One of the crucial heated debates surrounding Ethereum’s transition to a Proof-of-Stake community centered on the issuance of ETH. The main narrative behind the Merge was that it was alleged to make ETH a deflationary forex.

For the reason that Merge was accomplished on September 15, ETH issuance has been drastically diminished. The estimated annual issuance within the PoS community is round 600,000 ETH. The precise annual issuance will fluctuate all through the years, because it’s decided primarily based on the variety of validators taking part within the consensus mechanism.

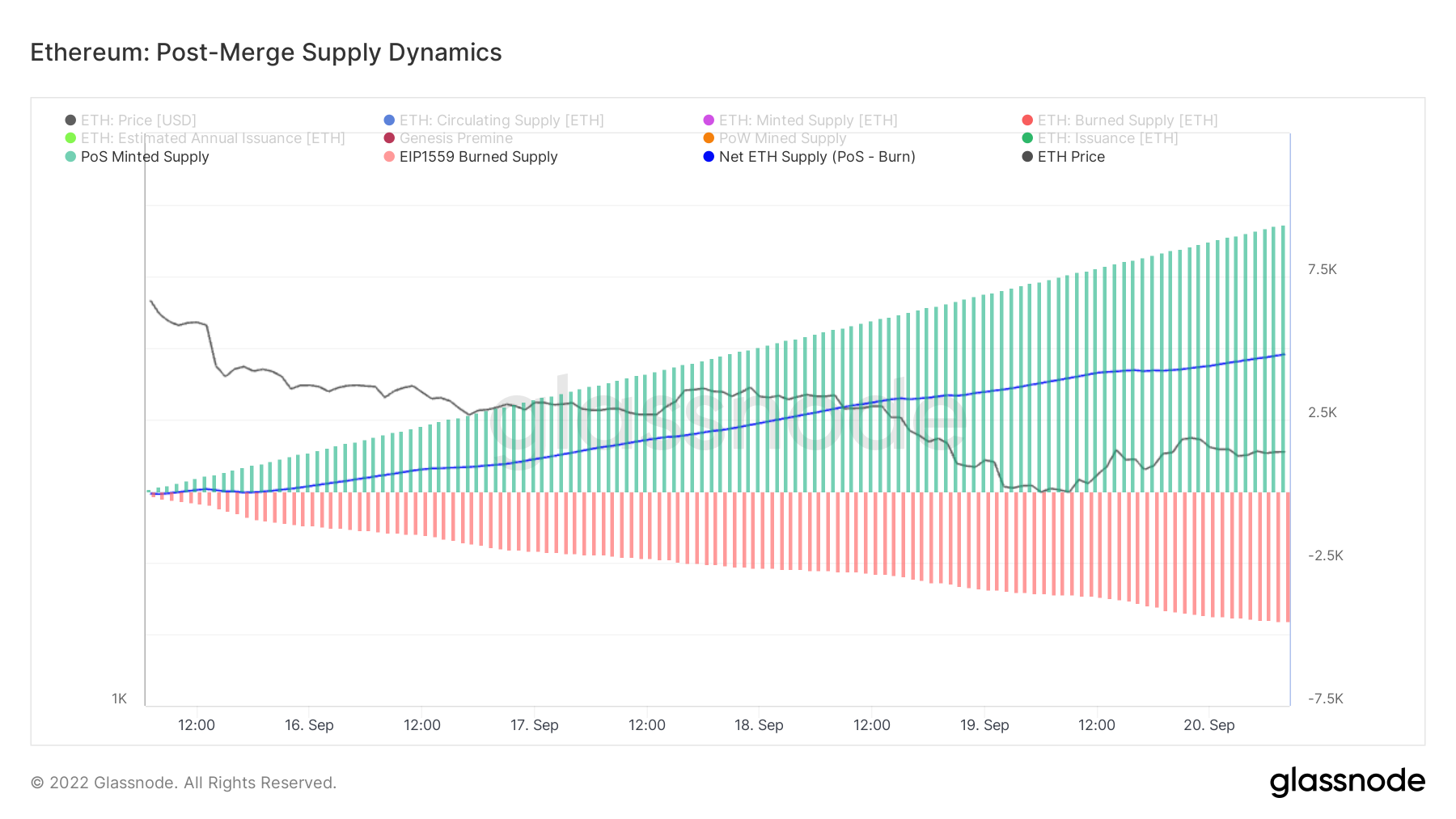

Nonetheless, whereas the issuance was diminished in concept, the precise provide of ETH has elevated for the reason that community deserted Proof-of-Work. The availability progress is at present constructive and has grown by over 4,000 ETH for the reason that Merge. On the present tempo, the provision is about to extend by 0.21% per 12 months.

The Merge has thus far didn’t ship on making Ethereum a deflationary forex. The minted provide from the PoS community has outpaced the burn fee applied with EIP-1559.

In keeping with knowledge from Glassnode, since Proof-of-Work issuance ceased completely, Ethereum’s provide has been growing on an hourly foundation. The chart beneath reveals that the provision mined by PoS is outpacing the provision burned by EIP-1559. This triggered the web provide of ETH to extend following the Merge.

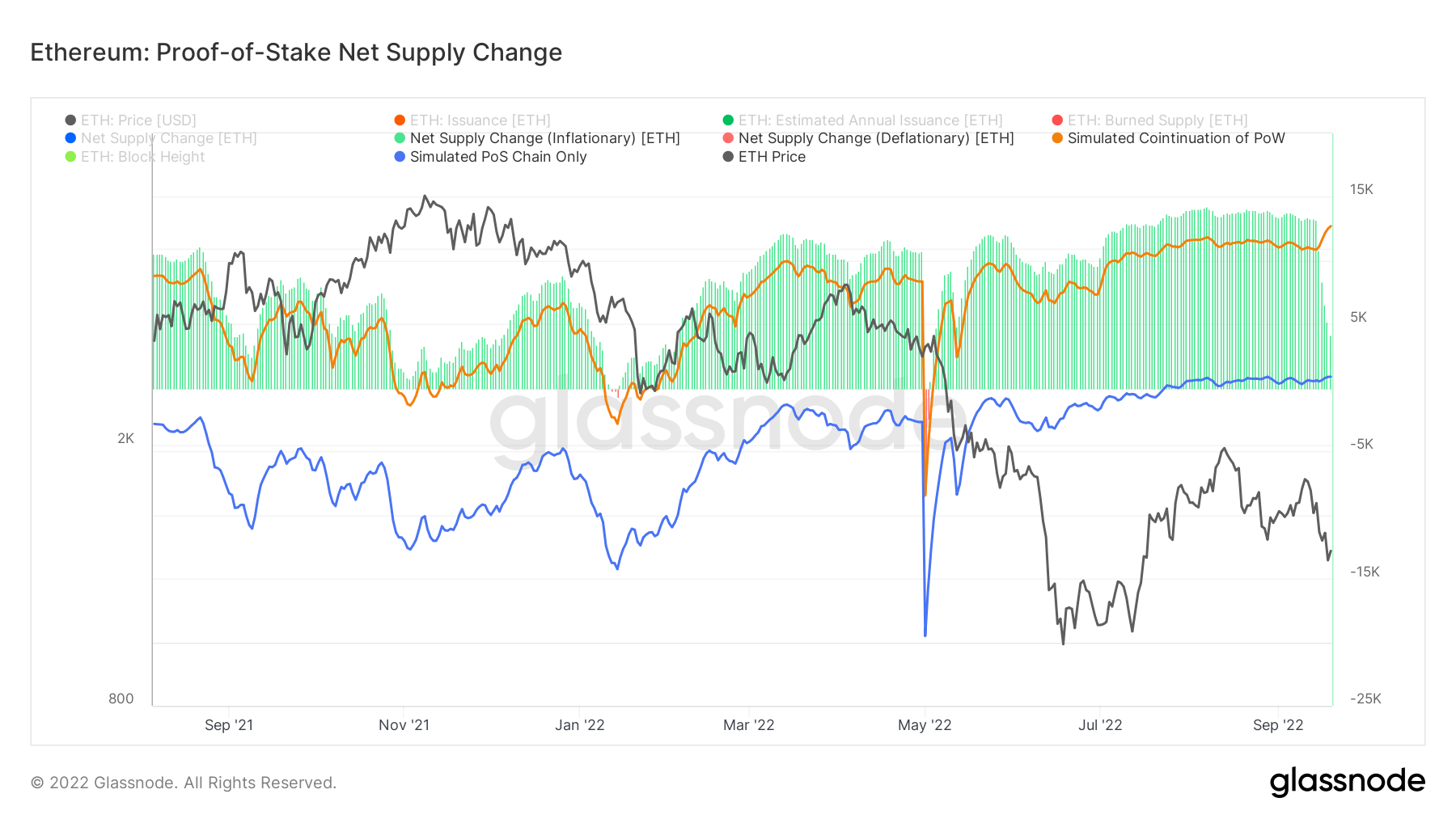

Analyzing Ethereum’s provide and issuance earlier than the Merge reveals the community has been below inflationary strain for nearly two years.

The PoS issuance of ETH started lengthy earlier than the Merge — proper after the beacon chain genesis occasion on December 1, 2020. The PoW issuance, nevertheless, wasn’t halted till September 15, 2022. EIP-1559, the transaction pricing mechanism that applied a set transaction charge burned with each block, was put in force on August 5, 2021.

This discrepancy in implementation instances has additional exacerbated the strain on the community.

Since EIP-1559 was applied, ETH has been deflationary for under very brief intervals — in January and Could 2022. The graph beneath reveals the disparity between inflationary and deflationary intervals — the previous are marked inexperienced, whereas the latter are marked purple.

Nonetheless, PoS managed to cut back the provision of ETH drastically. Within the graph above, the orange line represents the simulated provide if Ethereum continued to exist as a PoW system. The blue line represents the simulated provide if Ethereum existed as a PoS system for the previous 12 months. The information clearly reveals {that a} PoS system drastically reduces the provision of ETH.

The graph additionally illustrates that the inflationary strain on Ethereum has been steadily dropping for the reason that Merge. Nonetheless, we’re but to see whether or not the diminished strain finally results in a deflationary provide.