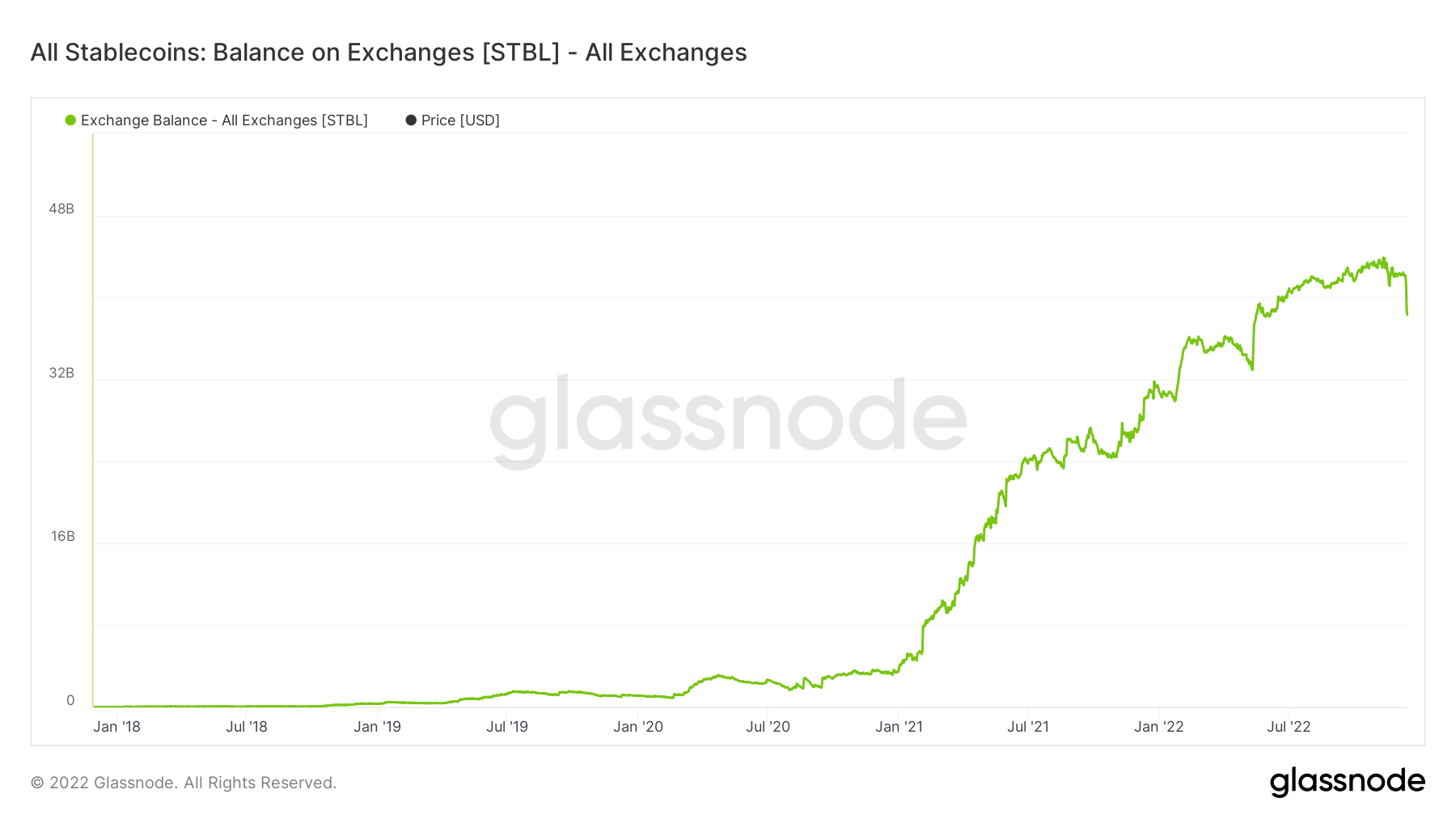

Information analyzed by CryptoSlate analysts revealed that round $4 billion value of stablecoins left the exchanges over the previous seven days, leaving a quantity of $38 billion.

This evaluation is predicated on the STBL information, which is a digital asset that aggregates the info of all ERC20 stablecoins to create a metric that may replicate the stablecoin balances throughout all crypto exchanges.

Stablecoins held on exchanges

STBL contains Binance USD (BUSD), Gemini Greenback (GUSD), HUSD (HUSD), DAI (DAI), Paxos Commonplace (USDP), Stasis Euro (EURS), SAI (SAI), Synthetix USD (sUSD), Tether (USDT), USD Coin (USDC).

The inexperienced line on the chart under displays the full quantity of the stablecoins included within the STBL metric that has been held on exchanges for the reason that starting of 2018.

In line with the info, the exchanges began accumulating stablecoins at an growing fee in January 2021. The expansion has been roughly steady since then, aside from a couple of downfalls throughout late 2021 and 2022.

The chart additionally exhibits a visual drawdown recorded over the previous week. Change customers bought round $4 billion value of stablecoins and eliminated them from the exchanges’ portfolios.

USDC vs. USDT

Relating to the market shares of stablecoins that sit on exchanges, a current evaluation by CryptoSlate revealed that USDT has taken the lead.

In line with numbers from Sept 2022, the USDT stability on exchanges doubled and reached $17.7 billion, in comparison with Sept. 2021, when it was slightly below $8 billion. USDT has been obtainable on exchanges since early 2019, however its share began to develop exponentially solely after 2021.

USDC has additionally been growing its market share for the reason that starting of 2021. By early 2022, it stood at $7 billion. Nonetheless, its dominance didn’t proceed because it fell to $2.1 billion by Sept. 2022.