Bitcoin has dipped to its lowest level in over a 12 months with the flagship token dropping 4.4 per cent since yesterday so as to add to its total decline this week.

Bitcoin is now valued at US$29,531, marking its lowest degree since December 2020.

Crypto traders have been experiencing a world of ache up to now seven days as Bitcoin and different cryptos plummet in worth.

Bitcoin has misplaced over 60 per cent of its worth because it reached its all time excessive of US$68,500 in November 2021.

In the meantime, shares in publicly traded crypto trade, Coinbase, plummeted, signalling investor skepticism concerning the worth of the crypto trade in a bear-market.

Coinbase plunged round 25 per cent to its present worth of US$53.72 – a large drop from its opening worth of US$328.28 in April 2021.

Regardless of the devastating efficiency of the crypto market, Australia’s first three cryptocurrency exchange-traded funds (ETF) launched on the Cboe trade right this moment. The ETFs imply that Bitcoin and Ethereum merchandise are actually accessible to merchants and traders on the inventory market.

Additionally Learn: What’s yield farming? Is it one of the simplest ways to spend money on cryptocurrencies?

One of many funds, the Cosmos Function Bitcoin Entry ETF from Cosmos Asset Administration, tracks the Function Bitcoin ETF on the Toronto inventory trade.

The remaining two funds had been launched by Australian ETFS Administration Ltd. and Swiss 21Shares AG spot-trade Bitcoin and Ether by monitoring the crypto asset immediately.

Whereas the ETFs had been initially slated for launch in April, brokerage issues resulted in final minute delays.

Nevertheless, the launch of the ETFs come at a turbulent time for the cryptocurrency market, with Bitcoin and Ethereum each hitting their lowest factors in 2022.

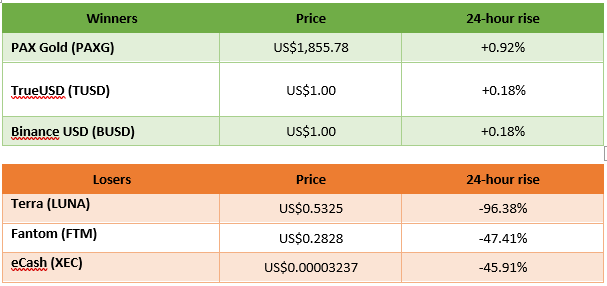

Winners and Losers

Picture Supply @ 2022 Kalkine Media®

Information Supply: CoinMarketCap.com, primarily based on prime 100 cryptos.

Observe: Development from the 24 hours previous to 12:30pm AEDT

Danger Disclosure: Buying and selling in cryptocurrencies entails excessive dangers together with the chance of dropping some, or all, of your funding quantity, and will not be appropriate for all traders. Costs of cryptocurrencies are extraordinarily risky and could also be affected by exterior components corresponding to monetary, regulatory, or political occasions. The legal guidelines that apply to crypto merchandise (and the way a selected crypto product is regulated) might change. Earlier than deciding to commerce in monetary instrument or cryptocurrencies you need to be totally knowledgeable of the dangers and prices related to buying and selling within the monetary markets, fastidiously contemplate your funding goals, degree of expertise, and threat urge for food, and search skilled recommendation the place wanted. Kalkine Media can’t and doesn’t signify or assure that any of the knowledge/information accessible right here is correct, dependable, present, full or applicable on your wants. Kalkine Media is not going to settle for legal responsibility for any loss or harm because of your buying and selling or your reliance on the knowledge shared on this web site.