Because the Terra Luna disaster earlier this yr, there was a shake-up within the stablecoin ecosystem.

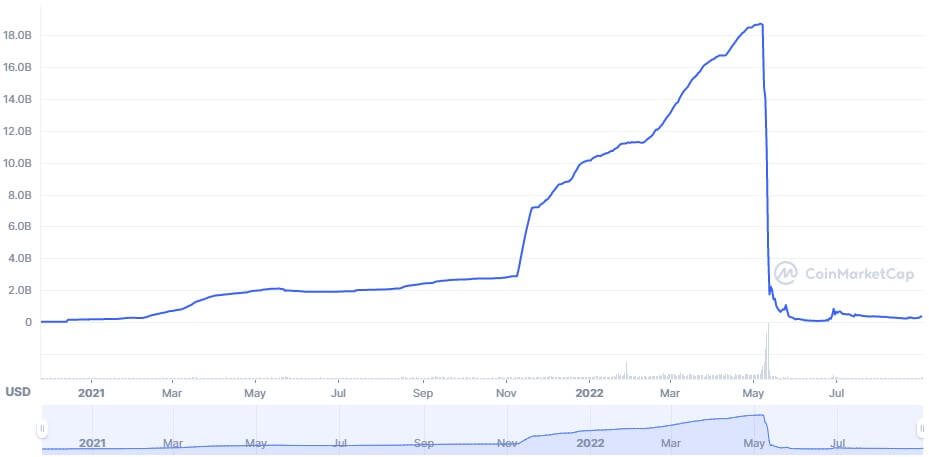

On the time of its collapse, TerraUSD (UST) had a market cap of simply over $18 billion, which was washed away nearly in a single day.

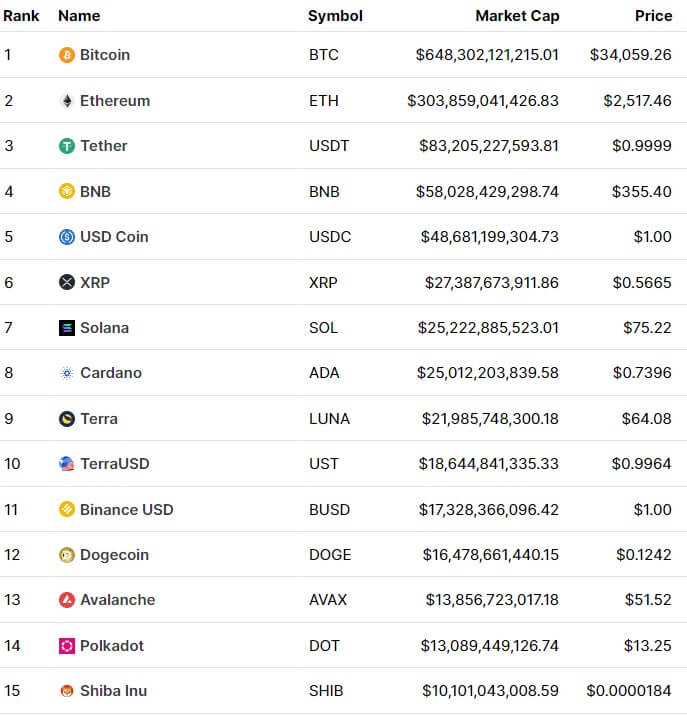

Terra’s UST gained market share quickly between November 2021 and Could 2022 earlier than dropping its peg. On the time of Terra’s nostril dive, UST was the third-largest stablecoin by market cap behind Tether(USDT) and Circle’s USD Coin (USDC).

USDT was the clear entrance runner with nearly double the market cap of USDC. The mixed market cap of the stablecoin business was greater than $170 billion at the moment.

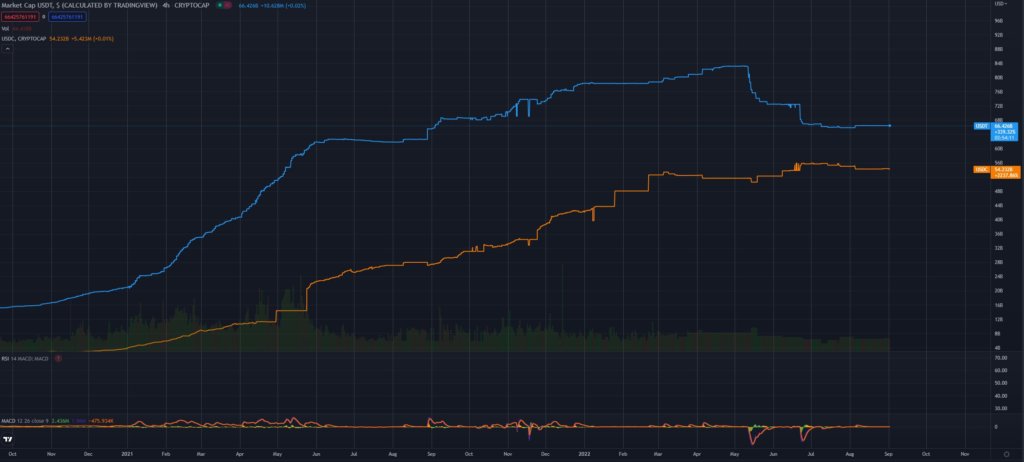

As we speak, the stablecoin market is value a mixed $153 billion, with the 2 most outstanding gamers nonetheless USDT and USDC. Nevertheless, the hole between the premier tokens has closed significantly, as seen within the graph beneath. The chart portrays the dominance of every token throughout the complete crypto market. Collectively, USDC and USDT make up roughly 12% of the whole crypto market cap.

Tether has misplaced over $16 billion in market cap since Could, whereas USDC has grown by $4 billion. When it comes to market dominance, each peaked in June earlier than reaching a neighborhood low initially of August.

Nevertheless, over the previous few weeks, each tokens have began to see a resurgence in total crypto market dominance whereas their market caps have remained steady. A weakening market alongside regular issuance from the lead stablecoins has boosted their mixed dominance by 40%.

All through this time, quite a few tales have affected the circulating provide of each tokens. Tether continues to combat claims of insolvency, improper audits, and a deceptive treasury. On the similar time, Circle has needed to fight criticism for his or her determination to “blacklist” any handle linked to Twister Money.

On Wednesday, Circle introduced a partnership with Bybit to “assist speed up the expansion of Bybit as a gateway for retail and institutional USDC-settled merchandise,” in line with the press launch.

Spinoff contracts akin to choices and futures are primarily settled in USDT, so the transfer to allow $USDC-settled choices is an aggressive transfer for Circle to try to shut the hole with Tether additional.

Jeremy Allaire, co-founder and CEO of Circle, said, “we’re thrilled to have Bybit onboard as a companion in our efforts to advertise better entry and adoption for USDC.”

Stablecoins have additionally been leaving exchanges quickly over the previous couple of weeks, which hardly ever occurs throughout bull markets however is frequent throughout crypto winter.

Will USDC flip USDT, or can Binance USD (BUSD) come from behind to problem each? BUSD presently has a market cap of $19 billion however is rising sooner than the highest two.