In gentle of latest occasions within the crypto business, it’s turning into more and more necessary for Kraken purchasers and business individuals to grasp the importance of Proof of Reserves (PoR) at Kraken.

This system, one that’s solely attainable within the new world of cryptocurrency, is a method for Kraken purchasers to confirm whether or not or not their account balances had been included in a 3rd get together audit that proved Kraken held coated consumer property on the day of the audit.

In different phrases, for each bitcoin, ETH and a number of other different cryptoassets you entrust with us, we wish you to have the ability to personally confirm that an equal quantity of that asset was verified as being held by Kraken, secure inside our safe wallets. PoR permits for this to be achieved transparently and securely.

What’s a reserve?

In monetary companies, a reserve is historically a retailer of property held in treasury. You possibly can consider it as an sum of money stored by an establishment, prepared for any state of affairs the place it may be wanted.

Reserves are sometimes held to cowl consumer liabilities, that are excellent debt an organization owes to its purchasers based mostly on the holdings of their accounts.

Reserves come into play when you could want to take your cryptocurrency off our trade and custody it your self. In conventional finance, a financial institution holds money and different helpful objects in reserve, however in lots of instances, it doesn’t maintain your precise deposits in full which implies their reserves usually are not at all times backed one-to-one.

Why are reserves necessary?

In conventional finance, a state of affairs when too many purchasers withdraw their funds abruptly known as a financial institution run and it may be deadly for an economic system.

Runs may occur on centralized cryptocurrency exchanges, resulting in main issues if the platform doesn’t have adequate property in reserve to facilitate consumer withdrawals.

Oftentimes in these unlucky eventualities, platforms with out satisfactory reserves might droop withdrawals, leaving purchasers unable to retrieve their property from the platform. Relying on the circumstances, these conditions can probably take weeks, months or generally years to resolve, and even then, there’s no assure purchasers will obtain the total quantity of what they misplaced.

What’s Proof of Reserves?

There’s at present no legally permitted definition of what a Proof of Reserves audit is.

At Kraken, PoR is an unbiased audit carried out by a 3rd get together that serves to show we held property in reserve on the date of the audit that not less than equaled our purchasers’ coated balances. That is achieved with user-verifiable cryptography to supply 100% transparency and certainty.

At Kraken, PoR isn’t a case of merely subtracting consumer liabilities from consumer property, or offering an inventory of on-chain pockets addresses for others to examine. These practices are incomplete and might be deceptive for purchasers seeking to perceive the transparency of their trade.

We consider the one method to unequivocally show to purchasers that we held coated property not less than equal to coated liabilities on the date of the audit is to make use of sound arithmetic and an unbiased agency to show that the balances in your account of cryptocurrencies like BTC and ETH (apart from these on which you opted in to earn further yield) had been in reality held by Kraken.

Why are Proof of Reserve audits necessary?

Proof of Reserves assist to show to our purchasers and the business that we didn’t mortgage the crypto in your account out to others with out your data or again your holdings with something apart from the cryptocurrency itself.

In a world of uncertainty, PoR audits exist as one of many few processes the place purchasers can really know whether or not or not a platform is sufficiently solvent and capable of course of withdrawals.

How are Proof of Reserves audits carried out at Kraken?

Our reserves are verified by way of audits carried out biannually (twice a yr) by an unbiased, top-25 world accounting agency. As an unbiased third-party, the auditor attests to the accuracy of each our consumer liabilities in addition to the property held by Kraken to cowl these liabilities.

Kraken takes this a step additional by permitting our purchasers to then independently confirm that their holdings had been included within the Proof of Reserves as properly.

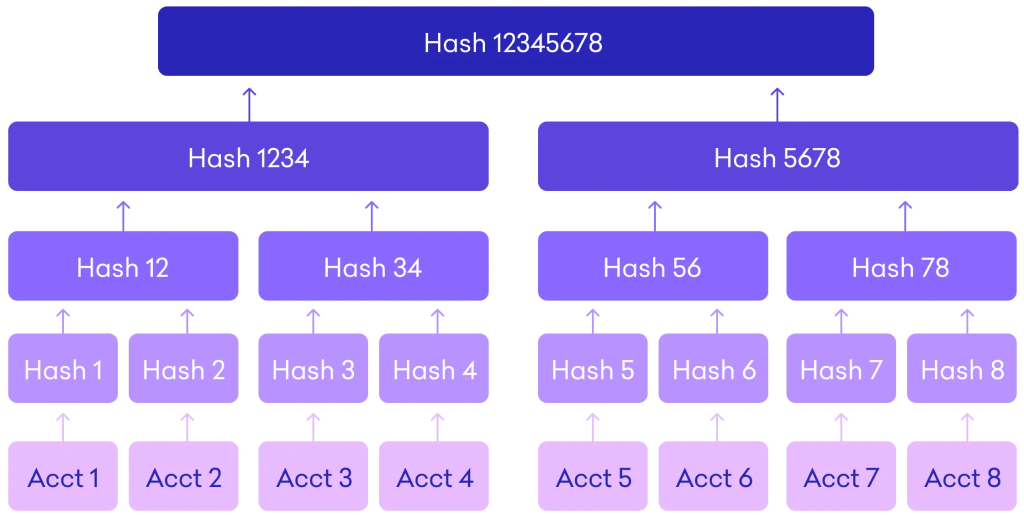

At a extra granular stage, the auditing agency takes a snapshot of consumer balances and arranges them in one thing known as a Merkle tree — a sort of knowledge construction utilized in cryptography to mixture and confirm the integrity of a dataset.

Utilizing the Merkle tree, account balances are first hashed (transformed into distinctive hexadecimal codes) after which repeatedly hashed collectively in pairs, till the ultimate two pairs of hashes are hashed collectively to type a single hash code. Referred to as a Merkle root, this single code acts like a fingerprint that uniquely represents all information captured within the auditor’s snapshot.

The auditor then matches up the quantity of property held in Kraken’s on-chain crypto pockets addresses with the balances proven within the Merkle tree.

To keep away from exposing safety vulnerabilities, Kraken gives digital signatures to the auditing agency. These signatures show we preserve management over the wallets with out having to reveal the corresponding non-public keys. It additionally exhibits that the funds don’t belong to another person.

Cryptoassets included within the PoR audit embody BTC, ETH, USDT, USDC, XRP, ADA and DOT. Sooner or later, we’ll look to incorporate further cryptocurrencies within the Proof of Reserves course of with the aim of reaching even better transparency for our purchasers.

How do I do know my investments are secure?

Kraken’s Proof of Reserves audits are supposed to reassure our purchasers that their funds are transparently and verifiably backed by adequate property held in reserve. Proof of Reserves audits point out that property had been held in Kraken’s reserves which had been adequate to cowl buyer withdrawals.

Along with our reserves, we preserve a excessive commonplace of safety throughout all areas of our ecosystem. It’s why Kraken stays one of many few crypto exchanges within the business that has by no means skilled a safety breach that resulted within the lack of funds. You possibly can study extra about Kraken’s business main safety requirements right here.

Create an account immediately to profit from Kraken’s business main safety and transparency.

There are not any formally accepted guidelines or procedures that outline a proof of reserves audit. For ours, we engaged an unbiased accounting agency to carry out an engagement beneath requirements set forth by the American Institute for Licensed Public Accountants and to situation an Unbiased Accountant’s Report on Agreed Upon Procedures. This report consists of particular procedures carried out by that agency in addition to their findings.

These supplies are for common info functions solely and usually are not funding recommendation or a suggestion or solicitation to purchase, promote, or maintain any digital asset or to interact in any particular buying and selling technique. Some crypto merchandise and markets are unregulated, and also you is probably not protected by authorities compensation and/or regulatory safety schemes. The unpredictable nature of the cryptoasset markets can result in lack of funds. Tax could also be payable on any return and/or on any enhance within the worth of your crypto property and you must search unbiased recommendation in your taxation place.