Ether (ETH) gained 5.6% on Dec. 20 after testing the $1,150 assist the day before today. Nonetheless, a bearish pattern prevails, forming a three-week-long descending channel, a value motion attributed to expectations of additional U.S. Federal Reserve rate of interest hikes.

Jim Bianco, head of institutional analysis agency Bianco Analysis, stated on Dec. 20 that the Fed will hold the financial system tightening in 2023. Later that day, Japan’s central financial institution successfully raised rates of interest, far later than its international counterparts. The surprising transfer made analysts extra bearish towards threat property, together with cryptocurrencies.

Ethereum may need caught some tailwind after the worldwide fee processor Visa proposed an answer to permit computerized funding from Ethereum wallets. Auto-payments for recurring payments aren’t attainable for self-custodial wallets, so Visa proposed counting on good contracts, often known as “account abstraction.” Curiously, the idea emerged in 2015 with Vitalik Buterin.

Probably the most urgent challenge, nonetheless, is regulation. On Dec. 19, the U.S. Home Monetary Providers Committee reintroduced laws geared toward creating innovation workplaces inside authorities businesses coping with monetary providers. In response to North Carolina Consultant Patrick McHenry, firms might apply for an “enforceable compliance settlement,” with workplaces positioned in businesses just like the Securities and Alternate Fee and Commodity Futures Buying and selling Fee.

Consequently, buyers imagine Ether might revisit sub-$1,000 costs because the DXY greenback index loses energy whereas the 10-year U.S. reasury yields present increased demand for defense. Dealer CryptoCondom expects the subsequent couple of months to be extraordinarily bearish for crypto markets.

Algos see $DXY down & bid up crypto. BOJ in a single day isn’t bullish…it’s an indication of issues breaking.

DXY ⬇️ & 10Y ⬆️ = Recession

I can be shorting the market ready for 3 digit $ETH.

Crypto IS the way forward for France however the subsequent 2-3m will really feel like being within the Gulag as a substitute. pic.twitter.com/nLKqtNz3C3— CryptoCondom (@crypto_condom) December 20, 2022

Let us take a look at Ether derivatives knowledge to grasp if the bearish macroeconomic motion has negatively impacted buyers’ sentiment.

The current bounce above $1,200 didn’t instill bullishness

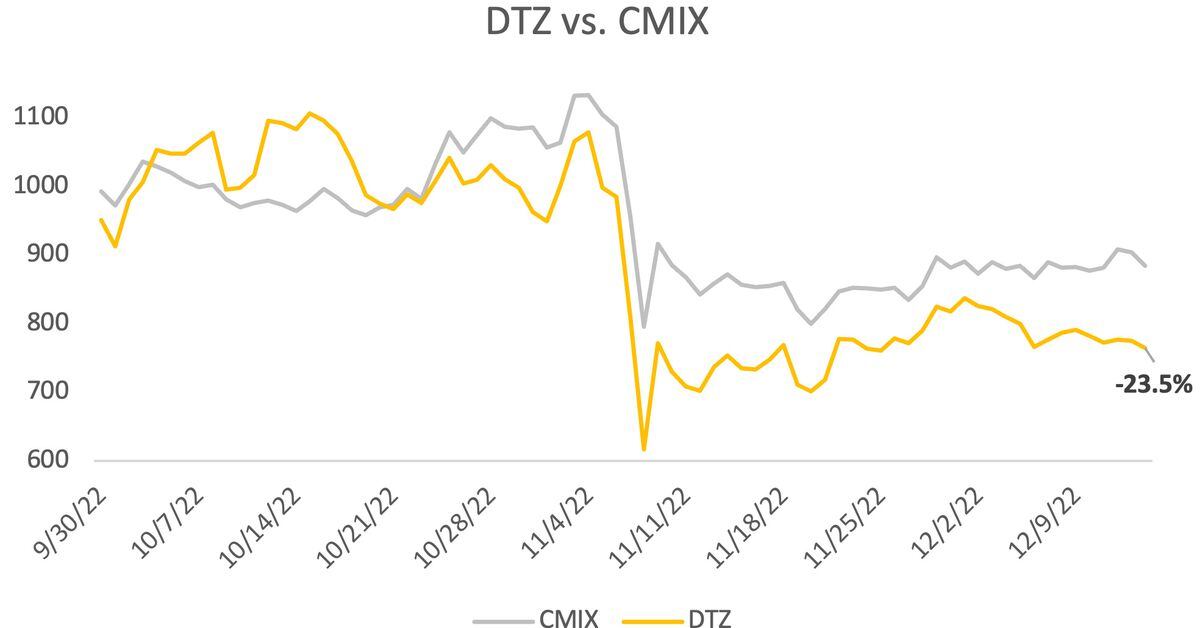

Retail merchants often keep away from quarterly futures because of their value distinction from spot markets. In the meantime, skilled merchants choose these devices as a result of they stop the fluctuation of funding charges in a perpetual futures contract.

The 2-month futures annualized premium ought to commerce between +4% to +8% in wholesome markets to cowl prices and related dangers. When the futures commerce at a reduction versus common spot markets, it exhibits a insecurity from leverage consumers, which is a bearish indicator.

The chart above exhibits that derivatives merchants proceed to make use of extra leverage for brief (bear) positions because the Ether futures premium stays detrimental. Nonetheless, the absence of leverage consumers’ demand doesn’t imply merchants count on additional hostile value motion.

For that reason, merchants ought to analyze Ether’s choices markets to grasp whether or not buyers are pricing increased odds of shock hostile value actions.

Choices merchants not eager on providing draw back safety

The 25% delta skew is a telling signal when market makers and arbitrage desks are overcharging for upside or draw back safety.

In bear markets, choices buyers give increased odds for a value dump, inflicting the skew indicator to rise above 10%. However, bullish markets are inclined to drive the skew indicator beneath -10%, which means the bearish put choices are discounted.

The delta skew elevated after Dec. 15 from a fearful 14% towards the protecting put choices to the present 20%. The motion signaled that choices merchants turned even much less snug with draw back dangers.

The 60-day delta skew alerts whales and market makers are reluctant to supply draw back safety, which appears pure contemplating the three-week-long descending channel.

In a nutshell, each choices and futures markets level to professional merchants not trusting the current bounce above $1,200. The current pattern favors Ether bears as a result of the chances of the Fed sustaining its steadiness sheet discount program appear excessive, which is damaging for threat markets.

The views, ideas and opinions expressed listed below are the authors’ alone and don’t essentially replicate or characterize the views and opinions of Cointelegraph.