Amid the latest value decline, XRP, the native token of Ripple Labs, has shaped a bullish value motion sample and is poised for a double-digit value rally. At the moment, January 31, 2025, the general cryptocurrency market appears to be recovering, together with Bitcoin (BTC) and Ethereum (ETH), however XRP seems to be struggling.

XRP Present Market Sentiment

Regardless of the optimistic market sentiment, XRP is presently buying and selling close to $3.13 and has skilled a modest value surge of over 0.80% previously 24 hours. Throughout the identical interval, traders and merchants have proven decrease curiosity, leading to a 35% drop in buying and selling quantity.

This modest value surge triggered XLM to surpass XRP when it comes to features, because it soared greater than 13% previously 24 hours. It seems that XRP merchants and traders at the moment are shifting their consideration to XLM, amid potential spot ETF talks.

XRP Technical Evaluation and Upcoming Ranges

In response to skilled technical evaluation, XRP has shaped a bullish flag and pole value motion sample on the each day time-frame and appears to be struggling to interrupt out.

Primarily based on the latest value motion, if XRP efficiently breaches this sample and closes a each day candle above the $3.21 stage, there’s a robust risk it might soar by 40% to achieve the $4.50 stage sooner or later.

With XRP’s Relative Power Index (RSI) close to 59, it signifies that the asset has sufficient room to soar and expertise spectacular value features.

XRP’s Blended-Sentiment

Wanting on the bullish value motion, traders appear to be accumulating the token, as revealed by the on-chain analytics agency Coinglass. Information from spot influx/outflow reveals that exchanges have witnessed an outflow of over $12 million value of XRP previously 24 hours, which signifies potential accumulation and will trigger shopping for strain and an additional upside rally.

Merchants Wager on XRP

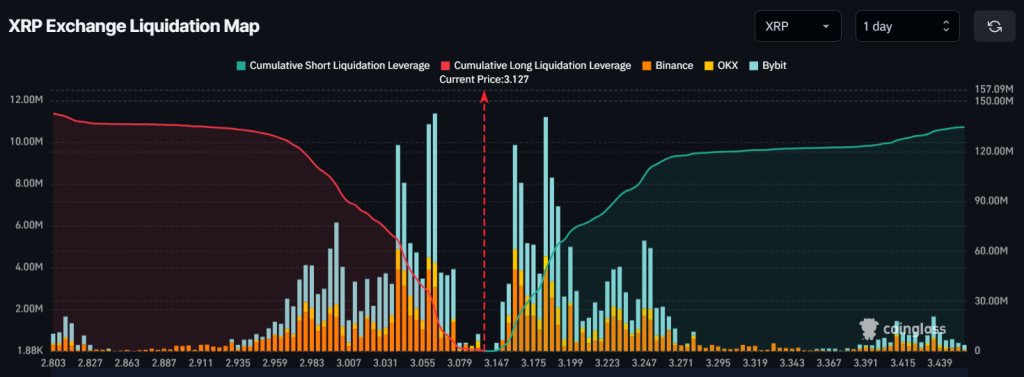

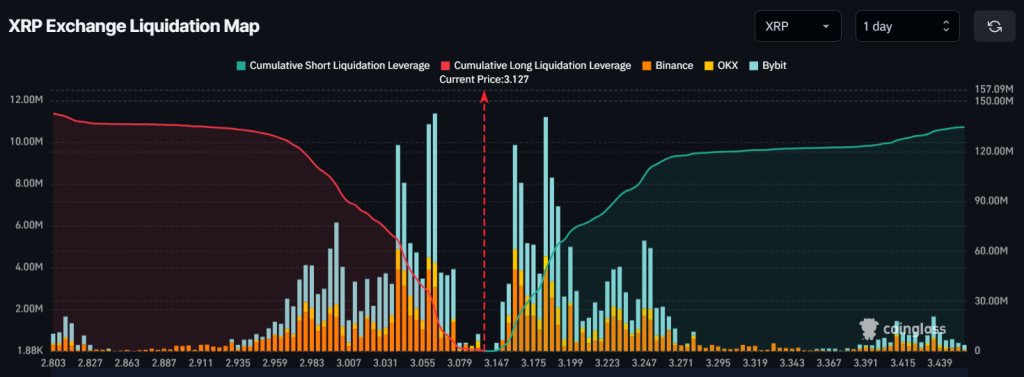

Regardless of the bullish outlook from traders and whales, intraday merchants discovered betting on the bearish aspect. XRP’s trade liquidation map revealed that $3.063 is a stage the place bulls are over-leveraged, holding $24.50 million value of lengthy positions. In the meantime, $3.183 is the extent the place quick sellers maintain $50.09 million value of quick positions.

This knowledge reveals that short-sellers are presently dominating within the quick time period, as they maintain almost double the positions of long-term holders.