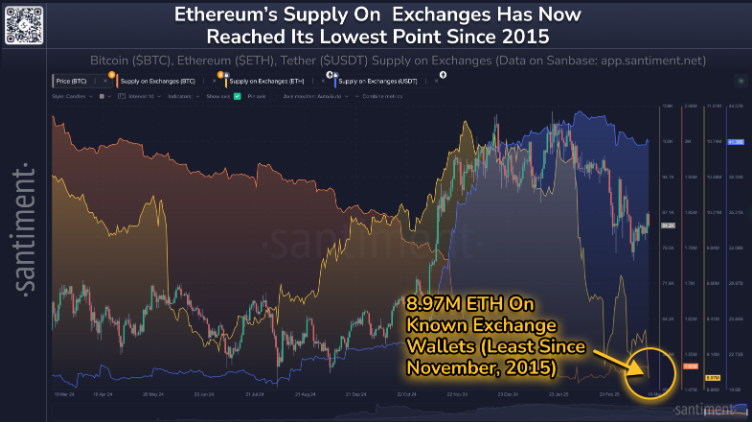

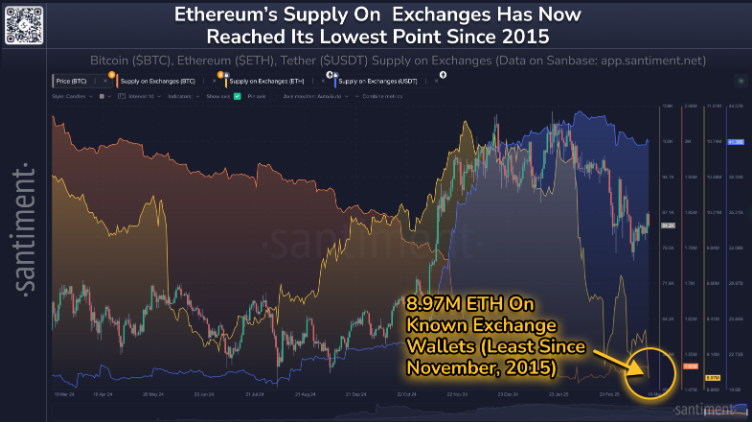

Amid Ethereum’s (ETH) steady value drop, whales and long-term holders have seized the chance to purchase the dip. On March 21, 2025, the on-chain analytics agency Santiment reported that through the ongoing value decline, crypto lovers have considerably gathered ETH tokens, leaving solely 8.97 million ETH on exchanges, which signifies a bullish pattern.

Ethereum Reserves Fall to eight.97 Million

This huge drop in change reserves has occurred for the primary time previously 10 years, with the final occasion reported in November 2015. Nevertheless, the present reserve is 16.4% decrease than it was seven weeks in the past, indicating potential accumulation by whales and long-term holders.

Specialists see these metrics as bullish indicators as costs proceed to fall, together with ETH change reserves. Moreover this important 16.4% drop in reserves, asset costs have additionally declined throughout the identical interval, which traders have taken as a shopping for alternative.

Present Worth Momentum

Ether is presently buying and selling close to $1,960, registering a 0.50% value drop previously 24 hours. Throughout the identical interval, its buying and selling quantity declined by 40%, indicating decrease participation from merchants and traders, probably as a result of market uncertainty.

Ethereum (ETH) Worth Motion and Upcoming Ranges

Regardless of the bearish market sentiment and lowered participation from traders and merchants, ETH’s present stage seems bullish. Its lack of a rally isn’t solely as a result of unfavourable sentiment.

In accordance with professional technical evaluation, ETH stays bullish, having not too long ago damaged out of a protracted consolidation section that lasted over per week. Following the latest value drop, the asset appears to have efficiently retested that zone, and its value now seems to be transferring upward.

Primarily based on latest value motion and historic patterns, if Ether holds above the $1,950 stage, there’s a sturdy chance it may surge by 12% to achieve $2,200 within the coming days.

At press time, the asset is buying and selling properly under the 200 Exponential Shifting Common (EMA) on the day by day timeframe, hinting at a possible value rebound.