The most important information within the crypto-verse for Dec. 2 consists of Bitcoin’s adverse 1.4% response to the U.S. payroll information, FTX Japan’s efforts to convey liquidity again, and Binance’s $3 million freezing as a precaution after the Ankr protocol acquired exploited.

CryptoSlate Prime Tales

Bitcoin drops 1.4% on better-than-expected U.S. payroll information

The U.S. Bureau of Labor Statistics’ latest payroll information revealed that 263,000 jobs had been added through the month of November. Bitcoin (BTC) reacted to this information by falling 1.4% to be traded at $16.780.

FTX Japan to Unfreeze Withdrawals of Consumer Funds

FTX’s Japanese subsidiary has been engaged on a monetary plan to permit customers to withdraw funds.

On Dec. 2, the subsidiary introduced that the associated authorities accredited its plans and that the customers would be capable to withdraw quickly.

Binance freezes $3M from Ankr exploit.

An attacker exploited a bug in Ankr Protocol’s (ANKR) code and minted six quadrillions of aBNBc tokens. The exploiter transformed an element right into a $5 million Coin (USDC).

Potential hacks on Ankr and Hay. Preliminary evaluation is developer personal key was hacked, and the hacker up to date the sensible contract to a extra malicious one. Binance paused withdrawals a number of hrs in the past. Additionally froze about $3m that hackers transfer to our CEX.

— CZ 🔶 Binance (@cz_binance) December 2, 2022

Binance’s CEO Changpeng Zhao stated that the change froze round $3 million of its funds in response to the exploit.

Over 8% of Bitcoin provide was purchased between $15.5K and $17K

Based on the UTXO Realized Worth Distribution (URDP) metric, 8% of the overall Bitcoin provide was bought when the worth was between $15,000 and $17,000.

Whereas the 8% quantity alerts that additional redistribution is probably going, Bitcoin consolidation stays excessive, which suggests long-term holders are in management.

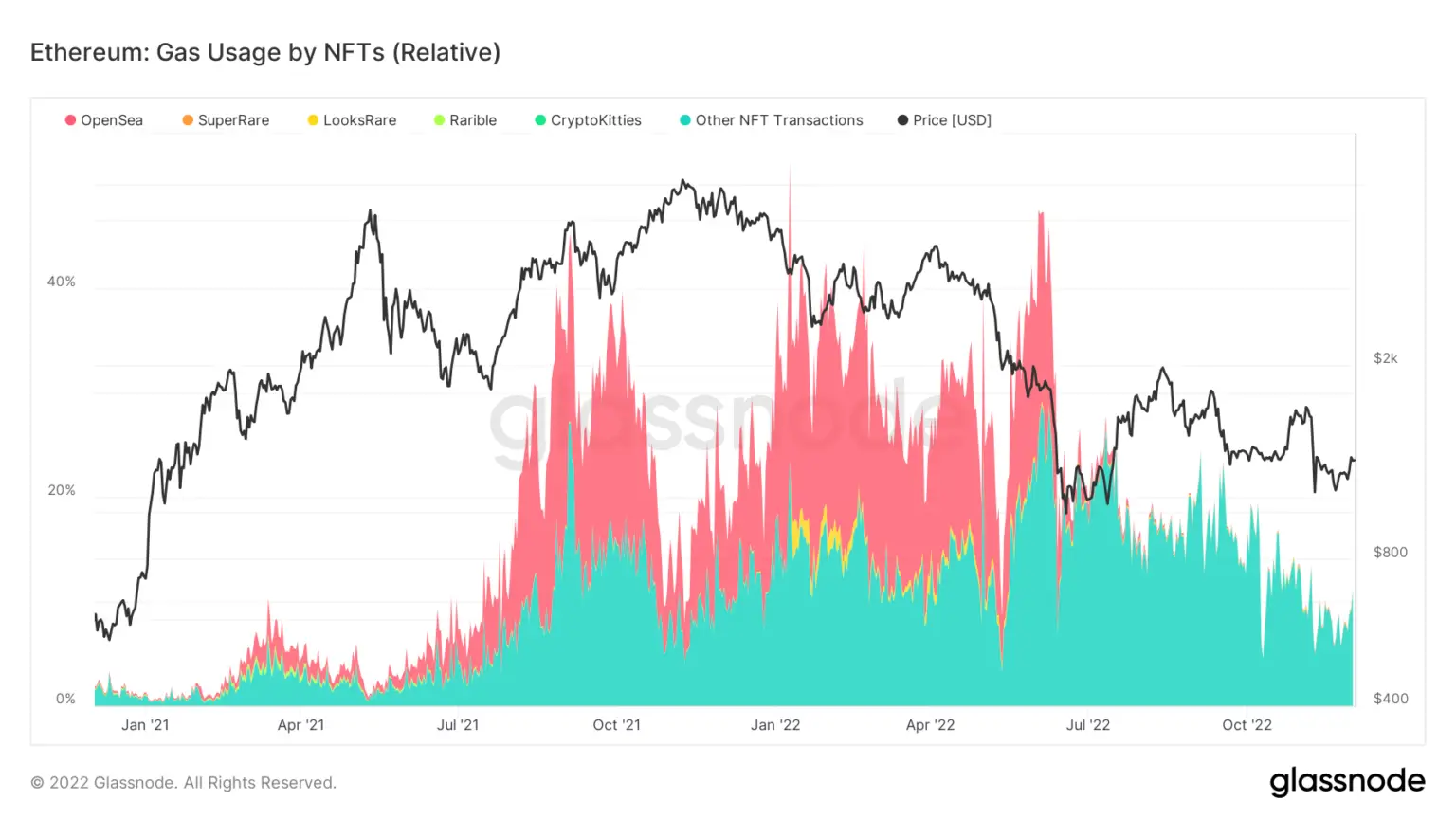

OpenSea’s Ethereum fuel utilization has declined to virtually zero

NFT market OpenSea’s Ethereum (ETH) fuel utilization has been declining for the final 5 months.

Based on the info from Dune Analytics, fuel charges in ERCC721 and ERC1155 token requirements that occurred in main NFT marketplaces spiked between Oct. 2021 and January 2022, and OpenSea accounted for round 20% of this quantity.

Nevertheless, for the previous 5 months, OpenSea’s proportion shrunk, permitting Optimism and Arbitrum to develop.

Galaxy Digital wins bid for GK8 in Celsius chapter asset public sale

Galaxy Digital introduced buying GK8 with out disclosing the sum. GK8 is a self-custody program and was acquired by Celsius in Nov. 2021, which went bankrupt after the Terra collapse.

Galaxy’s CEO stated buying the self-custody platform is a “essential cornerstone” in establishing a full-service monetary platform.

U.S. lawmakers query personal companies’ function within the growth of a CBDC

In response to the allegations that non-public companies are being concerned in designing the “hypothetical” U.S. Central Financial institution Digital Foreign money (CBDC), the U.S. lawmakers composed a joint letter to ship to the Federal Reserve Financial institution of Boston.

The lawmakers claimed that some personal companies concerned within the CBDC venture may be taking part in leveraging the venture as analysis and growing and scaling different CBDC merchandise to promote to business banks sooner or later.

CBDCs: India’s digital Rupee falls flat as low volumes blight trial run

Regardless of their adverse angle in the direction of the crypto market, Indian lawmakers have all the time discovered CBDCs useful.

India’s digital Rupee has been up and operating as a pilot program for the reason that starting of November. It lastly went dwell on Dec. 1, however the information retailers reported that it did not catch on.

Analysis Spotlight

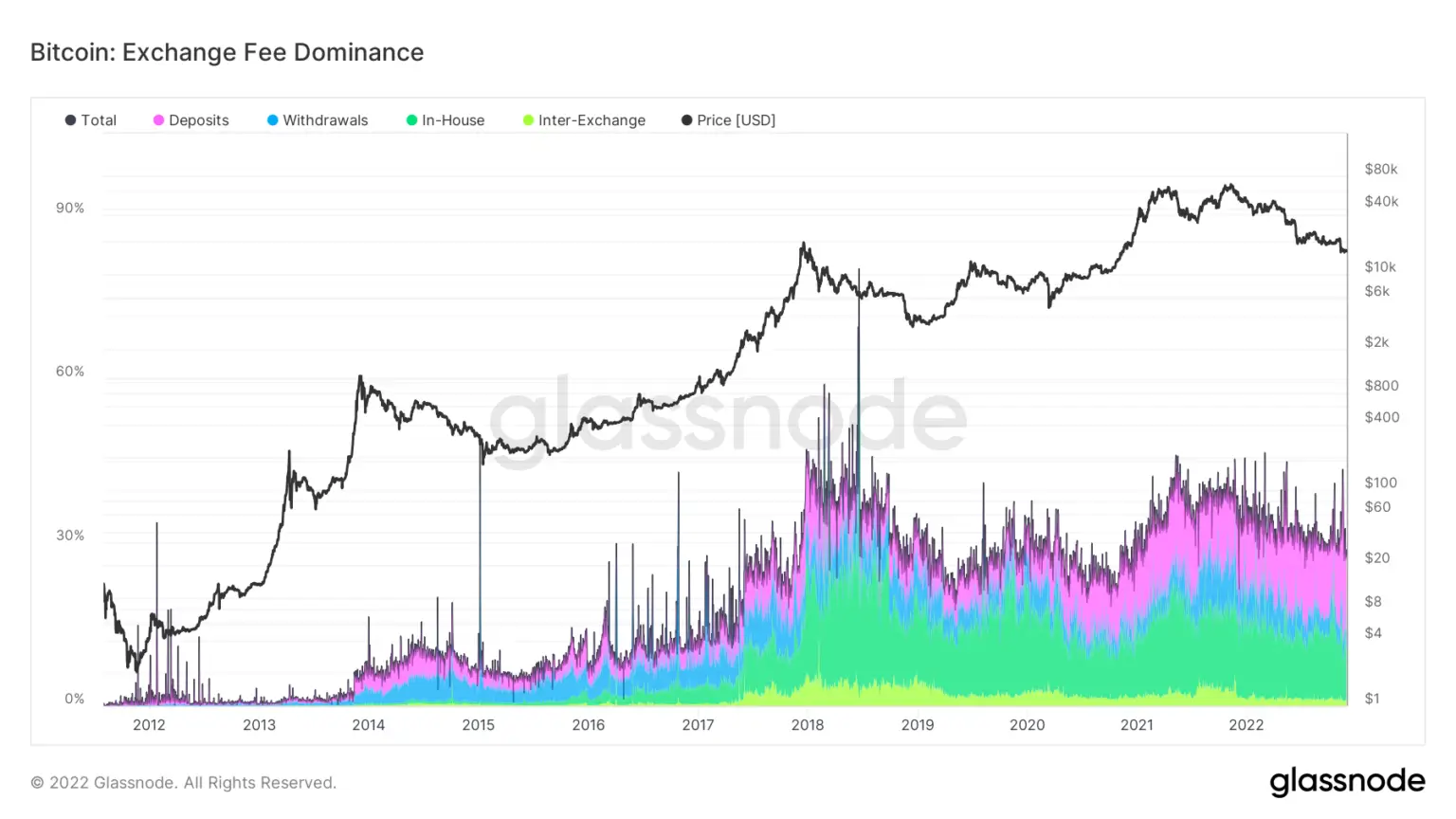

Analysis: Evaluation of crypto transaction charges suggests exchanges choose to maneuver to Bitcoin.

CryptoSlate analysts appeared into the on-chain information on the crypto change’s inner transactions to disclose that they like to make use of Bitcoin to switch funds internally.

The Trade Price Dominance metric is a proportion of whole transaction charges paid regarding on-chain change exercise. The kind of transaction that prices a payment is split into deposits, withdrawals, in-house, and inter-exchange.

The chart above exhibits Bitcoin transaction charges consisted of 36% of all change income sources associated to Bitcoin. It additionally demonstrates that deposits and in-house transfers have grown exponentially over the previous 5 years.

CryptoSlate Unique

Mythbusting Solana – downtime, competitors, and know-how with Matt Sorg of Solana Basis – SlateCast #38

Solana Labs’ Product and Expertise Chief, Matt Sorg, gave an unique interview to CryptoSlate and talked about Solana (SOL) and its future within the crypto sphere.

Sorg stated he was drawn to Solana as a result of it was a “differentiated know-how” by way of scalability, velocity, and future potential. He stated:

“Solana is differentiated know-how, there may be plenty of noise within the area about how issues l scale sooner or later however Solana is prepared at the moment and has a really clear path in scaling very arbitrarily sooner or later in a really user-friendly manner.”

Sorg additionally talked about that he anticipated the crypto area to evolve right into a multi-chain future the place “completely different chains and completely different protocols will take some studying from different protocols.” He argued that Solana can be extra configurable over time to suit into this multi-chain setting.

Information from across the Cryptoverse

Alameda invested in Genesis earlier than the collapse.

Based on Bloomberg, Alameda Analysis invested $1.15 billion in whole in Genesis Digital earlier than the market imploded and the mining business began to undergo.

Galaxy CEO expects Bitcoin to see $500K

Based on a Bloomberg article revealed on Dec.1, Galaxy Digital’s CEO Michael Novogratz expects Bitcoin to extend to $500,000 based mostly on the Federal Reserve’s rate of interest will increase.

Home Committee on Monetary Companies thanks SBF for being candid

The U.S. Home Committee on Monetary Companies chair Maxine Waters Tweeted to thank FTX founder Sam Bankman-Fried for being candid in regards to the FTX fallout and invited him to hitch their listening to on Dec. 13.

Binance Labs to speculate $4.5 million in Ambit Finance

Binance Labs introduced that it dedicated to investing as much as $4.5 million in Ambit Finance to spice up trustless DeFi growth on BNB Chain.

Crypto Market

Within the final 24 hours, Bitcoin (BTC) elevated by +0.33% to commerce at $17,001, whereas Ethereum (ETH) elevated by +1.11% to commerce at $1,288.