Crypto alternate Coinbase is in search of to find how a lot the US Securities and Change Fee spent on enforcement motion in opposition to crypto companies.

Coinbase chief authorized officer Paul Grewal mentioned in a March 3 assertion to X that the request beneath the Freedom of Info Act (FOIA) was submitted to the SEC to learn how many investigations and enforcement actions had been introduced in opposition to crypto companies between April 17, 2021, via Jan. 20, 2025.

The crypto alternate additionally seeks info on what number of staff labored on the enforcement actions, what number of third-party contractors had been used, and the way a lot all of it price.

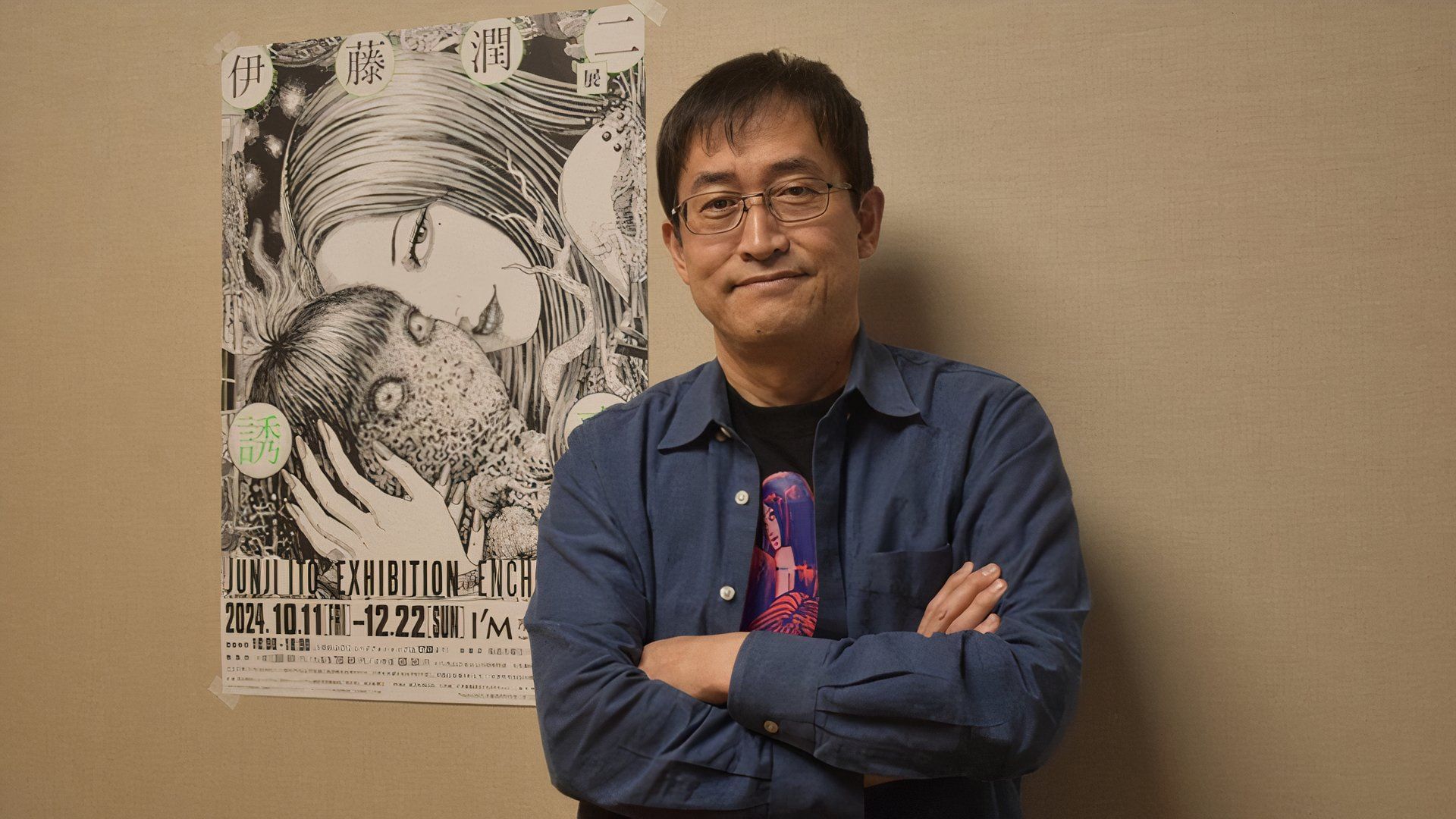

Supply: Paul Grewal

“We all know the earlier SEC’s regulation-by-enforcement strategy price Individuals innovation, world management, and jobs, however how a lot did it price in taxpayer {dollars}? “ Grewal mentioned.

“We additionally need to know extra concerning the earlier SEC’s notorious Crypto Belongings and Cyber Unit inside the Enforcement Division – what was their funds, what number of staff labored on it, how a lot did these worker hours price?”

The SEC’s Crypto Belongings and Cyber Unit, shaped in 2017, introduced enforcement actions in opposition to fraudulent and unregistered crypto asset choices and platforms. The unit was changed by the Cyber and Rising Applied sciences Unit (CETU) on Feb. 20.

Grewal says whereas it could take time to “get the complete image,” the crypto alternate will fortunately “do what it takes for so long as it takes” to get the requested info.

Coinbase desires to know what number of staff labored on the SEC’s enforcement actions in opposition to crypto exchanges and the way a lot it price taxpayers. Supply: Workplace of FOIA Providers

An SEC spokesperson declined to remark.

Former SEC Chair Gary Gensler, recognized for his hardline stance on crypto regulation, resigned on Jan. 20, 2025.

Whereas Gensler was on the helm of the regulator, beginning in 2021, the SEC took an aggressive regulatory stance towards crypto, bringing upward of 100 regulatory actions in opposition to companies.

Associated: SEC drops investigation into NFT market OpenSea

Gensler departed the identical day that crypto-friendly Donald Trump began his second time period as US president. Trump had promised to fireplace Gensler if elected.

Following Gensler’s exit, the SEC has opted out of a swathe of lawsuits in opposition to crypto companies.

Coinbase was sued by the SEC in June 2023, alleging the alternate by no means registered as a dealer, nationwide securities alternate, or clearing company.

The motion was dropped on Feb. 27, when the SEC agreed to voluntarily dismiss all litigation tied to Coinbase and Coinbase International with prejudice, ending the case completely.

The SEC dropped its lawsuit in opposition to crypto alternate Kraken on March 3, which adopted a raft of different dismissals, which reportedly included non-fungible token (NFT) conglomerate Yuga Labs on the identical day and crypto alternate Gemini on Feb. 26.

It additionally not too long ago ended its investigation of Uniswap Labs, the developer behind the Uniswap decentralized alternate and on-line brokerage Robinhood Crypto, which obtained a Wells discover on Might 4.

Journal: Elon Musk’s plan to run authorities on blockchain faces uphill battle