Key Takeaways:

- With the acquisition of 871 extra Bitcoin, Semler Scientific has grow to be one of many prime 10 company Bitcoin holders, with a complete of three,192 BTC.

- The corporate’s Bitcoin technique has had a formidable begin, with returns surpassing 150% since its inception.

- This transfer positions Semler Scientific as one of many main company adopters of Bitcoin as a treasury asset.

Introduction: Semler Scientific’s Daring Bitcoin Transfer

Semler Scientific (NASDAQ: SMLR), a healthcare know-how firm that gives instruments for diagnosing and treating persistent ailments, has surged within the tech and crypto communities via its grand Bitcoin technique. Amid monetary conditions reminiscent of the rise in inflation and the rise in financial uncertainty, Semler has recognized Bitcoin as greater than only a speculative funding however a strong retailer of worth and a attainable hedge within the face of macroeconomic dangers.

One other 871 BTC Acquired: The Particulars

Briefly put, throughout the interval that passes between eleventh of January and third of February, 2025, Semler Scientific was profitable in acquiring extra Bitcoins. Though some Bitcoin detractors may be reluctant to spend money on the cryptocurrency because of its volatility, Semler have to be given a giant shout out such that its imaginative and prescient could also be performed out in the long term.

- Acquisition Interval: January 11, 2025 – February 3, 2025

- Bitcoin Acquired: 871 BTC

- Whole Funding: $88.5 million

- Common Worth: $101,616 per BTC

Whole Bitcoin Holdings and Spectacular Returns

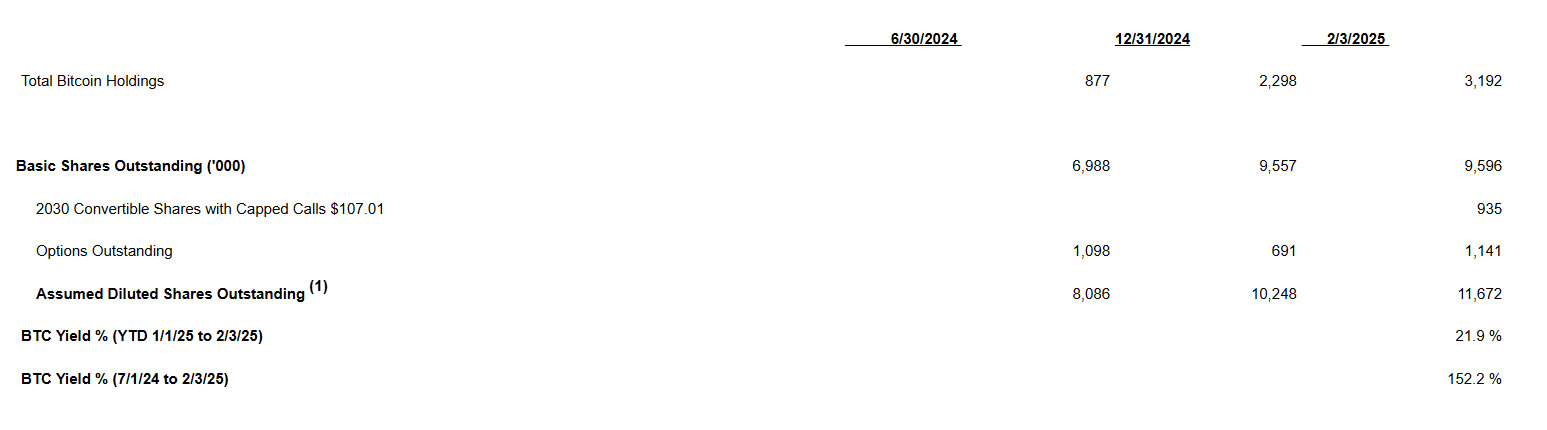

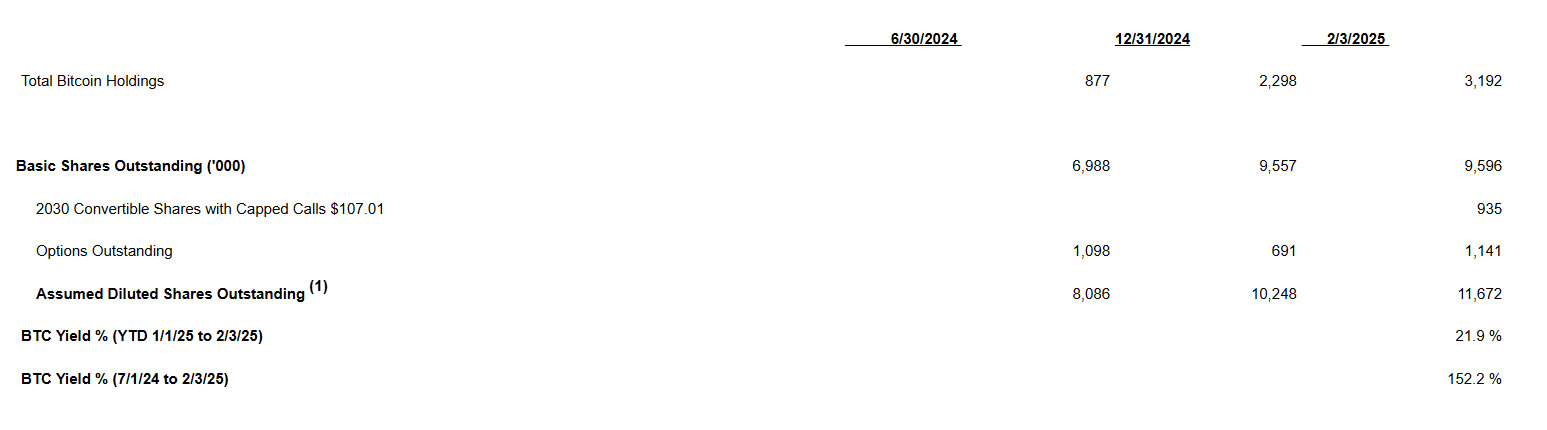

By February 3, 2025, Semler Scientific had gathered a complete of three,192 Bitcoin, acquired at a mean worth of $87,854 per BTC, with a complete funding of $280 million. This equates to a achieve of roughly $313 million if the present market costs proceed. Probably the most excellent? The return on funding.

With 3,192 Bitcoin, Semler Scientific is now among the many prime ten personal firms holding Bitcoin globally, based on Bitcoin Treasuries. This locations the corporate alongside long-time company Bitcoin advocates.

| Metric | Worth |

| Whole Bitcoin Held | 3,192 BTC |

| Whole Funding Price | $280 million |

| Common Buy Worth | $87,854 per BTC |

| Estimated Present Worth | Roughly $313M |

The Numbers Don’t Lie: Eye-Popping Returns

- July 1, 2024 to February 3, 2025: Environmental earnings configuration of 152%

- 12 months-to-Date (2025): Expenditure of twenty-two%!

Semler’s revenue report

This information means that, at the very least for now, Semler’s Bitcoin funding is proving to be a worthwhile wager. Whereas the previous outcome doesn’t give a particular endorsement of the longer term, the big revenue is an instrument that helps the notion that Bitcoin could also be a most useful summary asset. You must keep in mind although that these returns are very risky, they are often swayed by the market’s temper and the principle financial traits.

Management’s Perspective

Eric Semler, Chairman of Semler Scientific, has expressed his satisfaction with the corporate’s growing Bitcoin holdings. Apart from, he acknowledged the nice outcomes of the convertible notes which he stated proved very sturdy investor curiosity. This exhibits the belief of the administration, that’s key on the subject of dealing with such a disputed asset.

Bitcoin’s Function as a Strategic Reserve Asset

The emergence of some firms like Semler Scientific as buyers in Bitcoin demonstrates the quickly rising development of these companies that deal with Bitcoin because the strategic reserve of the money reserve. The attractiveness of Bitcoin as a software for securing in opposition to inflation and world financial instability is turning into extra apparent. This uptake indicators the transferral of the method of firms towards digital property to the view of the position of digital property in defending capital reserves.

Market Response: Semler Scientific’s Inventory Worth (SMLR)

SMLR shares took off immediately because the report about Semler Scientific’s elevated Bitcoin investments hit the market. The corporate’s shares have been up by 1.55% in early buying and selling and have become an indication of the market’s belief within the firm’s plan. However, it ought to be stored in thoughts that different components apart from Bitcoin holding may considerably affect the shares available in the market.

Semler Scientific’s inventory worth went up 1.55%. Supply: Google

Extra Information: MicroStrategy Begins 2025 by Shopping for 1,070 Bitcoin with a Whole Worth of $101 Million

Contrasting Approaches: Semler vs MicroStrategy

It’s fascinating to see two very totally different strategic approaches of the businesses, that’s Semler with MicroStrategy being the dominant company action-taker in Bitcoin. Desisting itself from including extra Bitcoin to its hoarded Bitcoins the place the quantity summed as much as 471,017 having a price of $46 billion, MicroStrategy firmly determined to retain the prevailing quantities. This discrepancy looks like it isn’t simply how their threat appetites are glad but in addition their long-term Bitcoin development outlook. On the one hand is Michael Saylor, who has been the loudest and most ardent maximalist Bitcoin advocate for years, whereas Semler’s technique seems to be extra practical, indicative of the truth that Semler is working in a unique sector.

Semler Scientific’s daring transfer to proceed to avail of its cash in Bitcoin is a testomony to the corporate’s confidence sooner or later prospects of this cryptocurrency. The strong and huge returns in addition to the dynamic development of good points, mixed with Semler Scientific’s ascending place as a prime “institutional” Bitcoin proprietor, are proof of the corporate’s breaking ranks and subsequently, ascension to the pioneer standing.