Id thieves have been exploiting a obvious safety weak spot within the web site of Experian, one of many massive three client credit score reporting bureaus. Usually, Experian requires that these in search of a duplicate of their credit score report efficiently reply a number of a number of alternative questions on their monetary historical past. However till the top of 2022, Experian’s web site allowed anybody to bypass these questions and go straight to the buyer’s report. All that was wanted was the particular person’s title, deal with, birthday and Social Safety quantity.

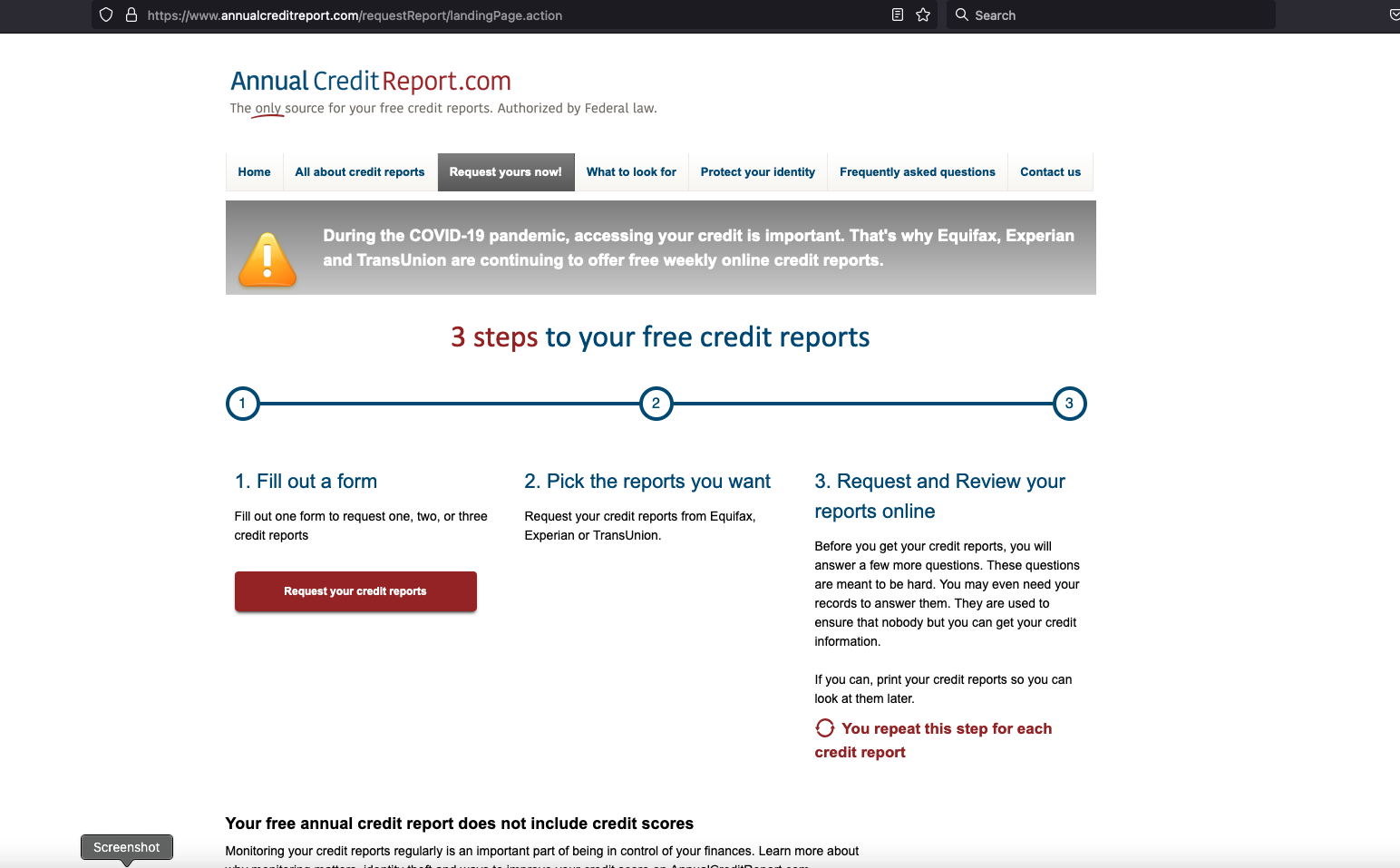

The vulnerability in Experian’s web site was exploitable after one utilized to see their credit score file through annualcreditreport.com.

In December, KrebsOnSecurity heard from Jenya Kushnir, a safety researcher residing in Ukraine who stated he found the tactic being utilized by id thieves after spending time on Telegram chat channels devoted to the cashing out of compromised identities.

“I wish to try to assist to place a cease to it and make it tougher for [ID thieves] to entry, since [Experian is] not doing shit and common individuals battle,” Kushnir wrote in an e-mail to KrebsOnSecurity explaining his motivations for reaching out. “If by some means I could make small change and assist to enhance this, inside myself I can really feel that I did one thing that truly issues and helped others.”

Kushnir stated the crooks discovered they might trick Experian into giving them entry to anybody’s credit score report, simply by modifying the deal with displayed within the browser URL bar at a selected level in Experian’s id verification course of.

Following Kushnir’s directions, I sought a duplicate of my credit score report from Experian through annualcreditreport.com — an internet site that’s required to offer all People with a free copy of their credit score report from every of the three main reporting bureaus, as soon as per 12 months.

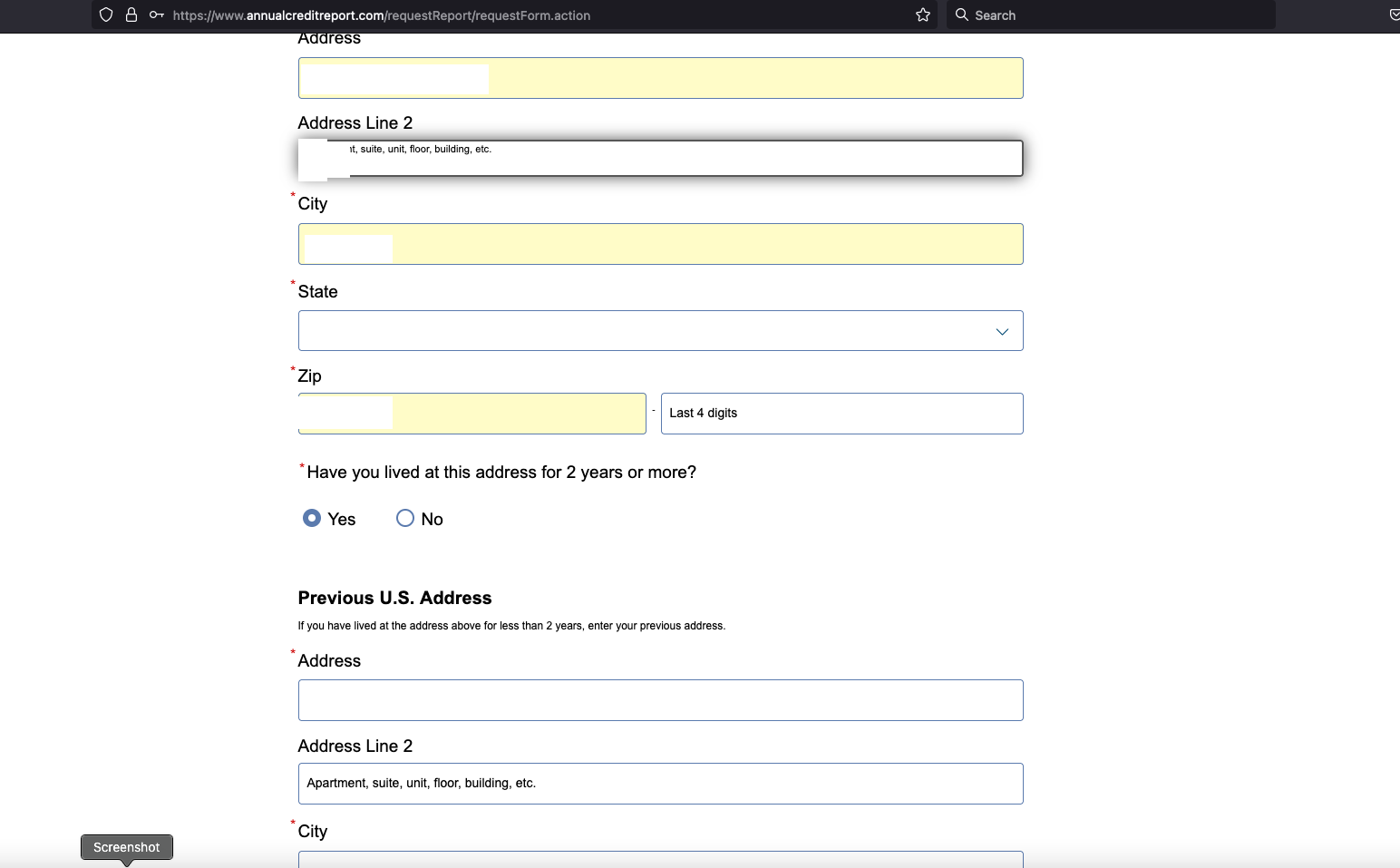

Annualcreditreport.com begins by asking to your title, deal with, SSN and birthday. After I equipped that and instructed Annualcreditreport.com I needed my report from Experian, I used to be taken to Experian.com to finish the id verification course of.

Usually at this level, Experian’s web site would current 4 or 5 multiple-guess questions, similar to “Which of the next addresses have you ever lived at?”

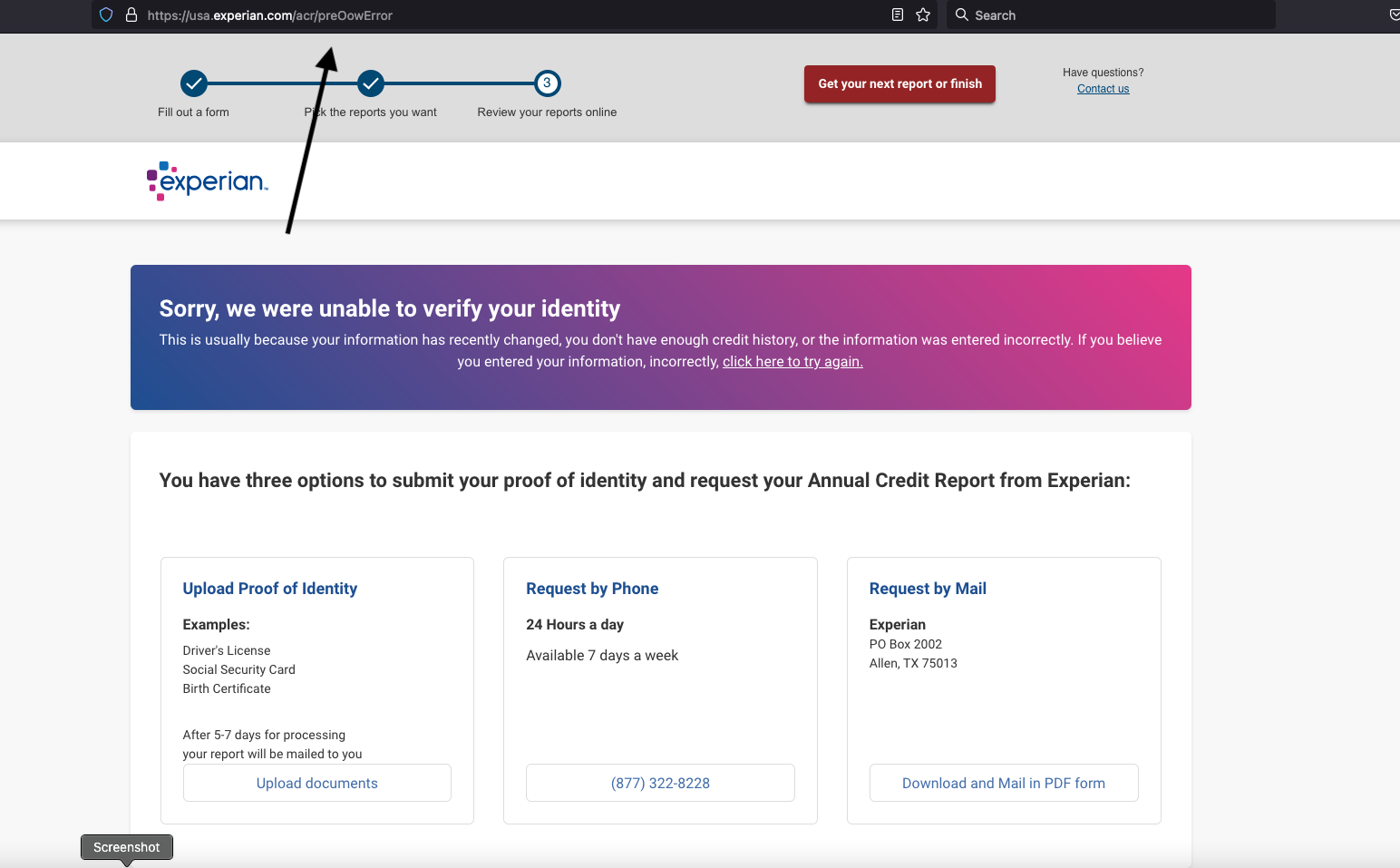

Kushnir instructed me that when the questions web page masses, you merely change the final a part of the URL from “/acr/oow/” to “/acr/report,” and the positioning would show the buyer’s full credit score report.

However after I tried to get my report from Experian through annualcreditreport.com, Experian’s web site stated it didn’t have sufficient data to validate my id. It wouldn’t even present me the 4 multiple-guess questions. Experian stated I had three choices for a free credit score report at this level: Mail a request together with id paperwork, name a telephone quantity for Experian, or add proof of id through the web site.

However that didn’t cease Experian from exhibiting me my full credit score report after I modified the Experian URL as Kushnir had instructed — modifying the error web page’s trailing URL from “/acr/OcwError” to easily “/acr/report”.

Experian’s web site then instantly displayed my total credit score file.

Although Experian stated it couldn’t inform that I used to be really me, it nonetheless coughed up my report. And thank goodness it did. The report incorporates so many errors that it’s in all probability going to take a great deal of effort on my half to straighten out.

Now I do know why Experian has NEVER let me view my very own file through their web site. For instance, there have been 4 telephone numbers on my Experian credit score file: Solely considered one of them was mine, and that one hasn’t been mine for ages.

I used to be so dumbfounded by Experian’s incompetence that I requested an in depth good friend and trusted safety supply to strive the tactic on her id file at Experian. Certain sufficient, when she obtained to the half the place Experian requested questions, altering the final a part of the URL in her deal with bar to “/report” bypassed the questions and instantly displayed her full credit score report. Her report additionally was replete with errors.

KrebsOnSecurity shared Kushnir’s findings with Experian on Dec. 23, 2022. On Dec. 27, 2022, Experian’s PR staff acknowledged receipt of my Dec. 23 notification, however the firm has to this point ignored a number of requests for remark or clarification.

By the point Experian confirmed receipt of my report, the “exploit” Kushnir stated he discovered from the id thieves on Telegram had been patched and not labored. Nevertheless it stays unclear how lengthy Experian’s web site was making it really easy to entry anybody’s credit score report.

In response to data shared by KrebsOnSecurity, Senator Ron Wyden (D-Ore.) stated he was disillusioned — however by no means shocked — to listen to about one more cybersecurity lapse at Experian.

“The credit score bureaus are poorly regulated, act as if they’re above the regulation and have thumbed their noses at Congressional oversight,” Wyden stated in a written assertion. “Simply final 12 months, Experian ignored repeated briefing requests from my workplace after you revealed one other cybersecurity lapse the corporate.”

Sen. Wyden’s quote above references a narrative revealed right here in July 2022, which broke the information that id thieves have been hijacking client accounts at Experian.com simply by signing up as them at Experian as soon as extra, supplying the goal’s static, private data (title, DoB/SSN, deal with) however a unique e-mail deal with.

From interviews with a number of victims who contacted KrebsOnSecurity after that story, it emerged that Experian’s personal buyer assist representatives have been really telling shoppers who obtained locked out of their Experian accounts to recreate their accounts utilizing their private data and a brand new e-mail deal with. This was Experian’s recommendation even for individuals who’d simply defined that this methodology was what id thieves had used to lock them in out within the first place.

Clearly, Experian discovered it less complicated to reply this fashion, reasonably than acknowledging the issue and addressing the foundation causes (lazy authentication and abhorrent account restoration practices). It’s additionally value mentioning that stories of hijacked Experian.com accounts endured into late 2022. That screw-up has since prompted a category motion lawsuit in opposition to Experian.

Sen. Wyden stated the Federal Commerce Fee (FTC) and Shopper Monetary Safety Bureau (CFPB) have to do far more to guard People from screw-ups by the credit score bureaus.

“In the event that they don’t imagine they’ve the authority to take action, they need to endorse laws like my Thoughts Your Personal Enterprise Act, which supplies the FTC energy to set robust necessary cybersecurity requirements for corporations like Experian,” Wyden stated.

Sadly, none of that is terribly surprising conduct for Experian, which has proven itself a totally negligent custodian of obscene quantities of extremely delicate client data.

In April 2021, KrebsOnSecurity revealed how id thieves have been exploiting lax authentication on Experian’s PIN retrieval web page to unfreeze client credit score information. In these instances, Experian didn’t ship any discover through e-mail when a freeze PIN was retrieved, nor did it require the PIN to be despatched to an e-mail deal with already related to the buyer’s account.

A couple of days after that April 2021 story, KrebsOnSecurity broke the information that an Experian API was exposing the credit score scores of most People.

It’s dangerous sufficient that we will’t actually choose out of corporations like Experian making $2.6 billion every quarter gathering and promoting gobs of our private and monetary data. However there must be some significant accountability when these monopolistic corporations interact in negligent and reckless conduct with the exact same client information that feeds their quarterly earnings. Or when safety and privateness shortcuts are discovered to be intentional, like for cost-saving causes.

And as we noticed with Equifax’s consolidated class-action settlement in response to letting state-sponsored hackers from China steal information on practically 150 million People again in 2017, class-actions and extra laughable “free credit score monitoring” companies from the exact same corporations that created the issue aren’t going to chop it.

WHAT CAN YOU DO?

It’s simple to undertake a defeatist perspective with the credit score bureaus, who usually foul issues up royally even for shoppers who’re fairly diligent about watching their client credit score information and disputing any inaccuracies.

However there are some concrete steps that everybody can take which is able to dramatically decrease the chance that id thieves will break your monetary future. And fortunately, most of those steps have the facet advantage of costing the credit score bureaus cash, or a minimum of inflicting the information they acquire about you to turn out to be much less invaluable over time.

Step one is consciousness. Discover out what these corporations are saying about you behind your again. Understand that — honest or not — your credit score rating as collectively decided by these bureaus can have an effect on whether or not you get that mortgage, condo, or job. In that context, even small, unintentional errors which can be unrelated to id theft can have outsized penalties for shoppers down the highway.

Every bureau is required to offer a free copy of your credit score report yearly. The best strategy to get yours is thru annualcreditreport.com.

Some shoppers report that this website by no means works for them, and that every bureau will insist they don’t have sufficient data to offer a report. I’m positively on this camp. Fortunately, a monetary establishment that I have already got a relationship with gives the power to view your credit score file via them. Your mileage on this entrance could range, and it’s possible you’ll find yourself having to ship copies of your id paperwork via the mail or web site.

Once you get your report, search for something that isn’t yours, after which doc and file a dispute with the corresponding credit score bureau. And after you’ve reviewed your report, set a calendar reminder to recur each 4 months, reminding you it’s time to get one other free copy of your credit score file.

Should you haven’t already accomplished so, take into account making 2023 the 12 months that you just freeze your credit score information on the three main reporting bureaus, together with Experian, Equifax and TransUnion. It’s now free to individuals in all 50 U.S. states to position a safety freeze on their credit score information. It is usually free to do that to your companion and/or your dependents.

Freezing your credit score means nobody who doesn’t have already got a monetary relationship with you may view your credit score file, making it unlikely that potential collectors will grant new traces of credit score in your title to id thieves. Freezing your credit score file additionally means Experian and its brethren can not promote peeks at your credit score historical past to others.

Anytime you want to apply for brand new credit score or a brand new job, or open an account at a utility or communications supplier, you may rapidly thaw a freeze in your credit score file, and set it to freeze mechanically once more after a specified size of time.

Please don’t confuse a credit score freeze (a.ok.a. “safety freeze”) with the choice that the bureaus will seemingly steer you in the direction of while you ask for a freeze: “Credit score lock” companies.

The bureaus pitch these credit score lock companies as a approach for shoppers to simply toggle their credit score file availability with push of a button on a cell app, however they do little to stop the bureaus from persevering with to promote your data to others.

My recommendation: Ignore the lock companies, and simply freeze your credit score information already.

One last notice. Frequent readers right here could have observed that I’ve criticized these so-called “knowledge-based authentication” or KBA questions that Experian’s web site didn’t ask as a part of its client verification course of.

KrebsOnSecurity has lengthy assailed KBA as weak authentication as a result of the questions and solutions are drawn largely from client data which can be public and simply accessible to organized id theft teams.

That stated, on condition that these KBA questions look like the ONLY factor standing between me and my Experian credit score report, it looks like perhaps they need to a minimum of take care to make sure that these questions really get requested.