What number of buying and selling approaches have you ever examined for the reason that starting of your buying and selling journey? Some consultants recommend that merchants could have to check out at the very least 5 totally different buying and selling strategies to establish probably the most environment friendly one for them. As we speak we’ll look into swing buying and selling – a buying and selling method which may swimsuit merchants with totally different ranges of expertise and doubtlessly supply optimistic outcomes on quite a lot of timeframes.

What Is Swing Buying and selling?

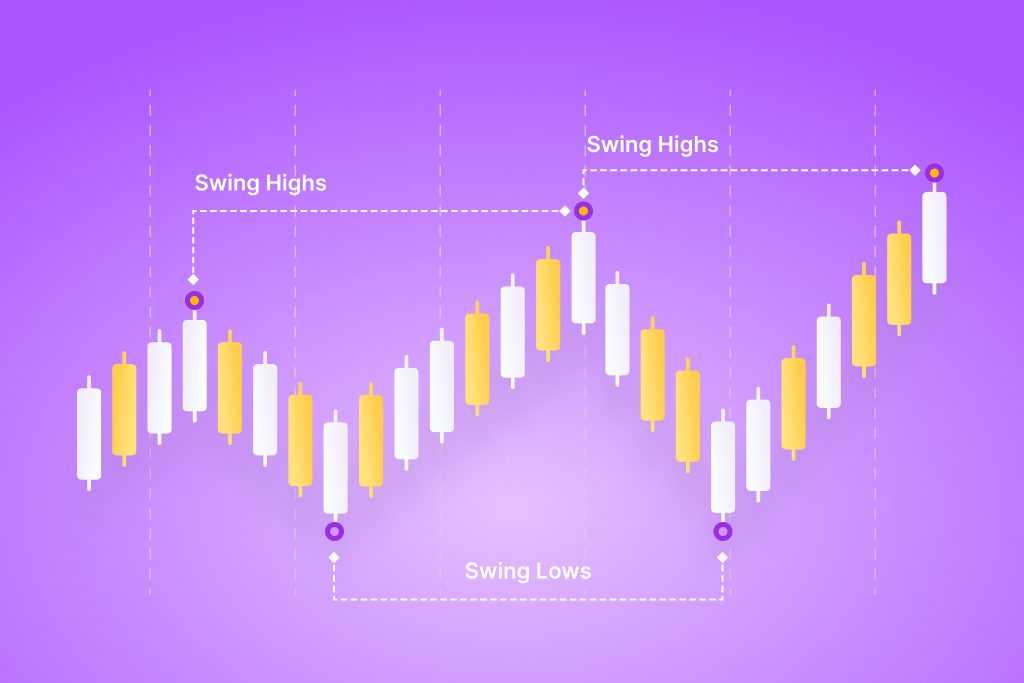

With this method merchants try to catch market swings because the asset worth fluctuates on quick, intermediate or long-term timeframes. Swing merchants normally preserve their positions open for numerous time intervals starting from days to weeks and even months.

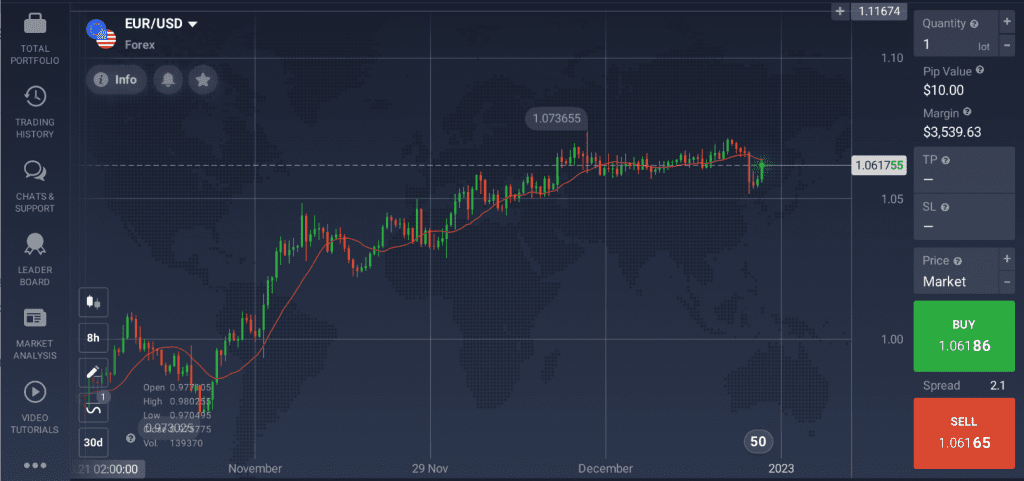

To anticipate upcoming swings, merchants usually flip to technical evaluation of belongings. Analyzing worth charts and patterns would possibly assist them establish early indicators of potential swings and catch the optimum time to enter a deal. Chances are you’ll use quite a lot of totally different devices for technical evaluation. Listed below are among the fundamental technical evaluation instruments you might contemplate making use of to your swing buying and selling method.

- The Transferring Common Convergence Divergence (MACD): a strong indicator to identify rising tendencies.

As soon as merchants spot a possible swing utilizing technical evaluation, they open both an extended (BUY) or a brief (SELL) place. Then they wait to see if the asset worth will transfer within the anticipated route. If it does, they might shut the deal in revenue for instance. If not, they may select to get out of the shedding place and search for different alternatives.

Because the swing buying and selling technique entails an excessive amount of technical evaluation, it might be an appropriate possibility for merchants who get pleasure from analyzing worth charts and making use of technical instruments. This may be time-consuming, particularly at first, if you find yourself getting accustomed to the buying and selling platform and testing totally different devices. Nonetheless, after you choose the best instruments and be taught to establish potential swings, you would possibly be capable to spend much less time within the traderoom monitoring worth charts.

Swing Buying and selling vs. Day Buying and selling

Equally to day buying and selling, with the swing buying and selling method offers could also be opened and closed inside a brief time frame. Nonetheless, there are nonetheless just a few variations between these two buying and selling strategies.

As day merchants solely commerce short-term timeframes, they have an inclination to give attention to extra risky belongings with frequent short-term worth fluctuations. This implies they higher handle dangers related to long-term trades and no in a single day charges. Nonetheless, there are some downsides as nicely: day buying and selling requires fast decision-making and spending lots of time within the traderoom monitoring asset costs.

With regards to swing buying and selling, belongings with bigger swings could also be most popular. They could have much less frequent worth fluctuations – an important issue is their depth. It might take extra time to get outcomes with this technique, as trades can keep open for days or even weeks. Additionally, take into account that in case of longer timeframes, your trades could also be uncovered to in a single day dangers and charges. Nonetheless, when you get some apply and discover ways to swing commerce foreign exchange, shares and different belongings, you would possibly get your outcomes with out spending an excessive amount of time monitoring worth charts within the traderoom.

Q&A

Is Swing Buying and selling Secure?

As with every buying and selling technique, there are dangers concerned. The monetary markets could be risky, so you need to remember the dangers of swing buying and selling and be taught to handle them. With swing buying and selling offers could keep open for longer intervals of time. Because of this asset costs may be affected by various factors in a single day or through the weekend when the market is closed.

Utilizing risk-management instruments could enable you handle dangers and shield your capital from unpredictable worth fluctuations. That is particularly vital when swing buying and selling foreign exchange and shares, which could be fairly risky.

Is Swing Buying and selling Price It?

Swing buying and selling could also be a helpful method for buying and selling totally different belongings on quite a lot of timeframes. It might be enticing to busy merchants who don’t have a lot time to observe worth actions within the traderoom. Nonetheless, it requires some data of technical evaluation to catch potential swings earlier than they occur and make a transfer on the optimum second. When you get the cling of those technical instruments and be taught to handle potential dangers of swing buying and selling, it might turn into an efficient instrument for rising your portfolio. However you need to at all times take into account that there is no such thing as a 100% assure of appropriate indications. So it might be sensible to use a number of instruments to verify your readings and get extra exact outcomes.