The crypto market is experiencing a major decline, triggered by international commerce tensions. Furthermore, President Trump’s Government Order to arrange a Strategic Bitcoin Reserve has surprisingly left crypto merchants feeling let down. Consequently, the value of Solana has fallen sharply, together with a lower in essential on-chain metrics. Regardless of a current restoration from its lows, the value of Solana seems prone to fall under $100 quickly.

Solana’s Realized Value Drops to 3-12 months Low

Over the past 24 hours, SOL value witnessed practically equal domination amongst consumers and sellers. Knowledge from Coinglass exhibits that Solana confronted a complete liquidation of round $27.3 million. Of this, consumers liquidated $15.7 million and sellers closed $11.6 million price of positions.

Solana’s SOL confronted turbulent occasions because it plunged by 15% to $114 amid a extreme downturn within the crypto market in the present day. This marked the primary time the token fell under its realized value of $134 since Might 2022, primarily based on knowledge from Glassnode.

Additionally learn: Will Solana (SOL) Reclaim $180? Key Chart Indicators Huge Transfer

The realized value, which represents the common price foundation of all cash final moved, means that the common holder is now going through losses. This case is often seen as a bearish indicator and will result in panic promoting or capitulation.

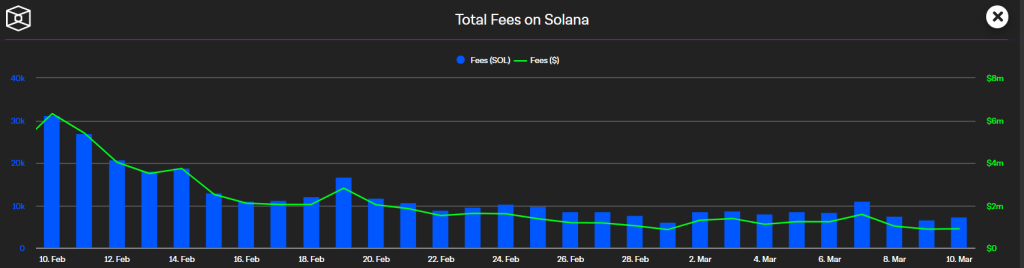

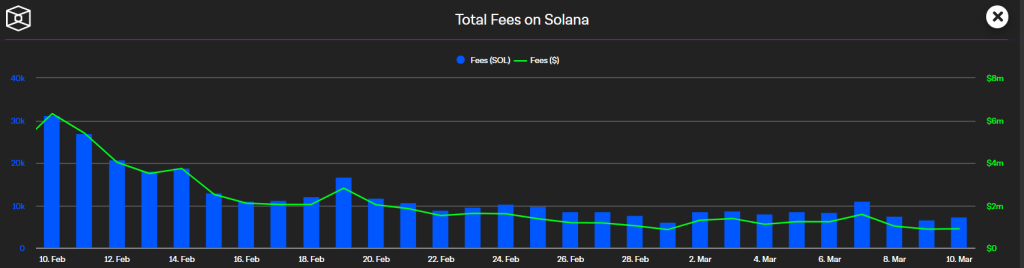

Moreover, Solana’s income dropped by 93% to round $4 million, the bottom it has been since September 2024. Moreover, the earnings from its decentralized purposes (DApps) fell by 86%, from $238 million in mid-January to simply $32 million by March 2025.

Within the wake of those downturns, the overall worth locked (TVL) in Solana’s DeFi ecosystem additionally halved, dropping from a January peak of greater than $12 billion to roughly $6.38 billion, as reported by DeFiLlama.

It’s not stunning that Solana skilled a major drop as curiosity in memecoins inside the crypto neighborhood dropped. After reaching its all-time excessive in January, SOL’s worth has fallen by practically 57%.

What’s Subsequent for SOL Value?

Solana’s value continues to be underneath intense bearish strain because it just lately dropped under the $114 stage. As consumers are struggling to defend a decline, SOL value is now aiming for a drop under quick Fib channels. As of writing, Solana’s value stands at $127, having surged by 6.56% within the final 24 hours.

The SOL/USDT buying and selling pair is going through a number of rejections as sellers defend an instantaneous surge above EMA pattern traces. With the Relative Power Index (RSI) hovering under the midline at stage 44, there’s a risk that SOL’s value may drop and retest $110.

If it sustains above this stage, it may benefit consumers and probably push the value for $139. A surge above that stage may ship the value towards $153. Then again, if the SOL value drops under $110, we’d see a powerful correction under $100.