Bitcoin (BTC) has a 95% likelihood of staying above $69,000 eternally, a basic BTC worth forecasting software says.

In a publish to X on March 4, community economist Timothy Peterson revealed a brand new flooring stage from the “Lowest Value Ahead” metric.

Peterson: $69,000 BTC worth has 95% likelihood of holding

Bitcoin stays extremely delicate to geopolitical choices in 2025, final week hitting its lowest ranges since November final 12 months.

Regardless of misgivings over the way forward for the crypto bull run amongst some market contributors, Peterson stays optimistic each on shorter and longer timeframes.

Now, the Lowest Value Ahead, which he created in 2019, provides $69,000 as the brink, which BTC/USD is extraordinarily unlikely to cross once more.

“Lowest Value Ahead would not inform you the place Bitcoin can be. It tells you the place Bitcoin will not be,” he instructed X followers.

“There’s a 95% likelihood it will not fall under $69k.”

Bitcoin Lowest Value Ahead chart. Supply: Timothy Peterson/X

Lowest Value Ahead has a powerful, albeit brief, historical past. In June 2020, Peterson predicted that Bitcoin would by no means revisit four-digit costs from August of that 12 months onward — which in the end proved appropriate, topic to a delay of barely two weeks.

In January this 12 months, in the meantime, Peterson delivered a $1.5 million BTC worth goal for the following ten years. On the time, BTC/USD traded at round $92,000.

“The 12 months is 2035. Bitcoin is at – and you’ll maintain me to this – $1.5 million. And someplace somebody is asking ‘Is now time to purchase Bitcoin?’” he wrote.

Bitcoin “cooling off interval” could final 3 months

Persevering with, Peterson advised that the latest journey to $78,000 was itself unsustainable.

Associated: Bitcoin now not ‘protected haven’ as $82K BTC worth dive leaves gold on high

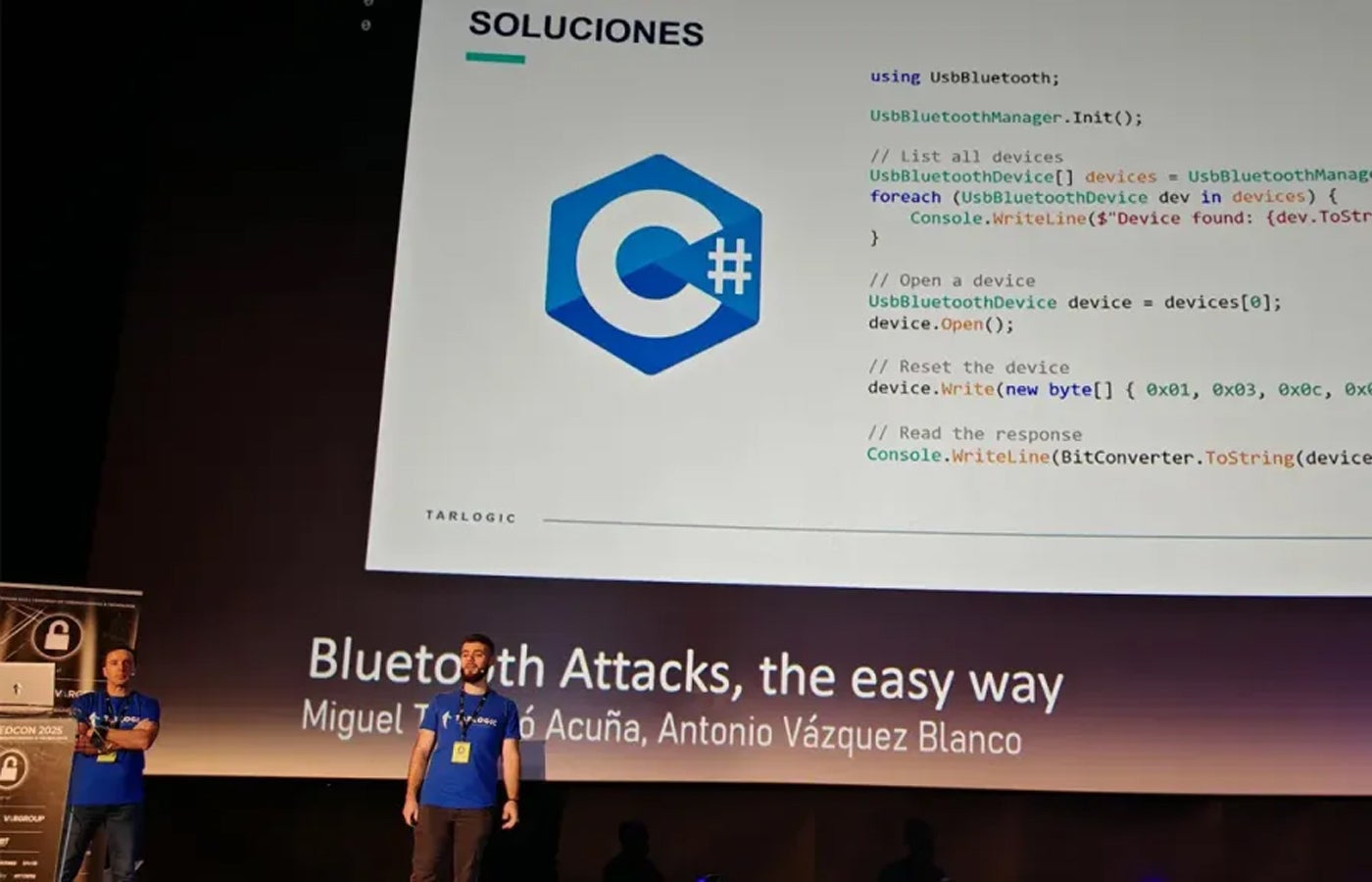

In late February, he argued that it could be “troublesome” to pressure the market under $80,000, based mostly on the Bitcoin Value to Pattern metric.

Additional X evaluation acknowledged {that a} fast return to BTC worth upside could take a while.

“Capitulation occasions like at this time are at all times adopted by a 2-3 month cooling off interval,” a publish from Feb. 25, when a protracted liquidation cascade was already in progress, reads.

“After that it is recreation on once more like nothing ever occurred.”

Bitcoin Value to Pattern chart. Supply: Timothy Peterson/X

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a choice.