Aave has voted to droop Ethereum borrowing forward of The Merge in a vote that acquired a 77.87% majority in favor. The governance proposal said,

“A proposal to pause ETH borrowing within the interval main as much as the Ethereum Merge…

Forward of the Ethereum Merge, the Aave protocol faces the chance of excessive utilization within the ETH market. Quickly pausing ETH borrowing will mitigate this danger of excessive utilization.”

The proposal said that the motivation for the transfer was to guard towards “excessive utilization within the ETH market.” There was a worry that this may be attributable to “customers probably benefiting from the forked PoW ETH (ETHW) by borrowing ETH earlier than the merge.”

Curiously, Aave has not voted to pause exercise on the Ethereum community altogether, merely to pause ETH borrowing. The proposal doesn’t point out concern over The Merge itself however that speculators may artificially enhance demand past tolerable ranges.

The proposal additionally defined how a excessive borrow fee may result in “stETH/ETH recursive positions [becoming] unprofitable, growing the probabilities that customers unwind their positions and driving the stETH/ETH value deviation additional, inflicting further liquidations and insolvency.” Additional info on the proposal will be discovered on the governance discussion board.

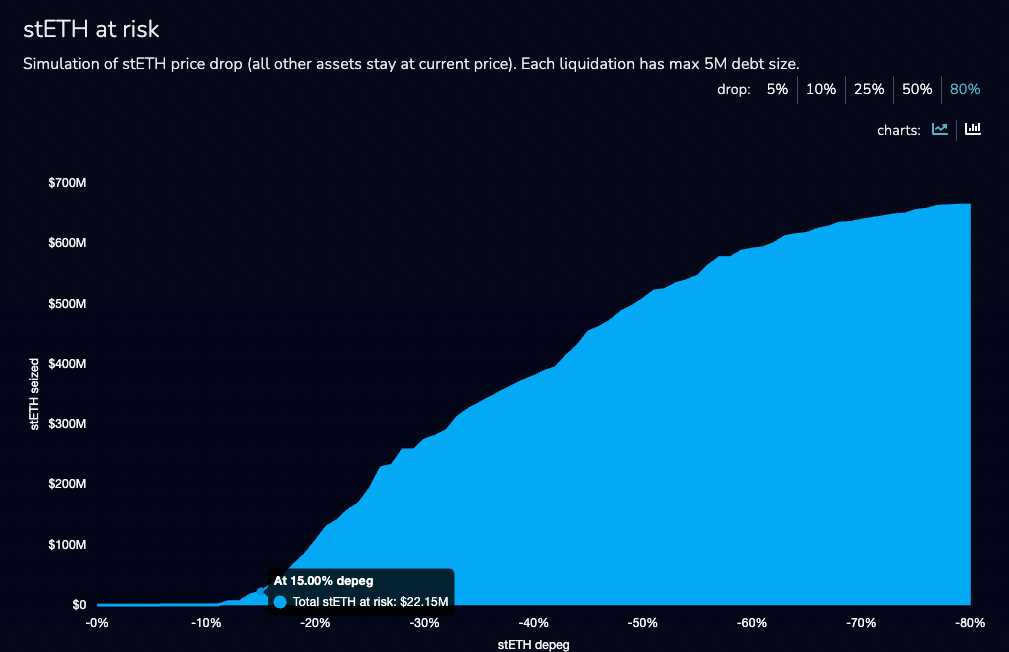

Knowledge on the discussion board included a simulation of the stETH in danger ought to borrowing be left on. In line with the chart, a depeg of 15% would unlikely trigger main liquidations on the Aave platform. Nevertheless, ought to the peg set up a deviation of fifty%, there could possibly be liquidations of over $500 million.

Additional, analyzing wallets utilizing the Aave platform resulted in discovering some “uncommon conduct of customers constructing ETH/ETH recursive positions.” The rationale for such a technique could be to maximise ETH publicity to reap the benefits of any ETHPoW fork.

Further dangers and eventualities that resulted in a name for a governance proposal to pause ETH borrowing are outlined intimately on the governance discussion board. Nevertheless, it seems that the DAO is performing effectively in working to guard the DeFI platform and self-govern.

There isn’t any centralized directive in play forcing adjustments to the platform. Governance token holders raised a possible concern, and the group voted to guard the market’s greatest pursuits. The proposal is obtainable for deployment from 1 am BST on Wednesday.