One of the best no KYC crypto exchanges are MEXC, Bybit, dYdX, Uniswap, Pancakeswap, Changelly, CoinEx, PrimeXBT, Pionex, and ProBit. These platforms enable merchants to purchase, promote, swap, and spend money on crypto with out id verification. Usually, these nameless buying and selling platforms are important for customers who prioritize privateness and need to keep away from prolonged registration processes.

This text outlines ten of one of the best no KYC crypto exchanges in 2025 utilizing standards like safety, buying and selling choices and supported cryptocurrencies, buying and selling charges, and deposit/withdrawal choices. We will even clarify what KYC is in crypto. How to decide on one of the best no KYC crypto alternate? And canopy purchase crypto and Bitcoin (BTC) with out verification.

One of the best no KYC crypto exchanges are highlighted within the comparability desk beneath:

| Alternate | Safety | Buying and selling Instruments | Buying and selling Charges | Deposit & Withdrawal Choices |

| MEXC | 2FA

Chilly storage Deal with whitelisting |

Copy buying and selling

Demo buying and selling TradingView chart |

0.1% for makers and takers. The charges go as little as 0%. | Cryptocurrency transactions

Third-party fee suppliers SEPA Financial institution transfers. |

| Bybit | Chilly storage

Two-factor authentication Insurance coverage fund |

Automated buying and selling instruments (bots)

Spot, futures, and margin TradingView chart |

0.1% maker and taker orders within the spot market.

0.02% makers and 0.055% takers for futures. |

Cryptocurrency transactions

Credit score/debit playing cards Financial institution transfers P2P buying and selling. |

| dYdX | Ethereum protocol

Self-custodial safety measures Third-party audited. |

Margin buying and selling

Perpetual contracts |

0.02% makers and 0.05% takers. | Crypto, credit score and debit playing cards, and financial institution transfers. |

| Uniswap | Sensible contract audits

Chilly storage Insurance coverage. |

Fundamental crypto swaps | Normal payment is 0.3%. | Financial institution playing cards, crypto, and third-party fee platforms. |

| Pancakeswap | Common safety audits

2FA Bug bounty program |

Fundamental swaps | 0.25% for spot buying and selling. | Bank card, debit card, and financial institution switch. |

| Changelly | Withdrawal tackle whitelisting

2FA |

Swaps and crypto buying and selling (spot, margin, and futures). | Flat payment of 0.5% for crypto buying and selling. | Bank cards, financial institution transfers, and Apple Pay. |

| CoinEx | Two issue authentication

Common safety audits Multi-sig chilly pockets storage. |

Spot, margin, and futures buying and selling.

CET token advantages. |

0.120% maker and 0.20% taker (relying on 30-day buying and selling quantity). | Credit score/debit playing cards, crypto, financial institution transfers, and third-party platforms. |

| PrimeXBT | Common safety audits

Chilly pockets storage Obligatory Bitcoin tackle whitelisting. |

Futures buying and selling

Foreign exchange Inventory indices No spot buying and selling. |

0.05% | Direct crypto deposits and credit score/debit playing cards. |

| Pionex | 100% reserves

Multi-factor authentication Withdrawal tackle whitelisting. |

Buying and selling bots | 0.05% | Playing cards, financial institution transfers, and third-party fee platforms. |

| ProBit | 2FA

FIDO safety keys Chilly pockets storage |

Margin buying and selling | 0.2% | Direct crypto deposits, financial institution transfers, and credit score/debit playing cards |

1.MEXC

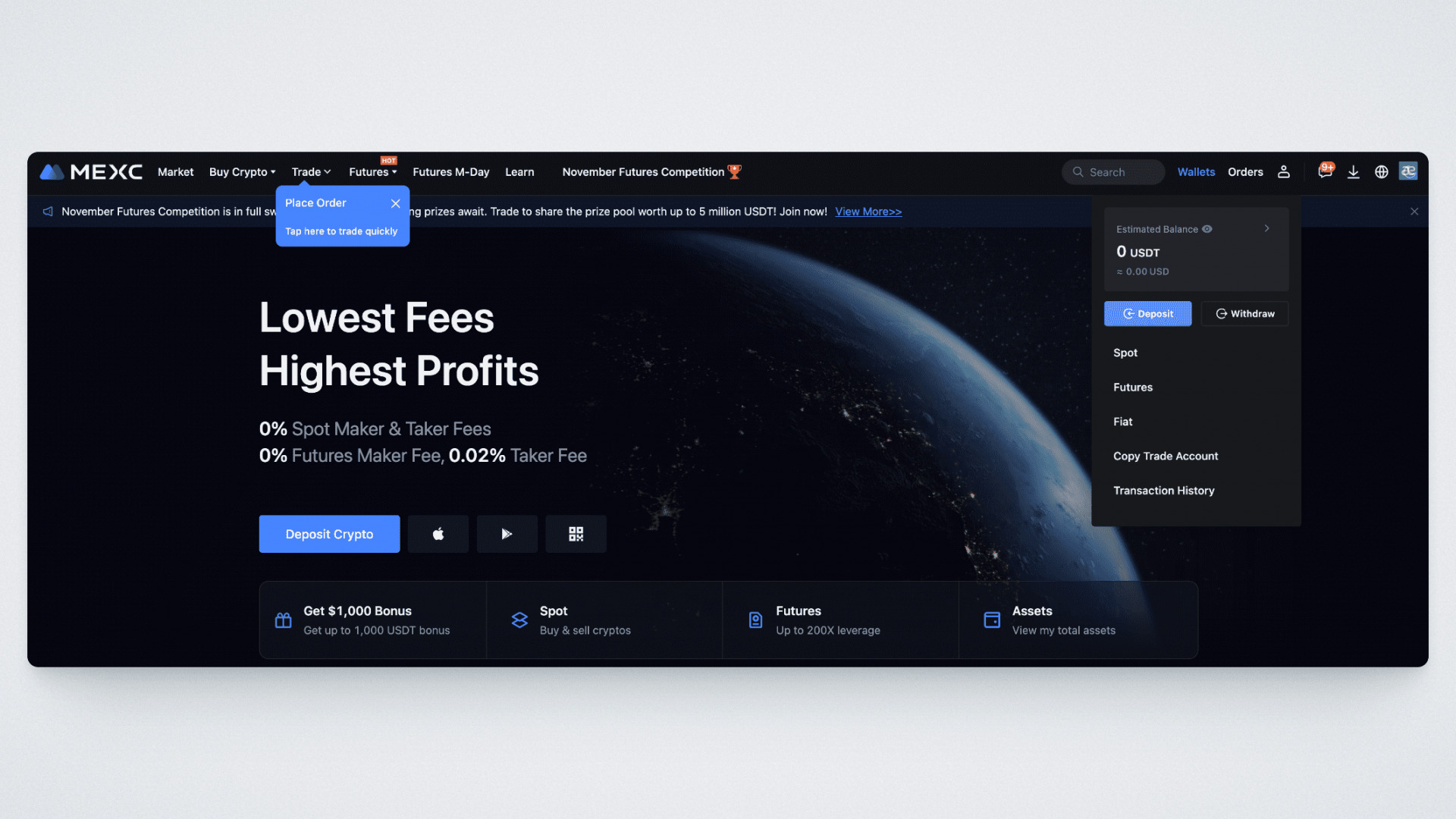

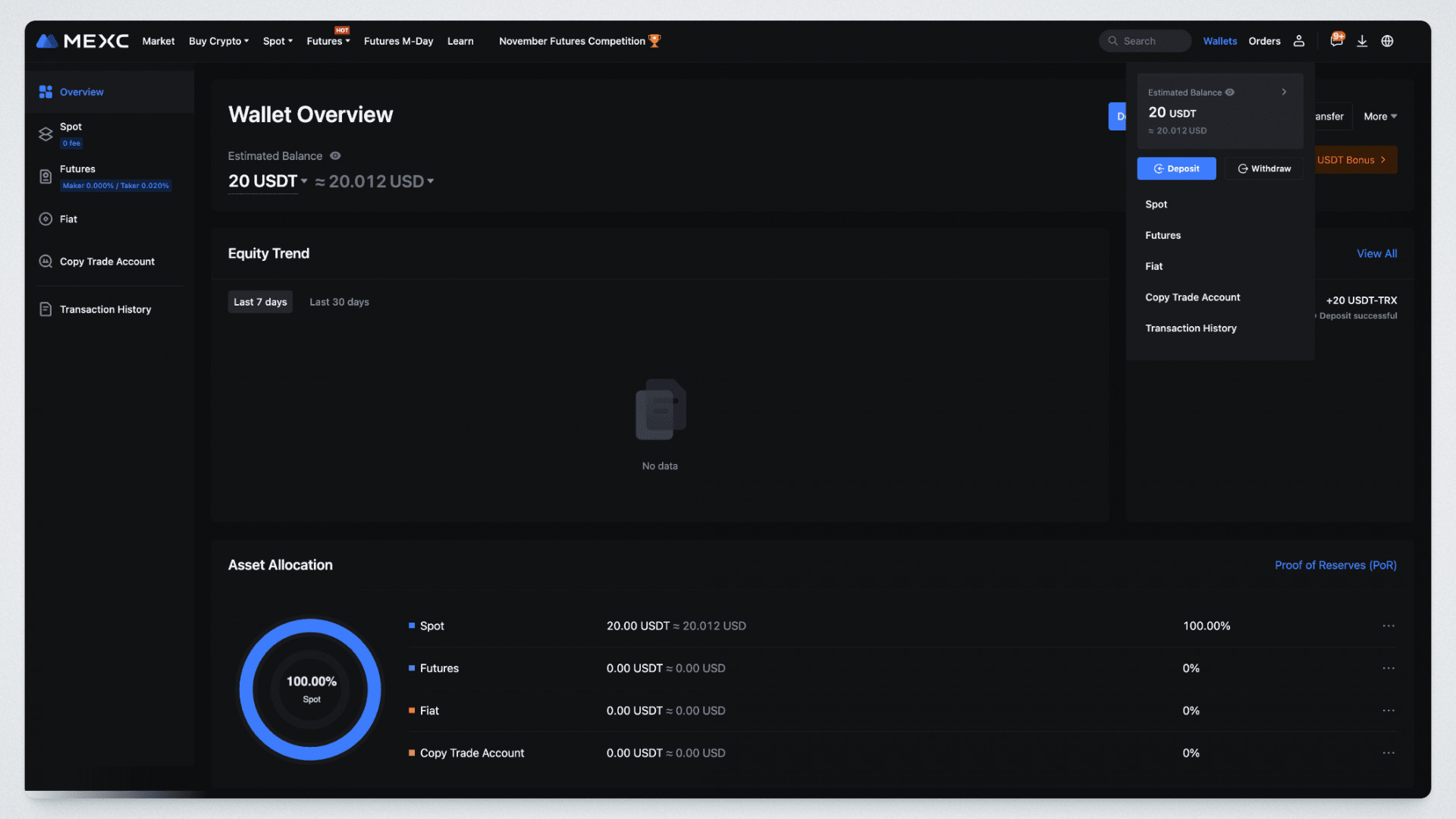

MEXC is a world centralized alternate that’s accessible to crypto merchants in over 100 international locations to purchase, promote, and spend money on crypto with out KYC verification. With solely your e mail, you’ll be able to register a brand new account on MEXC and deposit or withdraw funds at any time.

You may as well purchase and promote 2900+ cryptocurrencies, commerce over 3000 pairs, and discover all of MEXC’s greatest options anonymously, together with MX Token, MEXC launchpad, Kickstarter occasions, and numerous buying and selling choices. Here’s a rundown of MEXC’s professionals and cons.

The professionals of MEXC Alternate are;

- Futures Demo Buying and selling: The alternate gives a Demo Buying and selling interface for brand new crypto merchants to apply earlier than investing their very own cash.

- Incomes Choices: Merchants who need to earn passive revenue on MEXC can stake their crypto property via Financial savings, Easy Earn, and New Token Mining with fastened and versatile phrases for rewards.

- Copy Buying and selling Instruments: MEXC helps new customers benefit from their investments by copying the buying and selling methods of extra skilled merchants.

The cons of MEXC Alternate are;

- Complaints About Locking Person Funds: MEXC has been going through backlash for claims of locking consumer funds. This expertise just isn’t constant amongst a number of customers. Nonetheless, most complaints from crypto customers are associated to account bans or freezes with out prior discover.

- Could be Difficult for New Customers: Resulting from MEXC’s massive coin choices and in depth options, buying and selling crypto on MEXC is perhaps difficult for inexperienced persons.

Register on MEXC in the present day to get a ten% low cost on buying and selling charges and unique $1000 bonus rewards

2. Bybit

Bybit is the second largest centralized alternate within the crypto market by buying and selling quantity, with as much as eight billion {dollars}. The alternate gives crypto buying and selling companies to over 60 million customers globally and employs sturdy safety measures to guard customers’ property.

Bybit can be a gateway to the web3 ecosystem, providing an in-built pockets choice for customers who need to mint, purchase, or promote NFTs, discover DeFi initiatives, and different decentralized purposes (dApps).

Moreover, Bybit gives numerous crypto buying and selling services and products, together with NFT market, Bybit Earn, debit playing cards, crypto loans, and automatic buying and selling instruments (bots, TradeGPT, and duplicate buying and selling).

The professionals of Bybit are;

- Superior Buying and selling Options: In addition to the essential buying and selling instruments, ByBit gives superior buying and selling instruments, like its AI-powered TradeGPT, which automates buying and selling actions by giving customers entry to real-time market evaluation and solutions to technical questions.

- Excessive Liquidity and Buying and selling Quantity: The crypto alternate has good liquidity and quantity for crypto buying and selling pairs. This permits merchants to open and shut positions simply, decreasing.

- Excessive Leverage Buying and selling: Bybit gives leverage buying and selling choices as much as 100x for spot, 50x for futures, and 10x for margin. This permits skilled merchants to amplify their positions and enhance their income.

The cons of Bybit are;

- Restricted Entry: Bybit just isn’t accessible for customers within the US, Mainland China, Singapore, Crimea, Cuba, Sevastopol, North Korea, Sudan, Iran, and Syria because of regulatory points.

- No Direct Fiat Deposits or Withdrawals: Direct fiat deposits and withdrawals are unavailable in currencies just like the USD (US Greenback), MXN (Mexican pesos), HKD (Hong Kong Greenback), and ZAR (South African Rand).

Join on Bybit now to unlock unique buying and selling perks and declare as much as USD 30,000 in new consumer bonuses

3. dYdX

dYdX derivatives alternate is a decentralized alternate that gives perpetual futures, margin and spot buying and selling, crypto borrowing, and lending. In contrast to some non KYC crypto exchanges on this listing providing tiered verification, dYdX is a completely nameless crypto alternate.

dYdX is the most important decentralized alternate by buying and selling quantity, and it’s splendid for:

- Perpetual Futures Merchants: Customers who need to commerce futures contracts with out expiry dates. It gives leverage as much as 25X, permitting crypto merchants to transcend easy crypto shopping for and promoting.

- Skilled Margin Merchants: dYdX permits customers to commerce on Ethereum, providing as much as 5X leverage. For margin trades, dYdX gives remoted and cross-margin choices to cater to numerous merchants’ wants.

The dYdX crypto derivatives alternate is straightforward to make use of. Nonetheless, it will likely be a greater match for superior customers and merchants eager to earn curiosity in lengthy or quick positions.

The professionals of dYdX derivatives alternate are;

- Low Charges: dYdX gives low buying and selling charges for common customers whose 30-day buying and selling quantity is beneath $100,000.

- Crypto Lending: Merchants can earn curiosity on dYdX by lending their crypto property to different crypto merchants.

- Quick Transactions and Low Fuel Charges: dYdX makes use of ZK-Rollups to course of transactions off-chain and finalize them on-chain, decreasing transaction processing time and fuel charges.

- Margin and Perpetual Futures Contracts: dYdX is acknowledged as the primary DEX to offer contracts for margin and perpetual futures buying and selling.

The cons of dYdX derivatives alternate are;

- Not Newbie-friendly: Whereas dYdX supplies easy swap companies, the superior buying and selling instruments for perpetual futures and margin is perhaps a bit difficult for inexperienced persons. Subsequently, beginner merchants ought to begin with the spot market in the event that they wish to interact in additional than crypto swaps.

- Restricted Margin Pairs: In contrast to different no KYC exchanges on this listing, dYdX gives fewer buying and selling pairs for margin buying and selling.

4. Uniswap

Uniswap is a decentralized alternate, working on the Ethereum community. The platform gives permissionless entry, which means that anybody can use it to swap ERC-20 tokens with out an account or present process any type of verification.

Uniswap is ideal for giant quantity merchants as a result of it attracts massive liquidity swimming pools. This excessive liquidity permits merchants to make extra important swaps with a lower cost influence than exchanges with smaller liquidity swimming pools. As well as, Uniswap has a sensible router designed to separate trades throughout a number of swimming pools to get one of the best worth potential.

The professionals of Uniswap are;

- Intuitive Interface: Uniswap has a beginner-friendly net interface and cell app.

- Low Entry Obstacles: The alternate doesn’t require registration or id verification, making it simple for anybody to start out buying and selling crypto.

- Earn: Liquidity suppliers can earn charges by contributing to liquidity swimming pools.

- A number of Blockchain Networks: Uniswap helps about 12 blockchain networks, like Zora, Polygon, Arbitrum, and Ethereum.

The cons of Uniswap are;

- Extra Charges for Third-party Funds: Merchants utilizing third-party platforms like MoonPay pay extra transaction charges.

- Excessive Fuel Charges: The transaction payment for swapping tokens on Uniswap is larger than regular ETH fuel charges on crypto exchanges.

- Helps Ethereum Tokens: Uniswap helps solely Ethereum tokens, so you can’t commerce BTC and different non-ERC-20 tokens.

5. Pancakeswap

PancakeSwap is a decentralized alternate (DEX) constructed on the BNB Chain, launched in 2020. Much like different DEXs, trades on Pancakeswap are accomplished via liquidity swimming pools. Along with offering liquidity, Pancakeswap customers can stake their tokens and interact in yield farming.

Merchants also can take part within the Pancakeswap lottery the place they buy tickets for an opportunity to win CAKE (the platform’s native token) based mostly on random quantity attracts.

The professionals of Pancakeswap are;

- Liquidity Swimming pools: Customers can contribute to liquidity swimming pools by depositing pairs of tokens. In return, they obtain LP tokens representing their pool share, entitling them to a portion of the generated charges.

- Autonomy: As a decentralized alternate, Pancakeswap provides you full management of your non-public keys.

- Helps Staking: Customers can stake CAKE tokens to earn different tokens or extra CAKE.

The cons of Pancakeswap are;

- No Cell App: Pancakeswap doesn’t have a cell app, however you’ll be able to entry the platform in your cell phone.

- Helps Solely BEP20 Tokens: You can’t commerce Bitcoin or different non-BEP20 tokens.

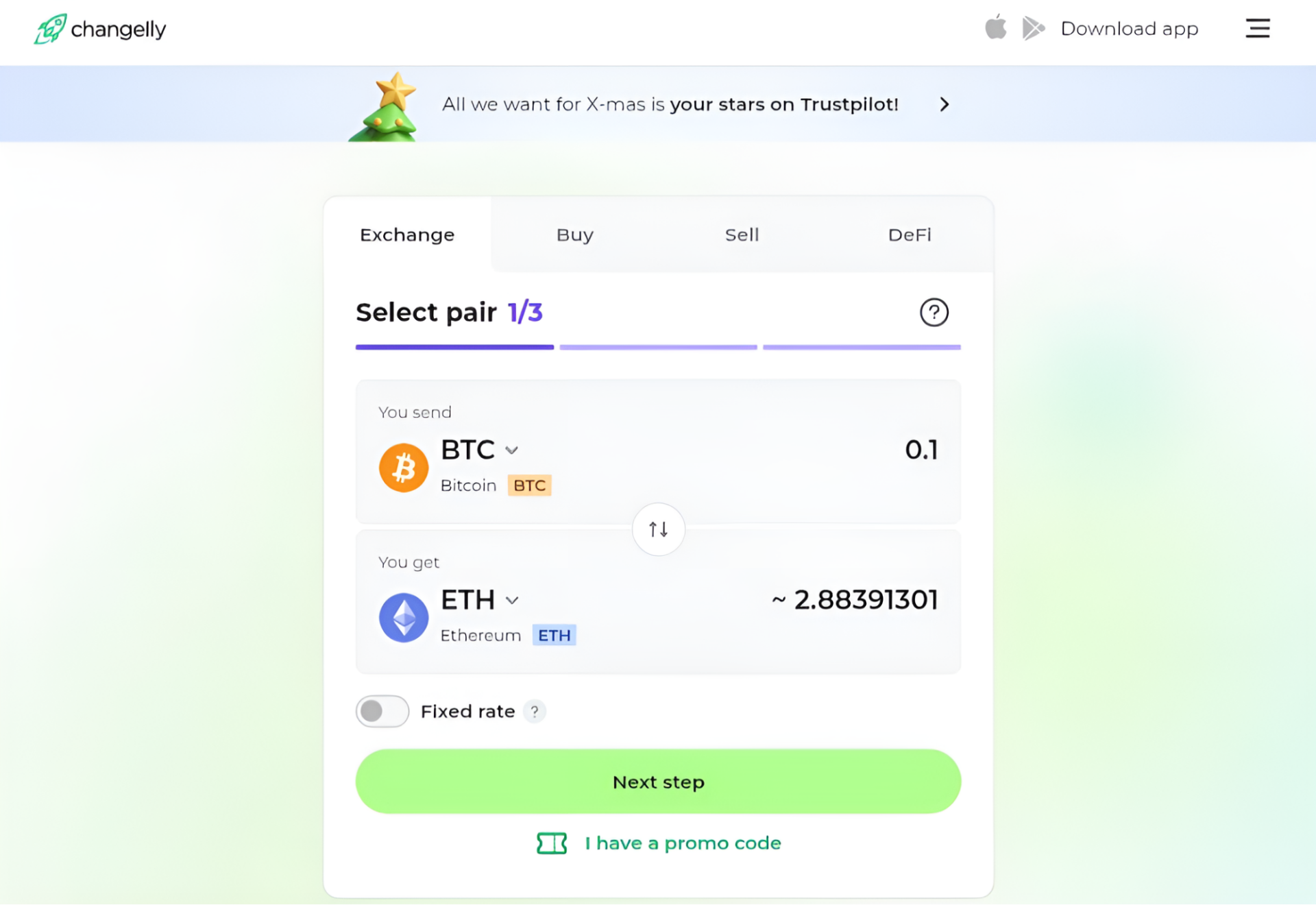

6. Changelly

Changelly is a non-custodial crypto alternate designed for customers who worth velocity, simplicity, and privateness. Its standout function is the power to let customers swap crypto for crypto and full different transactions inside minutes with out an account or KYC verification.

You solely have to offer a pockets tackle to obtain crypto that you just purchase via the platform. Changelly companions with high pockets manufacturers, like Trezor and Ledger, to supply crypto swaps immediately from the consumer’s pockets with out the funds ever touchdown on the platform.

The professionals of Changelly are;

- Intuitive Interface: The cell app is straightforward to make use of and full of all of the options accessible on the net interface.

- 24/7 Assist: Changelly supplies round the clock buyer assist.

- Simple Blockchain Community Identification: Tokens on Changelly are labeled with the corresponding Blockchain community for straightforward identification.

- Hybrid Platform: Changelly combines centralized and decentralized options for brand new and superior merchants who need to steadiness the options of CEXs and DEXs.

The cons of Changelly are;

- Excessive Charges: Transaction charges on Changelly are larger than these of conventional exchanges.

- Hidden charges: Changelly might do higher by providing extra upfront readability on all transaction prices.

- Restricted Crypto-to-fiat Transactions: Merchants in some areas have restricted entry to crypto-to-fiat pairs on Changelly.

7. CoinEx

CoinEx is a world cryptocurrency alternate that helps buying and selling in numerous cryptocurrencies, together with Bitcoin, Ethereum, Dogecoin, and Ripple. It has a user-friendly interface and gives superior buying and selling options, like superior charting instruments and a number of order sorts for spot, margin, and futures buying and selling.

The no KYC crypto alternate notably stands out for its sturdy and superior safety measures, together with a high-speed matching engine, full-dimension safety, and 100% reserves to make sure the security of consumer funds. As well as, CoinEx has a local cryptocurrency, CET, which merchants can use to scale back buying and selling charges.

The professionals of CoinEx are;

- Sturdy Safety: CoinEx gives superior safety features to guard unverified and verified customers’ property.

- Fast Withdrawals: Withdrawals on PrimeXBT have a quick processing time. There’s no want to attend lengthy for the cash to succeed in my pockets.

- Free Buying and selling Contests: They’ve free buying and selling contests which can be enjoyable to hitch and require no capital.

- Crypto Swaps: CoinEx has a separate part for immediate and beginner-friendly crypto swaps. This function makes it simpler for merchants to rapidly and simply alternate their cryptocurrencies.

The cons of CoinEx are;

- Poor Buyer Service: CoinEx buyer assist could possibly be higher

- Excessive Charges for Crypto Deposits: Direct crypto purchases on CoinEx are costly (between 2% and eight%).

8. PrimeXBT

PrimeXBT is a high contract for distinction (CFD) alternate that gives a complete suite of companies to merchants trying to commerce numerous property. These property embrace cryptocurrencies, shares, foreign exchange, commodities, indices and extra.

Nonetheless, these product choices don’t embrace spot buying and selling, so in case you are trying to commerce property in spot markets, please contemplate different exchanges.To make sure the security of customers’ property, PrimeXBT conducts common safety audits, shops digital property in chilly wallets, and so they require a compulsory white-labelling of Bitcoin withdrawal addresses

The professionals of PrimeXBT are;

- Low Charges for Futures Contracts: PrimeXBT gives low buying and selling charges for futures contracts.

- Copy Buying and selling: They supply a duplicate buying and selling interface for brand new customers to repeat the trades of skilled traders and maximize their investments.

- Free Deposits: PrimeXBT gives free deposits for fiat currencies and crypto.

The cons of PrimeXBT are;

- Restricted Buying and selling Choices: No assist for spot, margin, or choices buying and selling.

- Excessive Withdrawal Charges: Fiat foreign money withdrawals on PrimeXBT are comparatively costly.

9. Pionex

Pionex is a cryptocurrency alternate that gives customers with built-in and free entry to bots for commerce automation. This alternate has greater than 12 bots which you could simply add to your account. The purpose of Pionex bots is to simplify automated buying and selling and cater to superior merchants and people with little to no expertise.

Whereas Pionex is hottest for its user-friendly and environment friendly bots, it additionally gives quite a few options, together with spot, futures, and leveraged buying and selling. Pionex merchants additionally take pleasure in low buying and selling charges, good liquidity, and assist for greater than 250 cash.

The professionals of Pionex are;

- Free Buying and selling Bots: Pionex bots are free and straightforward to make use of. They’ve 12 free built-in bots with no coding or programming necessities.

- Low Charges: Pionex costs low transaction charges even for customers with low buying and selling volumes.

- Liquidity: Glorious liquidity engines aggregated from Binance and Huobi.

The cons of Pionex are;

- Restricted Deposit/Withdrawal Choices: No fiat foreign money deposit and withdrawal choices.

- Excessive Entry Barrier for Referral Program: Solely customers with a buying and selling quantity of USD 20,000 or extra obtain referral awards on Pionex.

10. ProBit

ProBit is a well-liked cryptocurrency alternate due to its user-friendly interface and powerful safety features. The KYC verification course of on Probit just isn’t obligatory, however it’s tiered, which means that you should use a few of its options by registering with solely your e mail verification.

The platform permits merchants to make use of margins and enhance their earnings. It additionally helps over 500 cryptocurrencies and preliminary coin choices (IEO). It additionally supplies incomes alternatives, together with staking via its native token, PROB, and arbitrage.

The professionals of Probit are;

- Intuitive Interface: Probit gives a user-friendly structure and options for numerous buying and selling actions.

- Rewards: Merchants can earn rewards by holding PROB utility tokens.

- Passive Earnings: Probit gives customers alternatives to earn passive revenue whereas buying and selling.

The cons of Probit are;

- No Fiat Withdrawals: Probit doesn’t assist fiat withdrawals

- No Insurance coverage Fund: Probit doesn’t have insurance coverage for purchasers’ funds.

What’s KYC in Crypto?

The KYC in crypto is laws that require crypto exchanges and different monetary establishments to confirm their prospects’ identities since they facilitate monetary transactions. Most centralized exchanges use KYC verification to forestall unlawful actions like cash laundering, scams, and terrorist financing.

KYC requires customers to offer private info, comparable to:

- Full Identify

- Authorities-Issued ID (Passport, Driver’s License, and so on.)

- Proof of Deal with (Utility Invoice, Financial institution Assertion, and so on.)

- Selfie for Facial Verification (on some platforms)

Why Select No KYC Crypto Exchanges?

There are a lot of the explanation why some merchants desire to make use of no KYC crypto exchanges.

- No Obligatory KYC: Customers can commerce with out present process KYC verification and revealing private info, like their date of beginning, driver’s license, and different government-issued identification. This reduces the dangers of id theft if the alternate faces safety points.

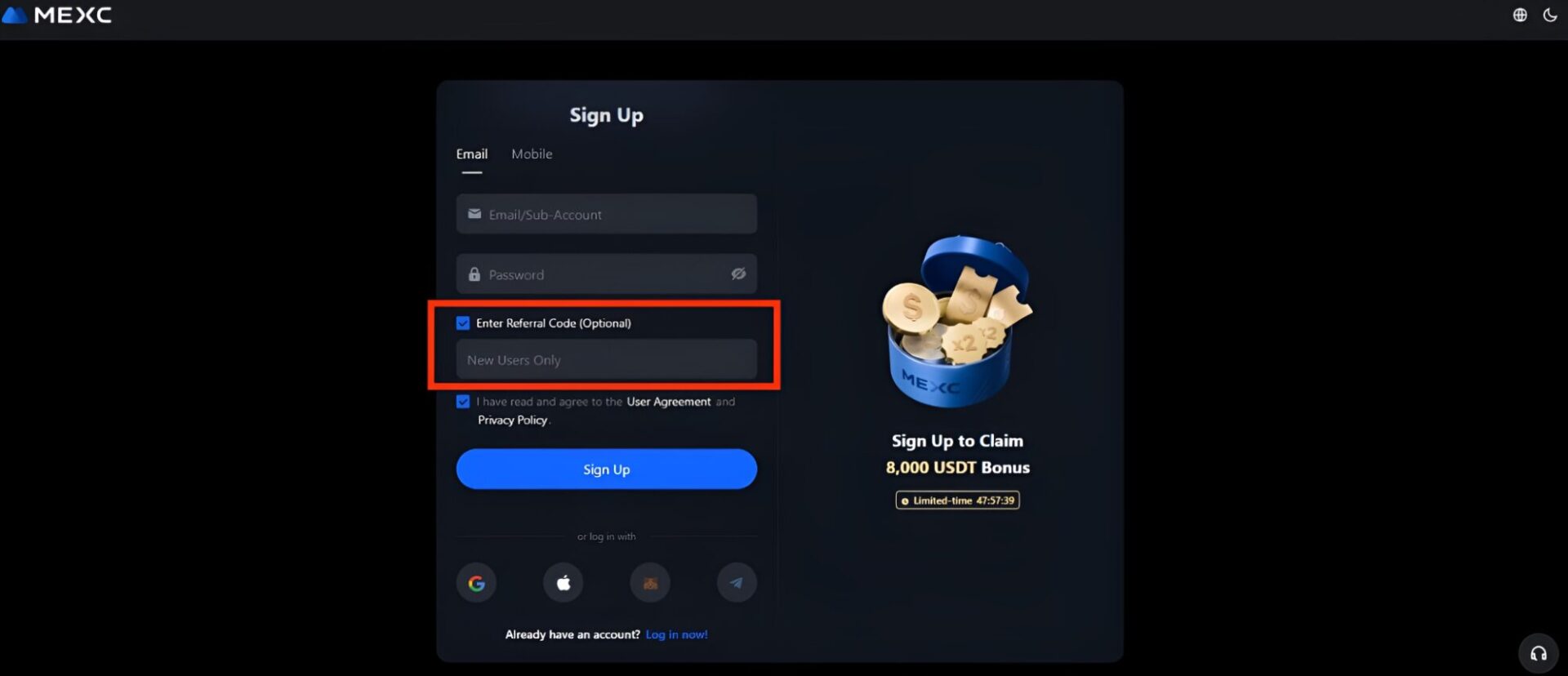

- Fast Registration: In contrast to regulated exchanges, you’ll be able to register on no KYC platforms in below a minute and begin buying and selling instantly. All you want is your e mail or telephone quantity, referral code (elective), and the distinctive verification code the alternate will ship to your e mail.

- Keep away from Native Rules: No KYC exchanges enable customers in restrictive areas to purchase, promote, and commerce crypto simply. For environment friendly buying and selling, customers in some areas may have to make use of a VPN anytime they need to commerce on some non KYC crypto exchanges.

The great factor is that these crypto exchanges not solely enable customers to commerce anonymously, however they additionally provide sturdy safety measures to make sure that the elective KYC legal guidelines doesn’t make your account susceptible.

Are No KYC Exchanges Protected and Authorized?

No KYC crypto exchanges are usually protected and authorized as a result of they implement sturdy safety measures to maintain consumer property protected. Additionally, they’re authorized within the majority of the international locations that they assist however unlawful in banned international locations.

Nonetheless, there are extra dangers when buying and selling on such exchanges than on regulated crypto exchanges. As an example, the alternate reserves the precise to grab digital property or freeze accounts if they understand that you’re buying and selling from an unsupported nation.

Additionally, there’s a probability of encountering fraudsters or scammers, as lack of KYC procedures reduces accountability. Nonetheless, many no KYC crypto exchanges provide a tiered id verification course of, so they might be susceptible to the identical dangers as KYC crypto exchanges.

Can the IRS Observe my Crypto if I Use a Non-KYC Alternate?

No, the IRS can solely monitor your crypto if you happen to commerce on KYC exchanges. This is as a result of the IRS can comply with your transactions and affiliate them with you thru the private info you offered through the verification course of.

The way to Select the Greatest No KYC Crypto Alternate?

Contemplate the next components when selecting a no KYC crypto alternate;

1. Safety

When deciding on a non KYC alternate to purchase Bitcoin and crypto, fastidiously consider safety considerations to guard your funds and information. Whereas these platforms prioritize consumer privateness by permitting nameless cryptocurrency buying and selling, safety dangers and regulatory compliance are widespread in crypto exchanges, particularly for centralized exchanges.

Make sure the alternate you select has sturdy safety features to guard your funds. The greatest centralized crypto exchanges ought to provide options like two-factor authentication, whitelist withdrawal addresses, offline fund storage, and endure common safety audits. In case you go for DEXs like Uniswap or Pancakeswap, verify their sensible contract audits and assist for chilly wallets.

2. Buying and selling Instruments and Supported Cryptocurrencies

Completely different exchanges present numerous instruments and markets for buying and selling crypto. For centralized exchanges, go for exchanges that assist futures, margin, spot buying and selling, and extra. If you’re going for decentralized exchanges, guarantee their tokens swap and different options are seamless and straightforward to make use of.

Additionally, verify if the alternate gives the cryptocurrencies you want to commerce as a result of some non KYC crypto exchanges have restricted choices in comparison with their KYC counterparts. As an example, MEXC helps about 2900 cryptocurrencies whereas Bybit helps solely 600+. Nonetheless, each cryptocurrency exchanges are among the many greatest crypto exchanges for Bitcoin buying and selling with out verification.

3. Buying and selling Charges

Some non KYC exchanges cost larger charges to compensate for the added threat of nameless buying and selling. Over time, these charges can cut back your income, particularly if you happen to commerce steadily. Examine Blockchain transaction payment constructions throughout a number of non KYC crypto exchanges, relying on what you like. One of the best crypto exchanges have low or aggressive buying and selling charges, withdrawal costs, and deposit charges.

4. Deposit and Withdrawal Choices

Some non KYC exchanges solely enable crypto withdrawals, which means you would want secondary cryptocurrency exchanges to transform your funds to fiat. So, guarantee the no KYC alternate you choose helps your most well-liked fee technique. Widespread strategies that the majority exchanges provide are direct crypto transfers, SEPA, debit/bank cards, and peer-to-peer transactions.

The way to Purchase Crypto and Bitcoin (BTC) With out Verification?

You should buy crypto and Bitcoin with out verification from no KYC crypto exchanges. Exchanges like MEXC enable customers to purchase crypto and Bitcoin with out verification. All it’s important to do is obtain the app and register a brand new account utilizing your e mail and this MEXC referral code, then place fast purchase orders for crypto and Bitcoin.

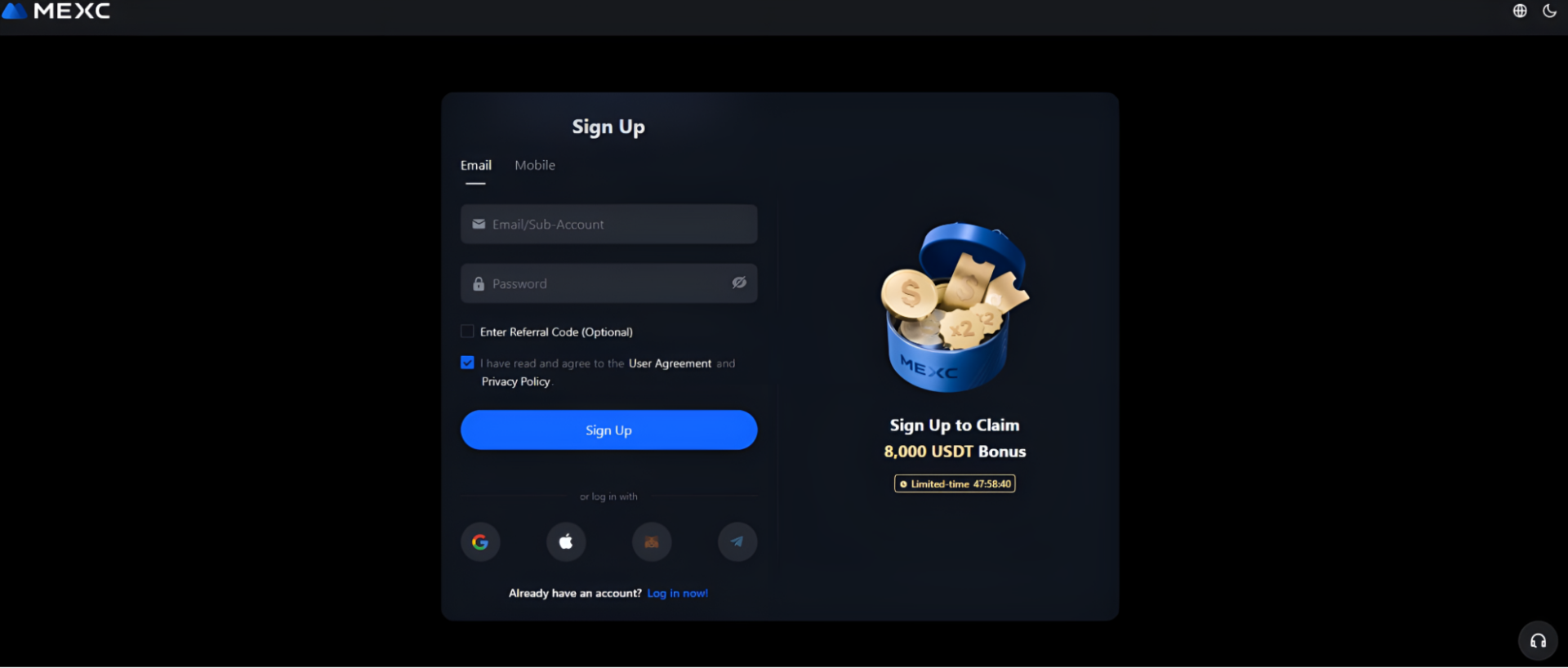

Right here’s an easy course of to register on MEXC and purchase crypto and Bitcoin with out verification:

- Go to the MEXC homepage or obtain the app on Play Retailer or App Retailer.

- Fill out your e mail or telephone quantity within the registration kind.

- Add this MEXC refferal code, CNJMEXCREF and click on “Signal Up.”

- Confirm your e mail or telephone quantity with a 6-digit code or the hyperlink despatched to your e mail and you might be in.

- You may as well log in to MEXC Alternate utilizing a third-party account, like Google, Apple, MetaMask Pockets, or Telegram.

You solely want an e mail to open an account on MEXC. As soon as your account is about up, you should buy your first crypto and Bitcoin.

Use this referral code, CNJMEXCREF, to open a brand new account on MEXC and get as much as 8,000 USDT enroll bonus and unique rewards.

Login to your MEXC account and comply with these steps to purchase your first crypto or Bitcoin on MEXC Alternate with out verification:

- Select the “Deposit” tab, choose the fiat foreign money to pay with (EUR, USD, JPY, and so on), and choose the cryptocurrency you want to obtain.

- Then, enter the quantity you need to pay or want to obtain.

- Click on (Purchase Bitcoin or the crypto you chose) and use an appropriate fee technique to make fee.

- As soon as your fee is confirmed, the crypto you got will mechanically deposit into your MEXC account.

We do an in depth breakdown of MEXC and register a brand new account and begin Bitcoin buying and selling on this MEXC overview article; test it out for extra steering. Additionally, if you need extra centralized crypto exchanges to hold out crypto and Bitcoin transactions, you’ll be able to discover our complete listing of the greatest crypto exchanges to broaden your search.