The cryptocurrency economic system has shed lots of worth over the past six months dropping 48.70% from $3.08 trillion to at the moment’s $1.58 trillion. Whereas crypto markets seems extraordinarily bearish today, just a few crypto advocates have theorized the bear market shall be much less harsh this time round. Moreover, there’s additionally the uncommon situation that bitcoin’s value might reverse and see a triple prime although it’s generally stated within the finance world “there is no such thing as a such factor as a triple prime.”

The Probabilities of Bitcoin Experiencing a Triple Prime State of affairs Is Uncommon, However May Occur

5 days in the past, Bitcoin.com Information reported on a principle that describes bitcoin (BTC) costs experiencing a softer bear market than the main crypto asset’s 80%+ declines recorded up to now. The reasoning behind the idea is due to previous bitcoin value peaks and the latest peaks recorded in Could and November 2021.

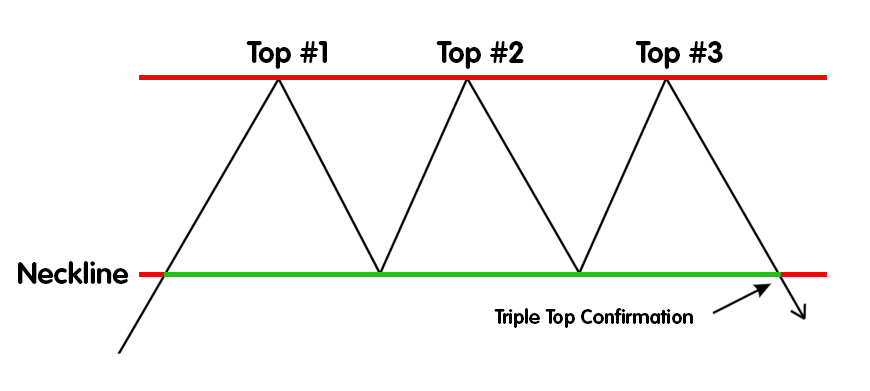

Whereas BTC hit $64K in Could and $69K in November, the 2 peaks have been a lot smaller than earlier bull run good points. From the seems of issues it appears, BTC’s value skilled what’s referred to as a double prime. Now, coinciding with the idea the present market downturn shall be a softer bear run, there’s additionally the uncommon chance of a triple prime situation.

Mainly, if a triple prime situation takes place, BTC’s fiat worth will faucet the identical resistance it touched throughout the previous downturn. As an illustration, after BTC tapped a excessive of $64K in mid-Could 2021, the worth dropped to a low of $31K on June 21, 2021. From there, the value as soon as once more skyrocketed and reached $69K on November 10, 2021.

If a triple-top occurs to happen, then the upcoming backside can be considerably within the vary of the $31K mark, when it begins one other reversal. To ensure that this to occur, BTC must see an entire reversal from the identical resistance ranges and the third prime could possibly be equal to and simply above or simply under the $69K area.

Reversal Theories Thought-about ‘Hopium’ as Many Received’t Wager on Such a Dangerous Play

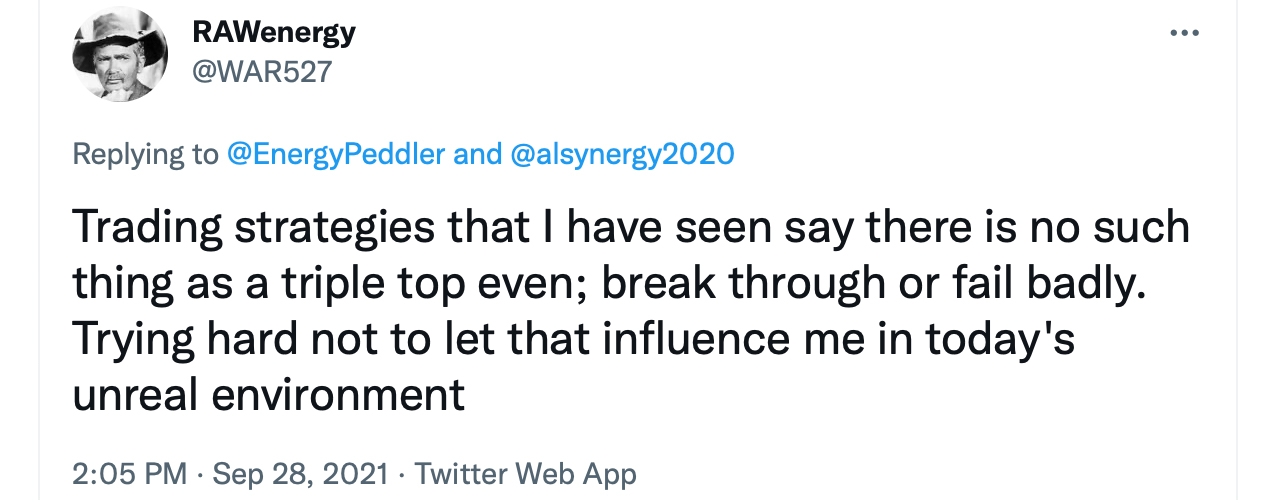

After all, many will assume theories of a triple prime are based mostly on pure religion and “hopium.” Within the buying and selling world, triple tops are very uncommon and quad tops are seemingly non-existent. In 2019, allstarcharts.com analyst JC says: “We hardly ever see triple tops, and I can’t even inform you if I’ve ever seen a quadruple prime. Betting on these outcomes appears to by no means pay.”

Which suggests betting on bitcoin (BTC) experiencing a triple prime is a really dangerous wager compared to betting on a double prime formation. Furthermore, its a typical message within the buying and selling world to state:

There isn’t a such factor as a triple prime.

Whereas it’s frequent to say the assertion, saying “there is no such thing as a such factor as a triple prime,” the remark will not be completely correct. They absolutely have occurred in monetary market eventualities up to now, and merchants who risked betting on them have reaped the rewards. Nevertheless, when a triple prime does execute and full, the “celebration is formally over.” When a triple prime is executed, the value will start a bearish descent till the subsequent value cycle regains bullish energy.

Whereas many are seemingly nonetheless prepared to wager on a triple prime formation so far as bitcoin’s value is worried, its much more seemingly they aren’t prepared to wager on a seemingly non-existent quad prime. Furthermore, triple tops being as uncommon as they’re, means quite a lot of merchants will not be prepared to wager a 3rd peak is within the playing cards. The possibility of a BTC triple prime coming to fruition will not be unattainable, and nobody can safely say the situation is not going to come into play.

What do you consider the possibilities of bitcoin’s value seeing a triple prime formation after hitting the subsequent resistance degree? Tell us what you consider this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any harm or loss prompted or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.