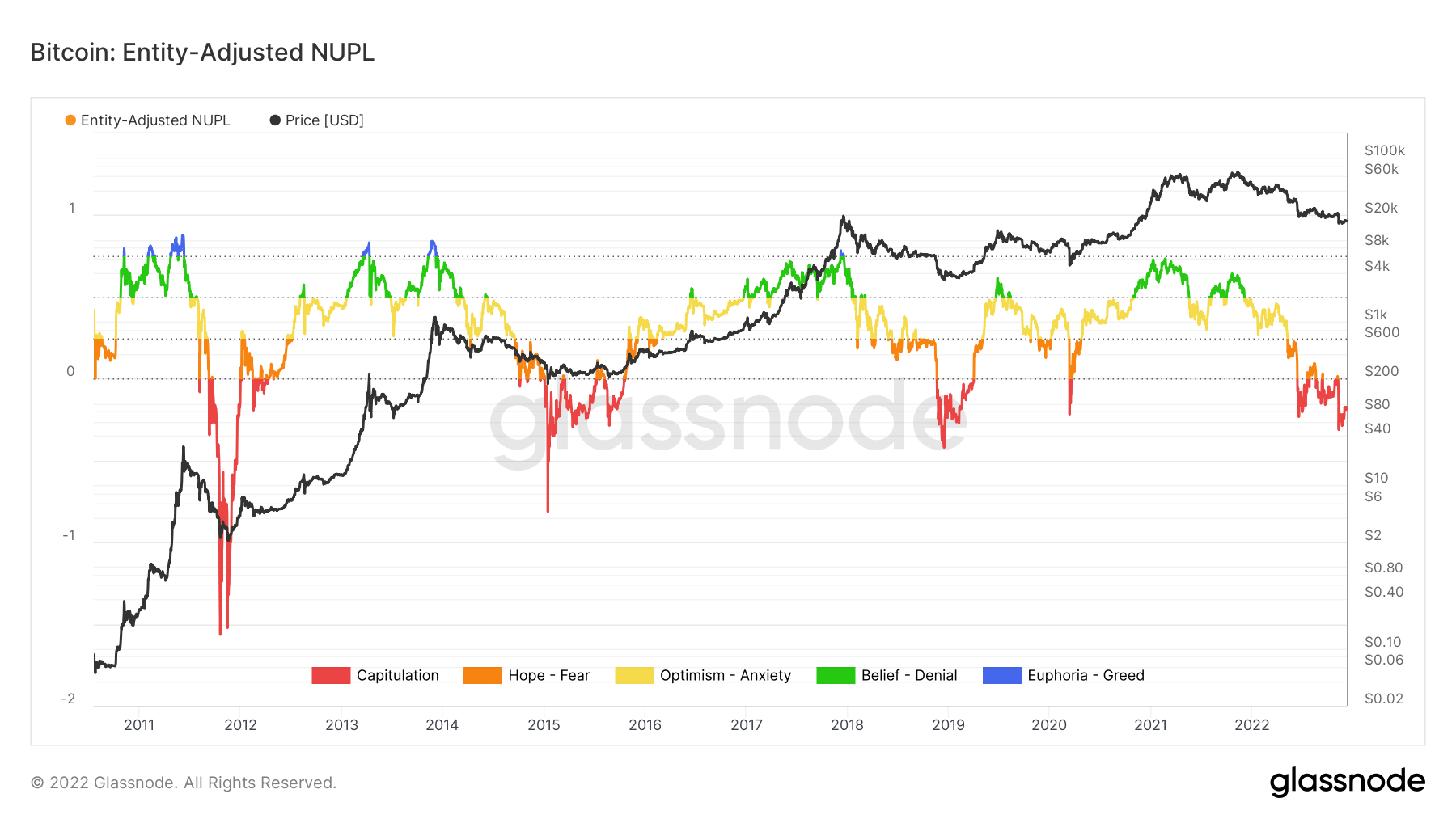

Since June, Bitcoin (BTC) – and the final market subsequently – has been in capitulation, aside from a handful of rallies seen in the summertime of this ongoing bear market based on on-chain knowledge offered by Glassnode, and analyzed by CryptoSlate.

Each bull and bear markets reveal on-chain sentiment knowledge, starting from ‘Capitulation’ to ‘Euphoria – Greed. Within the peak of a bull market, the highest is traditionally indicated when Euphoria grips tightly. Alternatively, Capitulation often indicators the underside.

Ongoing capitulation

The chart under exhibits that BTC has firmly sunk into the Capitulation sentiment because the Internet Unrealized Revenue/Loss (NUPL) on-chain knowledge shows a descent into pink territory seen earlier solely in 2012, 2015, and 2019.

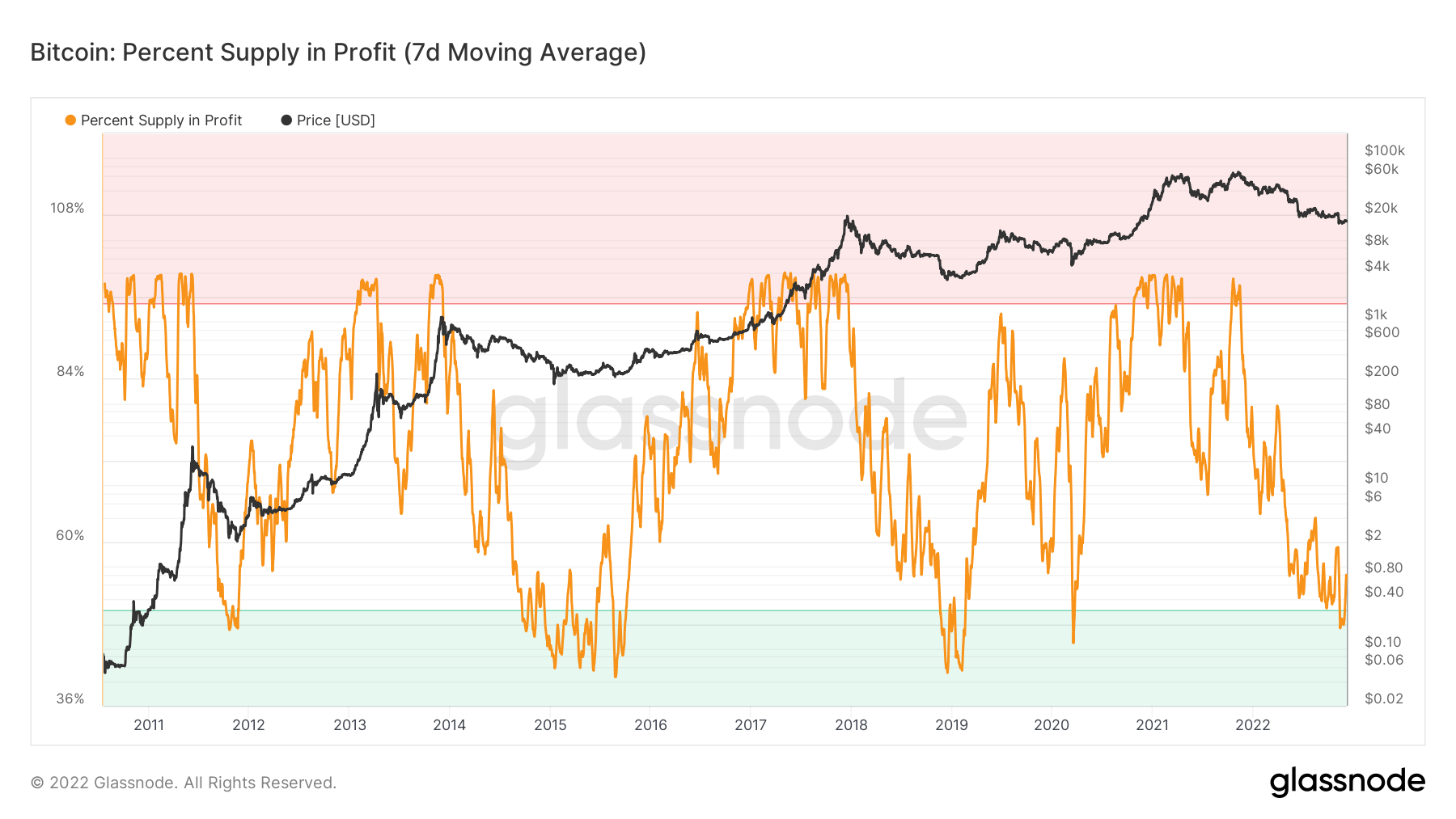

Bitcoin: Decreased circulating provide

The Bitcoin: % Provide in Revenue (7-day Transferring Common) metric exhibits that at present, solely 54% of BTC’s circulating provide was final moved on-chain for revenue. By means of the FTX collapse, this metric depicts BTC circulating provide falling under 50% – a stage which has solely occurred throughout bear market lows.

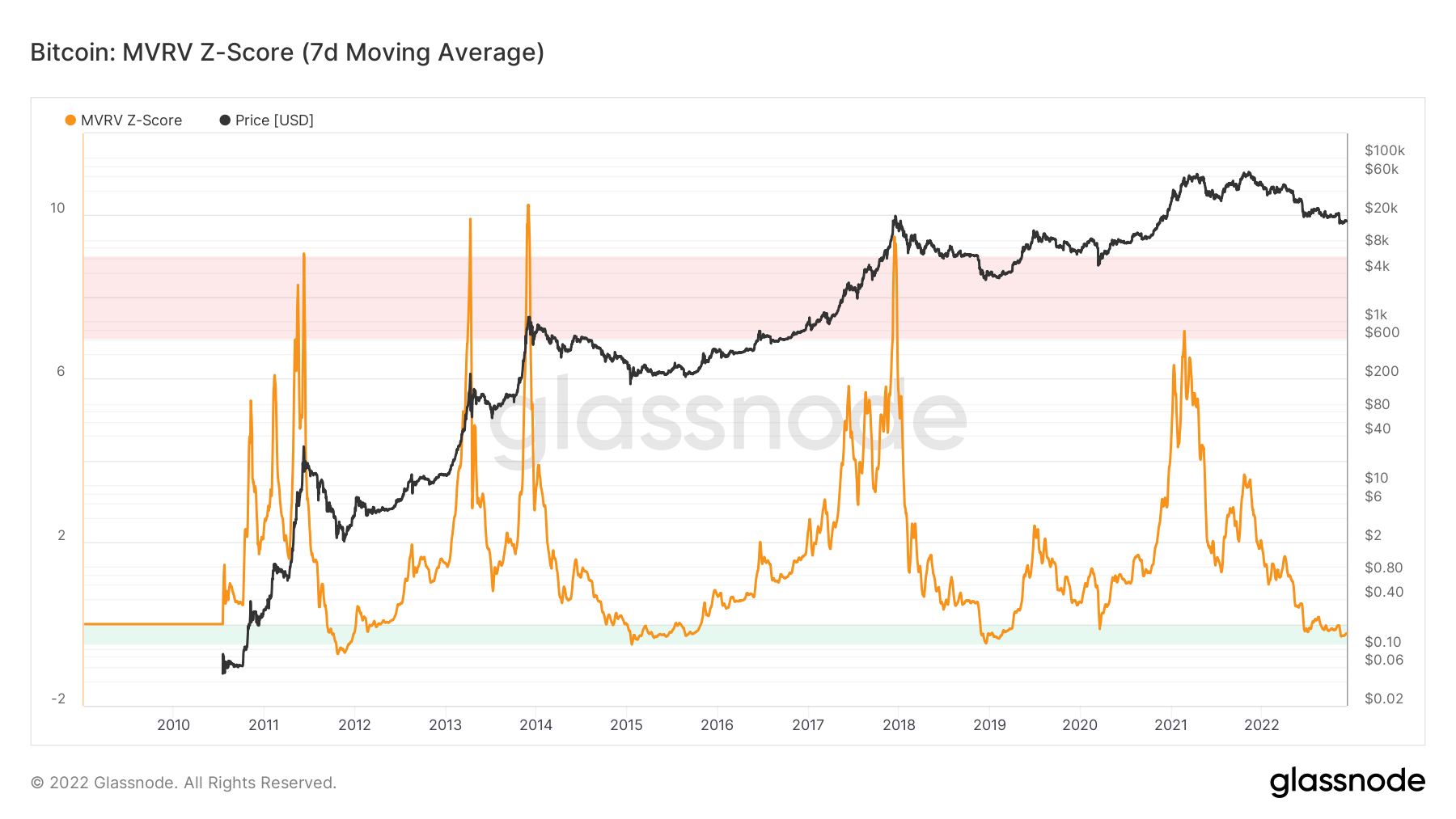

Bitcoin: Over or Undervalued?

Evaluation of the MVRV Z-Rating (7-day Transferring Common) metric reveals that we’re already over 170 days under the realized worth.

Although Bitcoin did go above the realized worth as the results of bear market rallies, traditionally earlier bear market days under the realized worth recommend the potential for additional capitulation.

Earlier Bear Markets:

- 2019-20: 134 days under the realized worth

- 2015-16: 384 days under the realized worth

- 2011-12: 215 days under the realized worth

To summarize all coated metrics on this evaluation, the indicators of the market backside analyzed are in step with different bear market cycles. Nonetheless, in assessing and evaluating this bear market to earlier bear markets, we might simply be under the realized worth for an additional six months to a yr.

With the addition of geopolitical points, macro uncertainty, and headwinds, calling a backside in an unprecedented time equivalent to this may solely stay hypothesis guided by historic knowledge.