First homebuyers will be capable to use their superannuation to get within the property market, Scott Morrison has introduced on the Coalition’s official marketing campaign launch on Sunday.

Underneath a Coalition re-election promise, a person can be allowed to speculate as much as 40 per cent of their superannuation steadiness, as much as a most of $50,000, in the direction of a deposit for a primary dwelling.

{Couples} could each entry the scheme as much as a most of $100,000.

There can be no revenue or property caps below the so-called Tremendous Residence Purchaser Scheme, with eligibility restricted to first homebuyers who will need to have individually saved 5 per cent of the deposit.

The scheme can be open to any owner-occupier, with no age, property or revenue thresholds. If the federal government is re-elected subsequent Saturday, the scheme would began by July 2023.

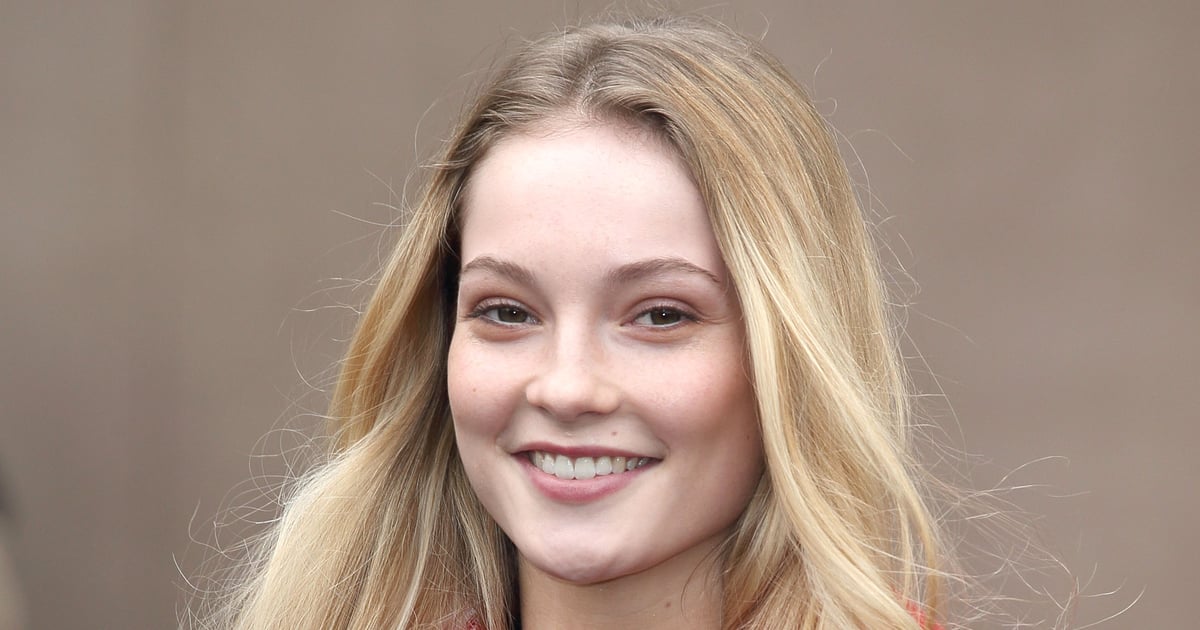

Talking to the get together devoted in Brisbane, the Prime Minister stated the coverage would assist Australians recover from the largest hurdle to purchasing a house – saving a deposit.

The pitch was aimed toward “aspirational” Australians struggling to get a foot on the property ladder after years of hovering home costs, significantly within the Jap States.

“Superannuation is there to assist Australians of their retirement. The proof exhibits that the perfect factor we are able to do to assist Australians obtain monetary safety of their retirement is to assist them personal their very own dwelling,” Mr Morrison stated.

“You possibly can already use your tremendous to buy an funding property however not your personal dwelling. Different international locations akin to New Zealand and Canada even have insurance policies that permit individuals to make use of their retirement financial savings to assist them purchase their dwelling and below a Morrison authorities it is possible for you to to try this too.”

He described the 40 per cent cap as a “accountable portion” that will guarantee “the vast majority of your tremendous stays in your present fund and maintains the diversification of your financial savings”.

The scheme would apply to new and present properties, with the invested quantity to be returned to superannuation funds when the home is bought, together with a share of any capital achieve.

“This shall be a game-changer for 1000’s of Australian households who sit and have a look at that cash on their steadiness and go, ‘If solely I had that to assist me now’,” Mr Morrison stated.

“There isn’t any restrict on who can use it. You don’t must promote it if you happen to get a pay rise or somebody needs to return to work full-time.

“There are not any complicated guidelines about revenue thresholds or who will get what. Whenever you do an enchancment you don’t must test with the federal government each time you go to Bunnings to purchase a can of paint.”

Labor shadow assistant treasurer Stephen Jones was the primary from the ALP to answer the plan, taking to Twitter to argue that former Liberal treasurers Peter Costello and Joe Hockey had beforehand rejected the concept in addition to former prime minister Malcolm Turnbull.

“Scott Morrison has simply trashed any vestiges of financial credibility,” he wrote.

“Costello, Hockey, Turnbull… all stated tremendous for housing was a dumb concept that will blow up the housing market.”

“However Scott doesn’t give a dam (sic). It’s all in regards to the politics for this bloke.”

As revealed in The Sunday Instances, Mr Morrison additionally used his launch speech to announce a re-elected Coalition authorities would the increase eligibility of the property downsizers scheme.

Underneath the change, the over 55s to downsize their property and make investments as much as $300,000 of the proceeds per individual into their superannuation outdoors of the prevailing contribution caps.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25841912/Silo_Photo_021008.jpg)