is revealing its latest portfolio allocations as most cryptocurrencies search to recuperate from an total downtrend.

Every week the Actual Imaginative and prescient Bot conducts surveys with a purpose to compile algorithmic portfolio assessments that generate a “hive thoughts” consensus.

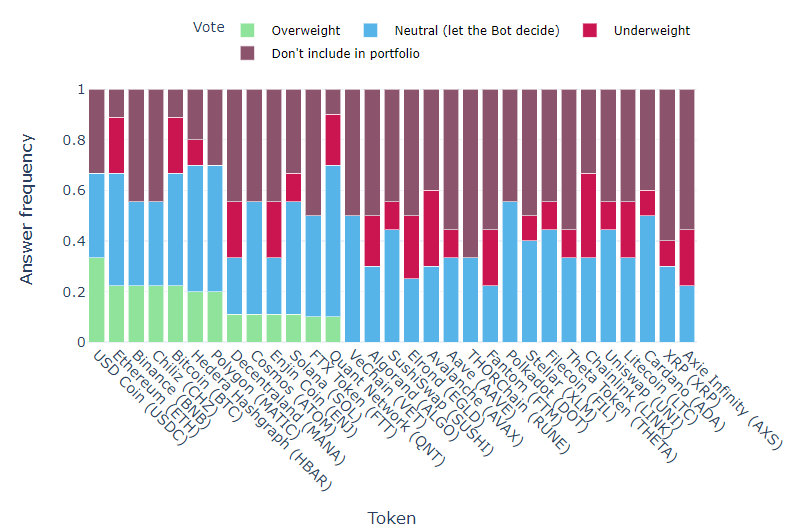

The bot’s newest data reveals that merchants’ danger urge for food has decreased considerably from per week in the past, with most market contributors voting to obese their portfolios with 11 altcoins along with the highest crypto property Bitcoin (BTC) and Ethereum (ETH).

Surging into first place was the dollar-pegged stablecoin US Greenback Coin (USDC) with a 33% boosted allocation, whereas final week the altcoin was at round 20%.

4 crypto property tied for second place being voted 22% heavyweight: main sensible contract platform Ethereum, well-liked cryptocurrency trade Binance’s native token BNB, sports activities fan token community Chiliz (CHZ), and Bitcoin.

“Newest outcomes of the Actual Imaginative and prescient Change crypto survey. De-risking mode. Low total % to obese dangerous tokens. USDC on #1.

1. USDC 33%

2. Ethereum 22%

3. Binance 22%

4. Chiliz 22%

5. Bitcoin 22%”

Tied for sixth with a 20% increase had been decentralized application-creating protocol Hedera Hashgraph (HBAR) and layer-2 scaling resolution Polygon (MATIC).

The next distinguished digital property all acquired an 11% “obese” allocation: digital actuality world Decentraland (MANA), scalability and interoperability ecosystem Cosmos (ATOM), Ethereum-based blockchain gaming community Enjin Coin (ENJ), and layer-1 sensible contract platform Solana (SOL).

The ultimate pair of altcoins to obtain a heavyweight allocation by 10% had been the FTX cryptocurrency trade’s FTX Token (FTT) and enterprise-grade interoperability resolution supplier Quant Community (QNT).

The most recent survey-based trade portfolio allocation is led by USDC at 23.4%, adopted by Polygon at 18.8%, each Binance and Chiliz at 15.6%, Cosmos and Hedera Hashgraph every at 9.38%, and at last FTX Token at 7.81%.

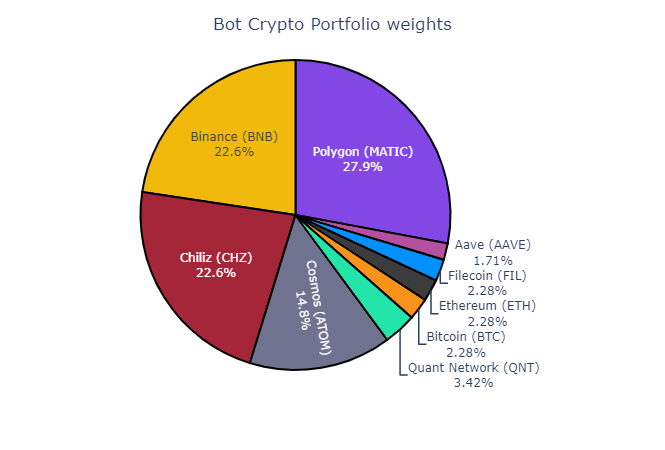

The bot itself additionally compiles a customized portfolio, and Actual Imaginative and prescient experiences that MATIC leads with 27.9%, adopted by BNB and CHZ each at 22.6%, and ATOM with 14.8%.

5 digital property acquired between 1.5% and three.5%, together with QNT, BTC, ETH, decentralized storage community Filecoin (FIL), and lending and borrowing protocol Aave (AAVE).

The Actual Imaginative and prescient Bot was co-developed by quant analyst and hedge fund CEO Moritz Seibert and statistician Moritz Heiden.

Actual Imaginative and prescient founder and macro financial knowledgeable Raoul Pal has referred to as the bot’s historic efficiency “astonishing,” saying it outperforms an aggregated bucket of high 20 crypto property in the marketplace by greater than 20%.

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Verify Value Motion

Observe us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any loses it’s possible you’ll incur are your duty. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please be aware that The Each day Hodl participates in online marketing.

Featured Picture: Shutterstock/sergeymansurov/Andy Chipus