Este artículo también está disponible en español.

In a current consumer word, Normal Chartered’s Head of Digital Belongings Analysis, Geoff Kendrick, predicted that Bitcoin (BTC) might surge to $500,000 by the top of 2028. The manager attributed BTC’s potential extraordinary worth rise to 2 main elements.

Components Propelling BTC Worth

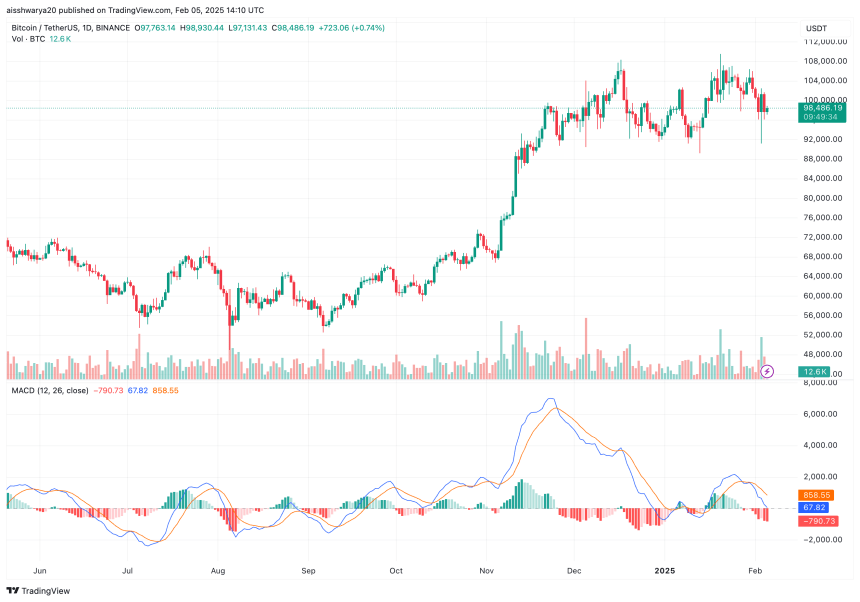

Whereas 2024 was a landmark yr for the world’s largest cryptocurrency – seeing it attain a number of all-time highs (ATH) and surpass $100,000 for the primary time – 2025 has seen extra reasonable worth motion. Since January 1, BTC has climbed from round $94,000 to $98,486 as of February 5.

Nevertheless, Kendrick believes that from the latter half of 2025 by way of 2028, Bitcoin might enter one other parabolic progress part. He forecasts BTC reaching $200,000 by the top of 2025, $300,000 by the top of 2026, $400,000 by the top of 2027, and in the end $500,000 by the top of 2028.

Kendrick attributes this bold worth trajectory to 2 key elements: improved investor entry and lowering volatility. The approval of spot Bitcoin exchange-traded funds (ETFs) within the US in January 2024 considerably simplified investor entry to BTC.

Moreover, as Bitcoin’s worth and market capitalization develop, its volatility has been lowering. A bigger market cap makes it tougher for any single dealer or entity to control BTC’s worth.

Kendrick expects this development to proceed as ETF markets mature and supporting monetary infrastructure throughout the crypto market strengthens. Kendrick added:

The ETFs have attracted a web $39 billion of inflows up to now, supporting the speculation of pent-up demand being unleashed by elevated entry. Donald Trump’s January 23 order that the administration consider a possible nationwide digital property stockpile can be vital, as this might encourage different central banks to contemplate Bitcoin investments.

If Trump’s administration strikes ahead with establishing a nationwide digital property reserve, Bitcoin’s volatility might decline even additional. This might appeal to historically risk-averse buyers who have been beforehand hesitant as a consequence of BTC’s worth swings.

Bitcoin Worth Forecasts Have Bullish Undertones

Over the previous few days, BTC has confronted elevated volatility, briefly plummeting to $91,000 amid issues over US commerce tariffs on Mexico, Canada, and China. Nevertheless, analysts stay assured in Bitcoin’s long-term bullish outlook.

Associated Studying

As an example, seasoned crypto dealer Alex Becker just lately acknowledged {that a} $150,000 worth goal for BTC is simply too conservative. Likewise, a report by CryptoQuant predicts BTC might attain wherever between $145,000 and $249,000 beneath a Trump administration.

On-chain knowledge additionally suggests that Bitcoin ‘whales’ – buyers controlling crypto wallets with massive BTC holdings – are positioning themselves for a bullish worth trajectory, signaling confidence in BTC’s long-term progress beneath the Trump regime. At press time, BTC trades at $98,486, down 1.3% previously 24 hours.

Featured picture from Unsplash, Chart from TradingView.com