The Bitcoin sell-off, which dominated a majority of the weak, seems to be easing off, with BTC value making a restoration again within the $80,000 vary to achieve an intra-day excessive at $85,120.

Some merchants consider that Bitcoin (BTC) was overdue for a bounce, given how deeply oversold a few of its technical indicators had change into. These holding that perception warn that when bids are stuffed close to the current lows, if new consumers fail to maintain the momentum or destructive macroeconomic newsflow resumes, BTC is prone to revisit its current lows.

HighStrike head of choices and crypto buying and selling JJ took a distinct view, noting that “Coinbase spot bids” had been “stuffed,” representing the “first flip of bids outweighing asks now because the September backside at $52,000.”

Bitcoin bids at Coinbase stuffed. Supply: JJ the Janitor

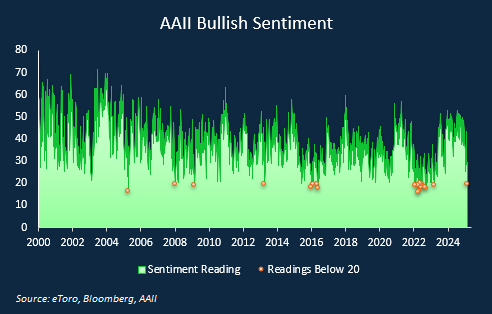

Whatever the short-term value motion from Bitcoin, many analysts proceed to say that historic information highlights the current drawdown as a first-rate buying alternative.

On X, Wintermute dealer Jake O mentioned,

“For anybody with long-term conviction within the house, the present disconnect between positioning/sentiment vs fundamentals has by no means appeared higher. The setup feels just like August 2024 as spot dipped beneath $50K on mass liquidations and I do assume we’ll see massive topside buying and selling over the following few classes.”

Crypto Concern & Greed Index. Supply: Jake O / X

Associated: Bitcoin rebounds to $84K — Analysts say BTC crash was final purchase sign

From a technical perspective, chartered market analyst Aksel Kibar described Bitcoin’s sweep of the $78,000 degree as a “sharp retest” however declined to say whether or not a value backside had been achieved.

Bitcoin 1-day chart. Supply: A

Momentum and technical merchants ought to notice that Bitcoin day by day RSI stays in deeply oversold territory, and regardless of the power of right now’s rebound, the day by day candlestick sample of decrease highs and decrease lows. Failure to ascertain a day by day shut candlestick that generates the next excessive might be an early signal that the downtrend just isn’t but full.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.