I’ve been investing for a big a part of my life, and I’ve by no means seen adverse sentiment like this earlier than. Not even throughout the newest two bear markets. First for the Covid-19 crash and later when the Fed went by way of a nasty rate of interest mountaineering cycle to take care of inflation, which was for my part, self-inflicted. It must be famous that ”formally” each crashes didn’t include a recession, nevertheless, we do know that submit Covid the economic system shrank for the required two consecutive quarters, however there was debate over its classification as the roles market was sturdy. It is a little gray although, since this was authorities backed, similar to actual private disposable revenue that declined in 2022 and was offset by stimulus. So, in my thoughts, the federal government shot itself within the foot to keep away from a technical recession, which created an even bigger drawback later down the road that we’re nonetheless coping with immediately. Has a tender touchdown been achieved? Or are we coming in sizzling?

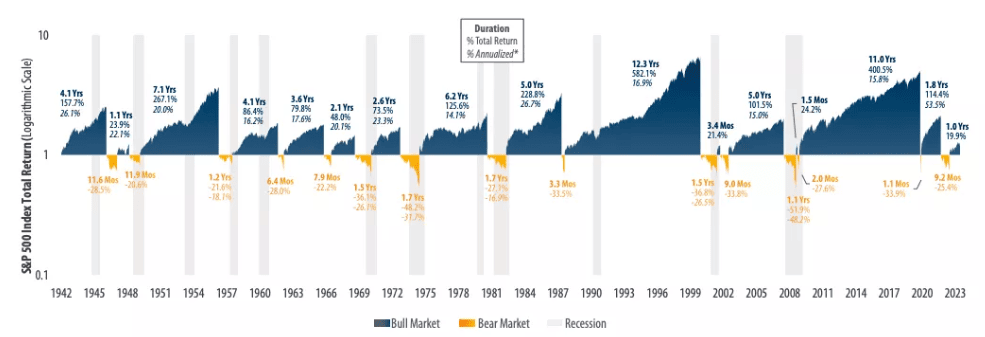

Bear markets by way of historical past – 56% coincided with recession

Supply: Investopedia

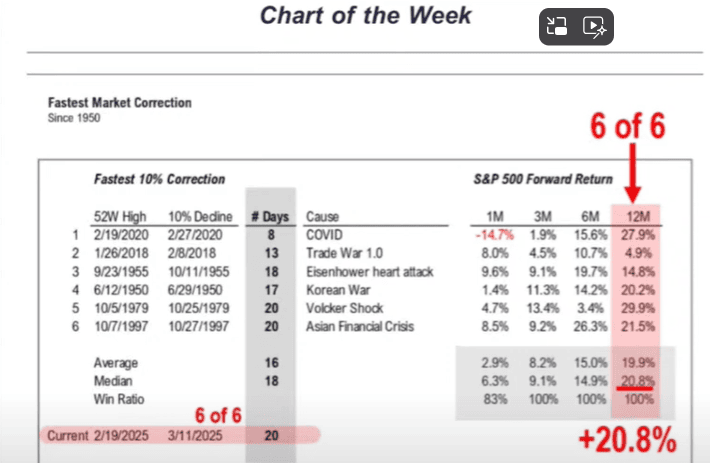

Taking a look at this latest correction, the S&P 500 dropped simply over 10% in 16 buying and selling days. On common, corrections of this dimension since 1950 have taken roughly 39 days. I feel the velocity of this drop is probably going what’s inflicting extra panic to construct. Different crashes that occurred at this velocity post-2000 embrace the 2008 monetary disaster, debt ceiling disaster, Fed hike cycle, and COVID-19 crash. All these occasions have been a robust and quick threat to the economic system.

What’s inflicting the drop immediately? Tariff threats primarily, at the very least that’s what the media is pushing. We now have recognized for a while that this was Trump’s agenda, which begs the query why that is surprising the market a lot since they’re ahead trying. We noticed the reverse occur when he received the election and the markets pumped, excited by the concept that much less purple tape and beneficial financial insurance policies have been coming.

The fact is there are some elementary issues, however the present market motion appears disproportionate to the underlying elements, and will not totally mirror the long-term outlook.

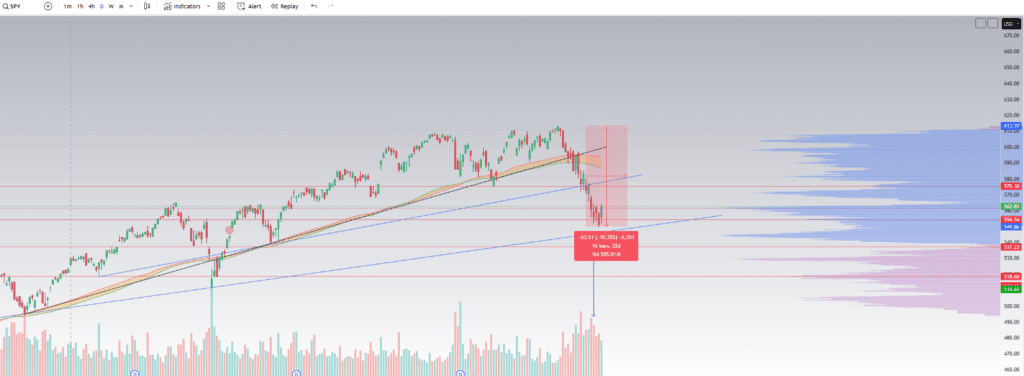

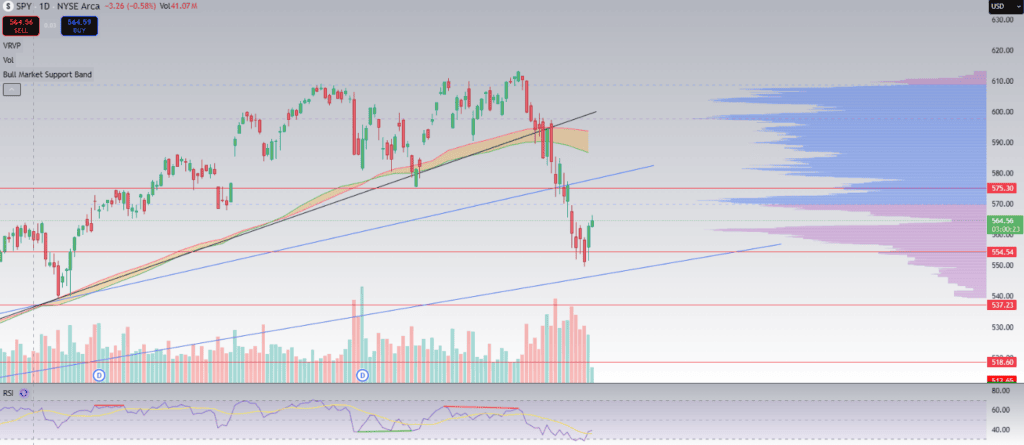

Present drop within the SPY

Supply: Buying and selling View chart

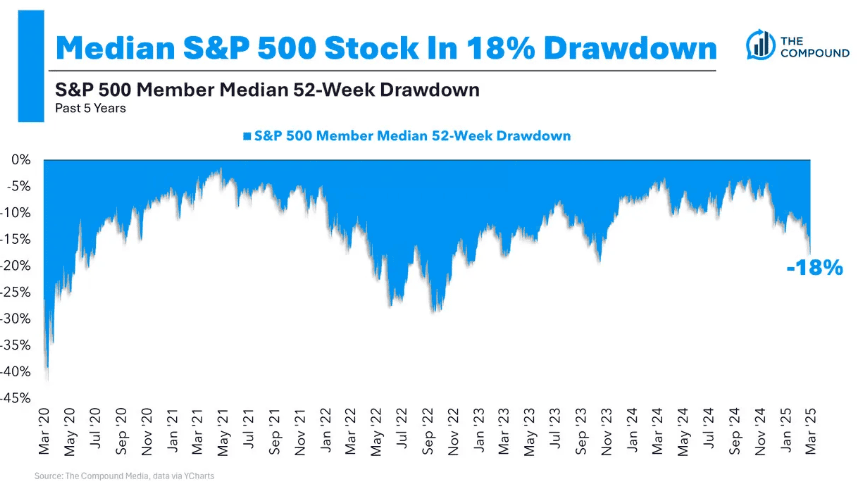

While a -10% drop doesn’t seem to be a lot; the consequence could be rather more significant to shares throughout the S&P 500. Signalling some nice shopping for alternatives on some ”secure” shares.

Supply: YCharts

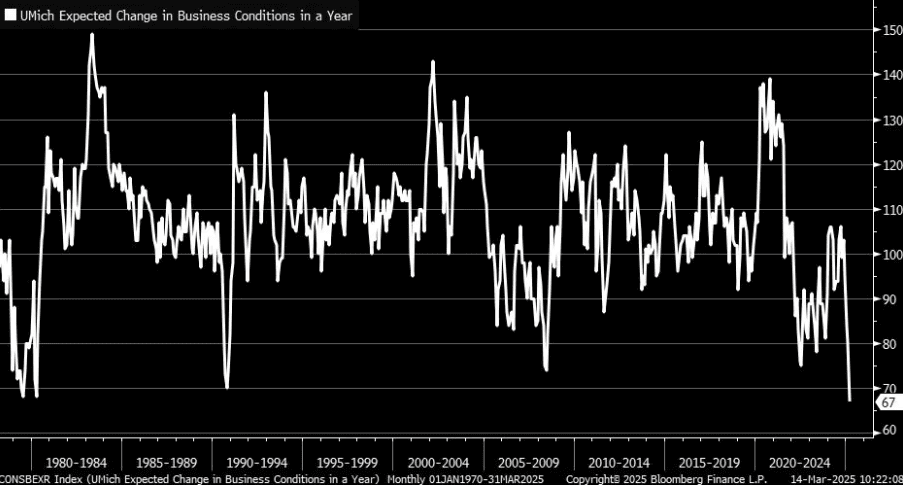

Sentiment

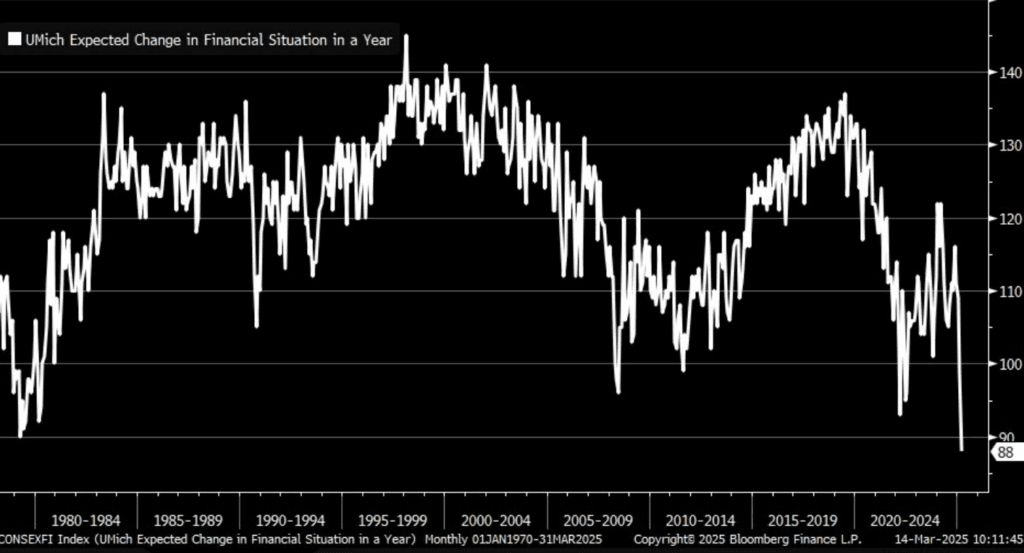

Latest information has highlighted some attention-grabbing factors. Within the chart under we are able to see Michigan College’s change in enterprise situations in a 12 months is now essentially the most bearish it’s been in historical past. Let that sink in. The market is extra fearful than Covid, rates of interest and inflation going up. The sentiment presently displays a degree of negativity that’s unprecedented in latest historical past, even surpassing the challenges seen throughout the monetary disaster and different main market occasions.

In fact, take this with a pinch of salt. All these surveys aren’t my favorite, and I don’t just like the teams or the way in which the info is collected, but it surely actually strains up with a variety of what we’re seeing and listening to on the market.

Supply: College of Michigan

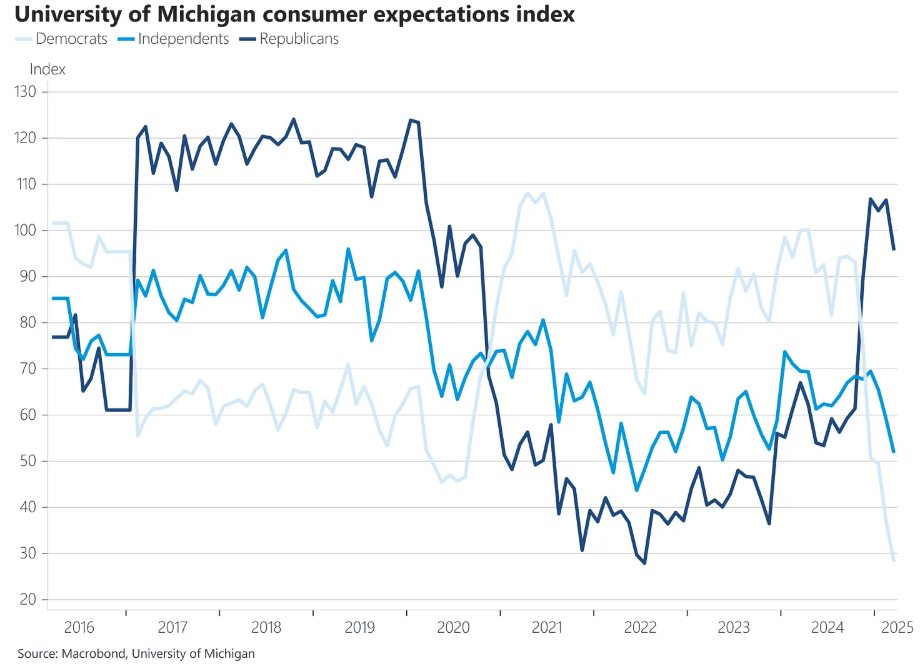

That is usually a left leaning base however even the appropriate facet exhibits a adverse outlook, simpler to determine once we have a look at their breakdown of shopper expectations between events within the chart under. Democrats are actually a bit of extra… adverse.

Supply: College of Michigan

One other chart that seems alarming at first look is the Anticipated change in monetary scenario in a 12 months, however mockingly this degree of concern (Under 100) throughout earlier financial downturns has usually been indicative of the market being near its backside. We will overlay that information onto the SPY and discover that in 1979, 1980, 2008, and 2022, the markets have been near peak concern and moved greater quickly after.

Supply: College of Michigan

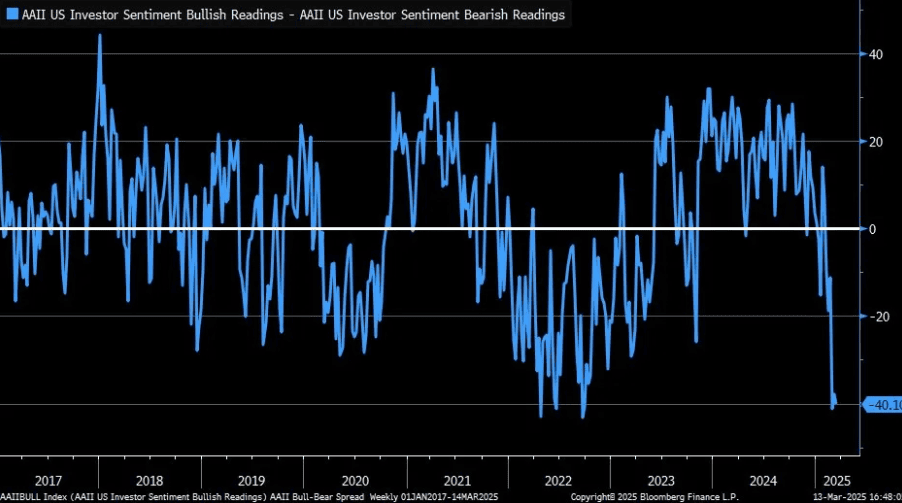

Different market sentiment gauges embrace the AAII bull-bear spreads, which has fallen off a cliff. Beforehand when this degree was hit in 2022, the market recovered just a few weeks after. I discover this one essentially the most helpful when measuring perceived sentiment. For me, it’s indicator of when is an effective time to lean into the concern, supplied that the underlying fundamentals are nonetheless on observe in fact. Scaling into positions when this metric drops under 20 and scaling out of positions when it’s over 20 is threat administration that is sensible to me.

Supply: Bloomberg

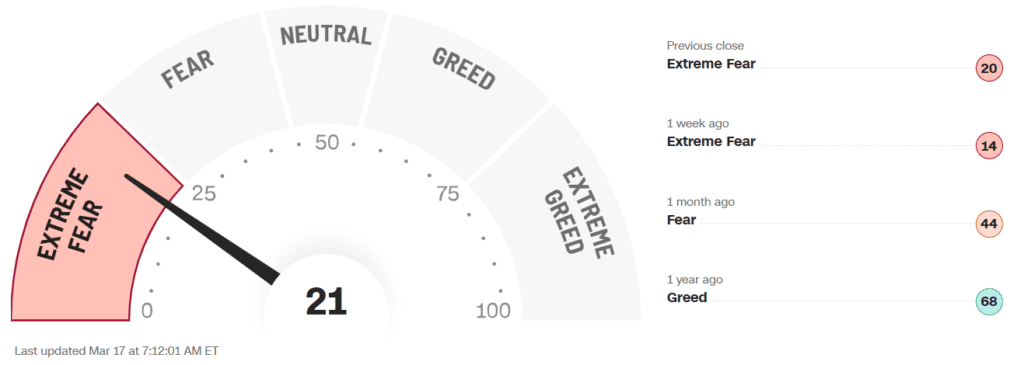

In case you would like a extra simplistic metric to observe, the concern and greed index affords a much less correct mannequin. Lots of people prefer to quote Buffet ”Be fearful when others are grasping and grasping when others are fearful.” when referring to this one and It’s going to provide you very broad strokes but it surely’s not a nasty place to start out.

Supply: CNN

We additionally lately bought the New York Fed survey information and you could find that by clicking right here. To avoid wasting you from extra charts I’ll stick to providing you with the cliff notes model of the info. The outcomes present a transparent acceleration in perceived threat of upper unemployment throughout most areas and demographics, with individuals additionally extra adverse about future family funds. Placing ranges for every of those measurements again at late 2022 ranges.

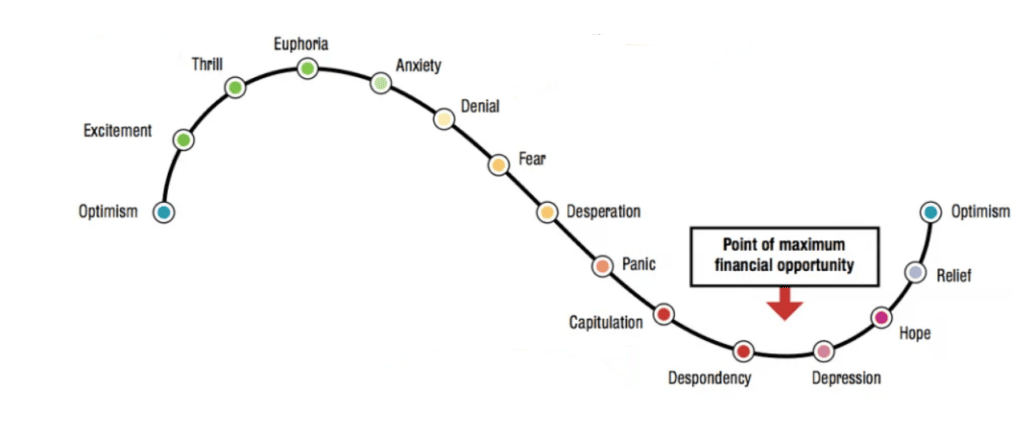

The info offered aligns with established market cycles and affords insights into investor psychology, which generally is a important affect on market conduct. Sentiment is commonly extra vital than the underlying information and the way buyers understand that information can transfer the market its methods. Headline information creates sharp preliminary reactions, however wise heads take time to kind by way of the noise to decide. The market normally will catch as much as its mistake sooner or later when information is digested and sentiment modifications. This is applicable to the broad market indexes and particular firms.

Supply: Understanding financial, market and tremendous cycles | FundCalibre

You will discover charts and information factors like this in all places with little or no effort and the explanation I’m displaying you all this information is solely to point out you that perceived threat is off the charts. Primarily based solely on these charts, one may conclude that there are important dangers forward. Nevertheless, it’s important to contemplate a wider vary of financial indicators earlier than drawing conclusions.

What triggered the unhealthy sentiment?

The brand new large unhealthy fear we should take care of is recession. Economists have been yapping about it for an age, and so they couldn’t have been extra unsuitable over the previous few years. Might this be considerably impacted by their reluctance to name the submit Covid financial contraction a recession? Possibly.

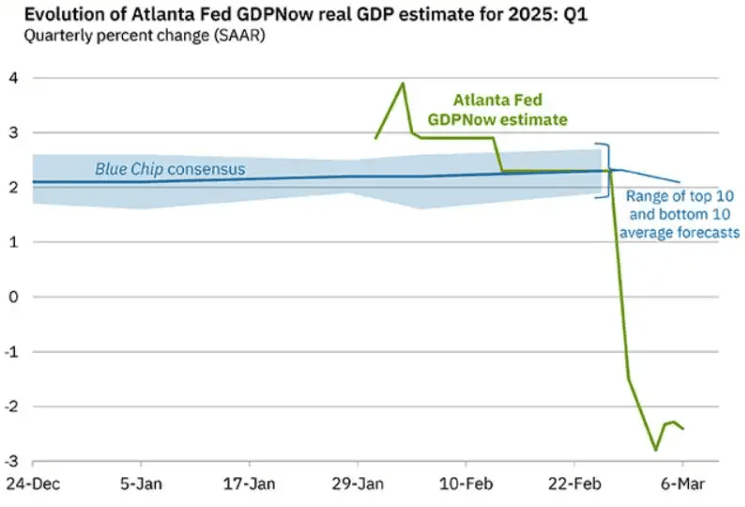

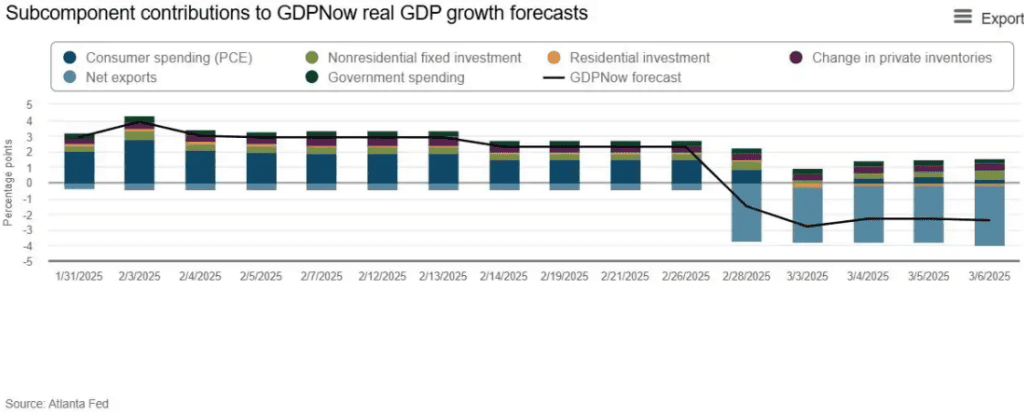

Issues over weak GDP have been partly pushed by the Atlanta Fed’s GDP updates, that are utilized by the Federal Reserve. Whereas this information raises issues, it must be thought-about alongside different financial indicators for a clearer image. It primarily attributes the drop to the commerce steadiness deficit and for those who dig into the info the imports are skewing these numbers. If we expect for a second why that’s, it doesn’t make a lot sense to base an opinion on that information.

The -2.6% GDP determine raises questions on its accuracy and the elements contributing to this drop. Additional evaluation is required to know its implications totally.

Supply: Atlanta Fed

Issues over tariffs are affecting firms in sure sectors, prompting them to regulate their methods to take care of margins amid uncertainty. Affected firms ship items in bulk earlier than tariffs are imposed. We noticed this being an enormous difficulty throughout Covid, exacerbated by transport constraints. It bought so unhealthy in Covid that stock ranges bought a bit of spicy, which brought on additional points when demand slowed down. Large shipments of Gold shifting again to the US is a big a part of this too, it’s not simply shopper items inflicting the numbers to be so off-kilter.

Web exports from the ultimate February print are method out of character. Exhibiting big imports offsetting exports.

Essential observe: There may be clearly a decline in exercise because the finish of February 2025, particularly referring to the buyer, however not as alarming because the preliminary chart signifies and enhancing after a drop.

Supply: Atlanta Fed

Why is the underside shut, or at the very least a bounce?

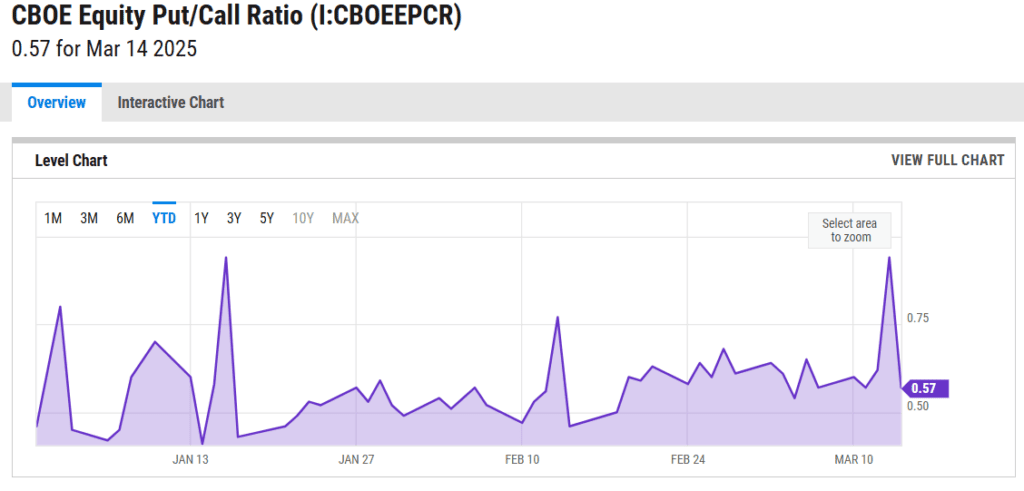

The Fairness Put/Name ratio is again in beneficial steadiness.

Supply: CBOE Fairness Put/Name Ratio Market Each day Insights: CBOE Each day Market Statistics | YCharts

The VIX has cooled off. I’d be happier to see it settle underneath 20 the decline right here is optimistic to see. If this unhealthy boy begins rising… We’ll be getting extra draw back.

Supply: My TA

Hedge funds have been unwinding positions in single shares on the quickest charge we’ve seen in over 2 years, lowering their market publicity, however nonetheless sustaining a optimistic outlook. Suggesting they’re simply rolling with the short-term noise, which is pretty customary behaviour for hedge funds. So why am I mentioning this as a optimistic indicator? The excellent news is that they’ll have loads of money to deploy once they sit match. It’s this model of threat on investing that drives the V formed recoveries that we regularly see after a correction.

Quantity can be falling for the SPY, suggesting some vendor exhaustion and the RSI has been at ranges usually solely hit when there’s a robust bounce or reversal.

Supply: My TA

I did need to briefly contact on some common market tendencies. I’m positive you’ve seen a great deal of charts like this recently, however they stand true. If we have a look at prior quickest 10% drops available in the market, on common 3 months from the drop we’ve a return of 8.2%, 6 months is a 15% return, and one full 12 months is a tidy 19.9% return. This occurs no matter a recession or extra draw back value motion.

One factor we do know for positive, is these drops present glorious long-term potential for consumers that may deal with the volatility.

Why I’m shopping for the dip

Most individuals are solely taking a look at this drop with a really short-term view. Does that make sense? No. Treasury Secretary Scott Bessent has been very clear on permitting markets to endure some short-term ache for long run acquire. From a Macro perspective, there’s nice advantages in permitting issues to say no over the quick time period and my expectation is that that is being finished for a number of causes. First, to nudge the Fed into chopping extra aggressively and permitting the US debt to be refinanced at decrease charges. Second, Bessent has additionally been very clear on his need to kind out the 10yr and get that charge decrease. A excessive yield places stress on the housing sector, which is a troubled sector proper now. One thing not many individuals point out is that when the yield is low, it may possibly increase inventory costs as a result of the current worth of future earnings is greater. A better yield can result in decrease inventory valuations as the price of capital will increase, making equities much less engaging in comparison with the risk-free return on authorities bonds.

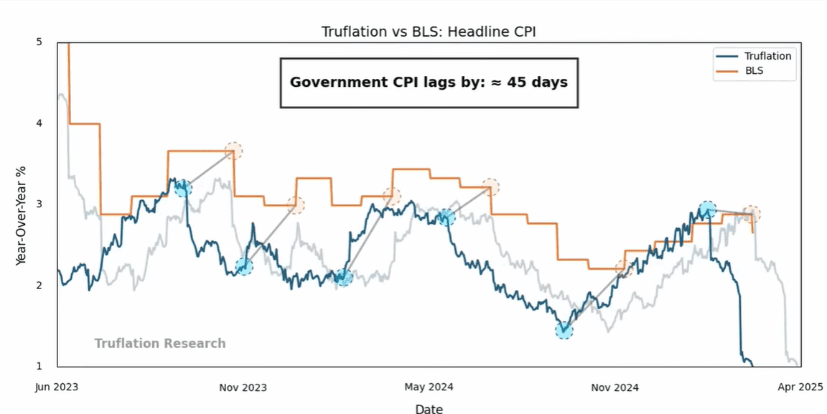

Simply to be clear, I don’t see inflationary dangers to the market. The Fed’s information is considerably lagging (Approx. 45 days behind the Truflation information) so I wouldn’t get hopes up for a right away lower.

Supply: Truflation US Inflation Index | Truflation

Dangers

Quick time period: A hawkish Fed this week that continues with QT might push us decrease and Trumps tariff replace on April 2nd might stoke up concern.

Long run: The ”mortgage disaster” and locked up actual property sector must be addressed, and US debt must be managed, which is what Bessent is about on coping with.

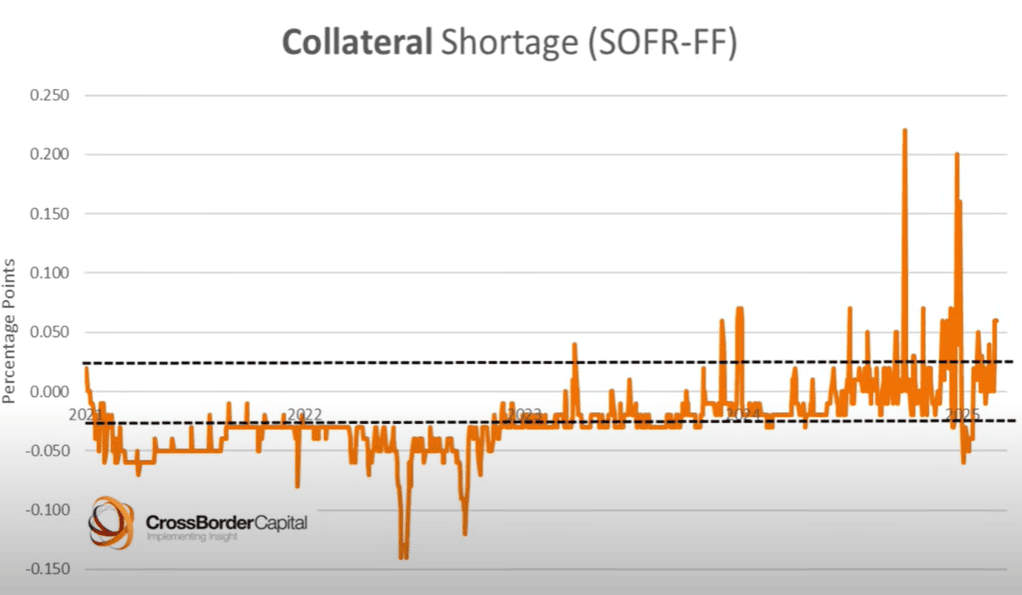

Quantitative tightening is seen liquidity go away the system and it’s trying worrying to me proper now. In all probability the measure I’m most involved with. The M2 measure has bought individuals excited however liquidity is extra advanced than that. US cash markets must be sounding some alarm bells to the Fed and it’s actually the center of the economic system. The SOFR (Repo charge) much less Fed funds unfold has been spiking since July 2024, value must be secure throughout the tram strains as they point out the traditional vary. What does this imply? Primarily there received’t be sufficient liquidity to maintain establishments that rely on it, similar to banks, that are seeing falling reserves. Financial institution reserves peaked at $4.2 trillion however have since misplaced over a trillion {dollars}, falling to $3.25 trillion. It’s recommended {that a} drop under $3.2 trillion, which is barely $50 billion under present ranges, might set off a black swan occasion.

Supply: CrossBorderCapital

There are different elements which have exacerbated this although, similar to reverse repo’s operating dry and all these quick time period issuances Janet Yellen left as a bit of reward for Bessent falling off too (It’s probably this was an try to spice up Biden’s re-election possibilities), however that’s stepping into advanced territory and a dialogue about hidden QE/QT. Silver lining although, QE beginning ought to alleviate this stress and in the event that they set the steadiness sheet dimension relative to the debt burden as a substitute of sticking to their present shrinking plan, we might have one much less factor to fret about. It’s attainable that we might see a restoration quickly. One potential answer to alleviate among the present pressures might be a revaluation of gold, because it hasn’t been adjusted since 1973. This might give the treasury an enormous windfall, assist yields to maneuver decrease so US debt could be refinanced and to allow them to get right down to stimulating.

Conclusion

Whereas there should still be some draw back dangers, it’s attainable that a lot of the market’s latest challenges have already been priced in, and my technique doesn’t concentrate on timing the tops or bottoms completely. What I love to do, is catch the meat of a transfer, whether or not it’s particular person shares or indexes. I do know it’s very cliché advising individuals to purchase when there’s concern and promote when there’s euphoria, however the actuality is, it’s exhausting to not fall into the psychological lure and promote on the lows.

One factor I can say with accuracy is, sentiment strikes the market extra simply and sooner than many actual market contagions, each to the draw back and upside. This does give us a variety of volatility, however that may additionally give us a variety of alternative and that’s what I see right here. Alternative to purchase extra of my favorite shares with some very beneficiant reductions. Will I’ve the prospect to purchase even cheaper? Possibly, however I don’t need to fear about timing after I’ll do nicely, given sufficient time, shopping for shares I like over the subsequent 5 years at immediately’s costs with a 25% to 50%+ low cost.

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any specific recipient’s funding aims or monetary scenario, and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product aren’t, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.